Mortgage Payoff Form With 2 Points In Georgia

State:

Multi-State

Control #:

US-0019LTR

Format:

Word;

Rich Text

Instant download

Description

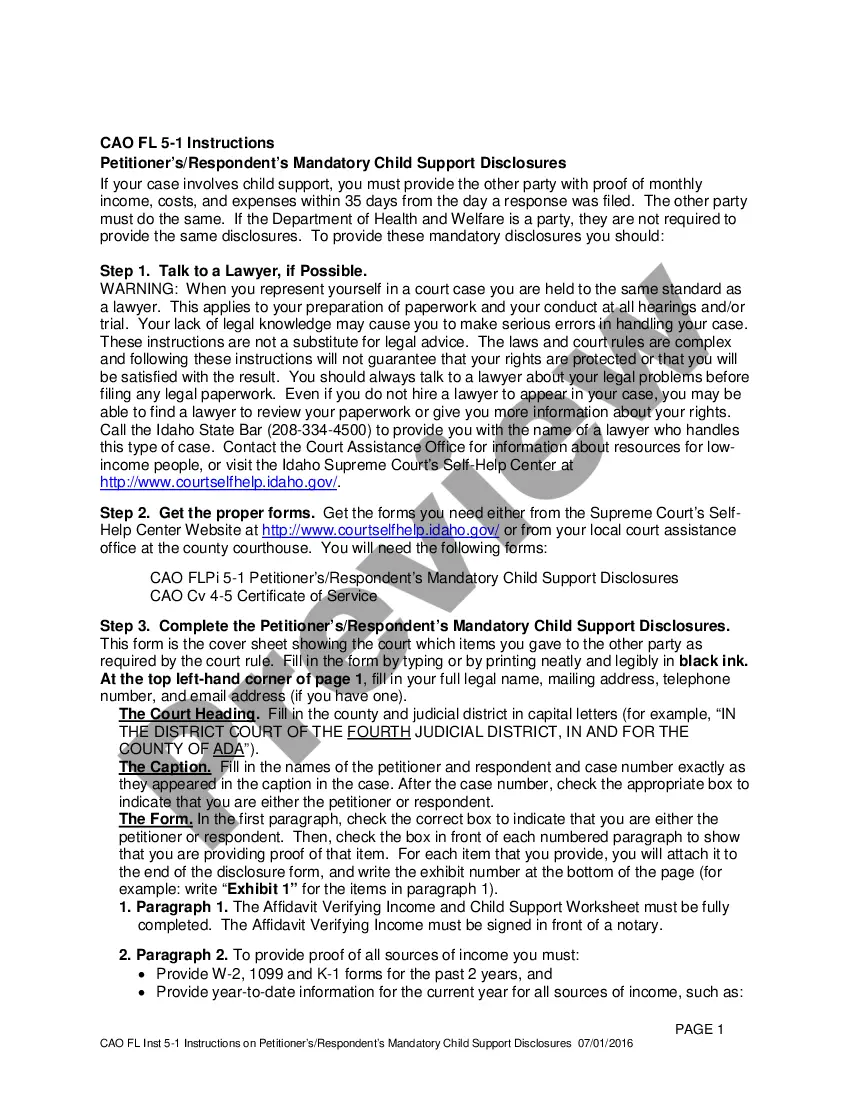

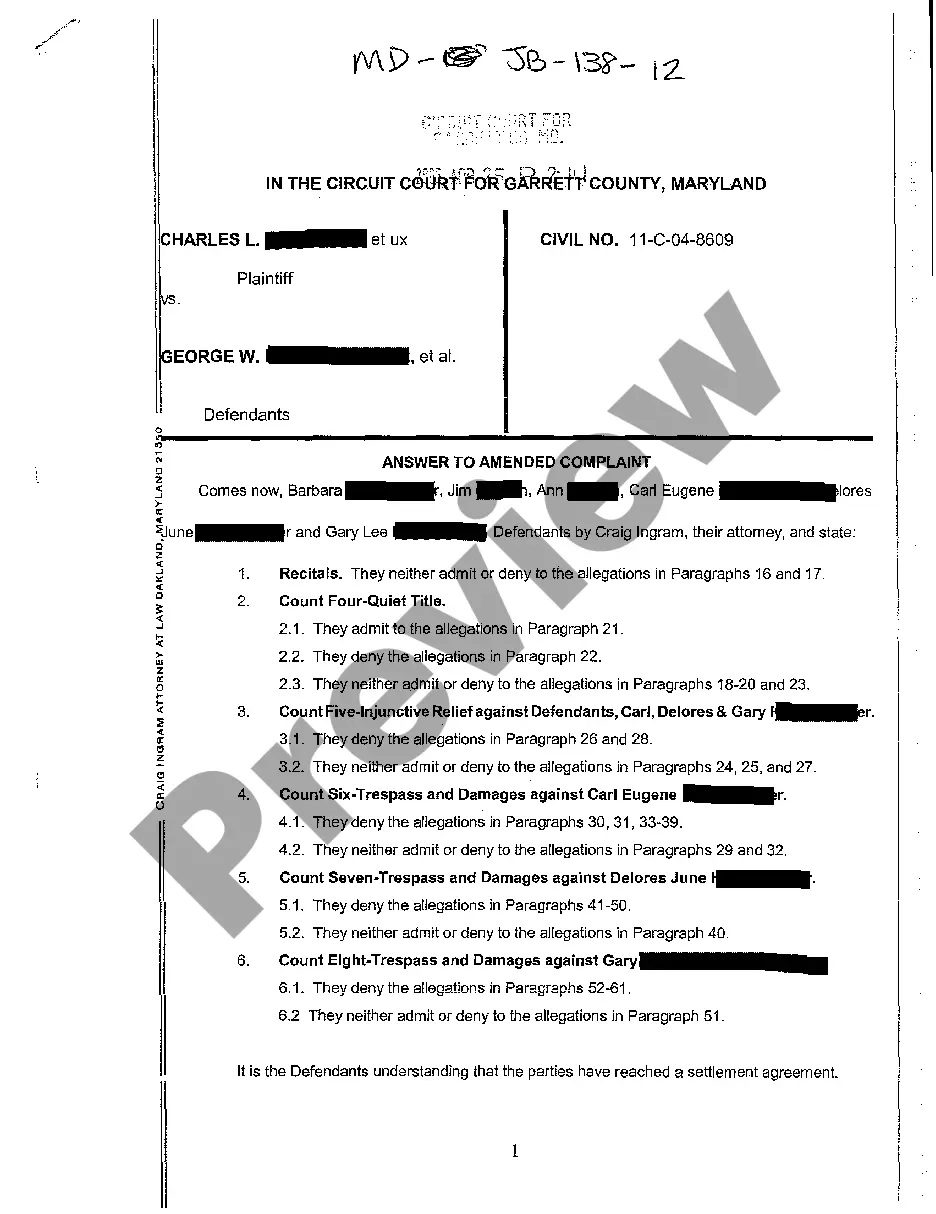

The Mortgage Payoff Form with 2 Points in Georgia is a crucial document for individuals and professionals managing mortgage loans in the state. This form is specifically designed to facilitate the process of paying off a mortgage, ensuring that both the lender and borrower are properly informed about the remaining balance, including any accrued interest and escrow adjustments. It highlights key features such as the inclusion of negative escrow calculations and the need to update payoff amounts based on interest accrued until the actual date of payment. For the target audience, including attorneys, partners, owners, associates, paralegals, and legal assistants, this form serves as a legal tool that simplifies communication between parties involved in mortgage transactions. Filling out the form requires clear identification of all parties, a precise calculation of the remaining balance, and the incorporation of necessary details such as payment dates and any adjustments. It can be used in various scenarios, such as finalizing a mortgage payoff, ensuring compliance with state regulations, and providing a formal record for legal or financial purposes. Overall, this form streamlines the mortgage payoff process and helps ensure all stakeholders are aligned in their expectations.

Form popularity

FAQ

Under federal law, the servicer must generally send you a payoff statement within seven business days of your request, subject to a few exceptions. (12 C.F.R. § 1026.36.)

Under federal law, the servicer must generally send you a payoff statement within seven business days of your request, subject to a few exceptions. (12 C.F.R. § 1026.36.)