Payoff Letter For Land Contract In Kings

Description

Form popularity

FAQ

Legally, a seller's best bet for successfully backing out of a sale is if a contingency written into the contract has not been met. Home sellers can give themselves an “out” by adding contingencies to the contract that make the sale contingent upon certain conditions.

First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

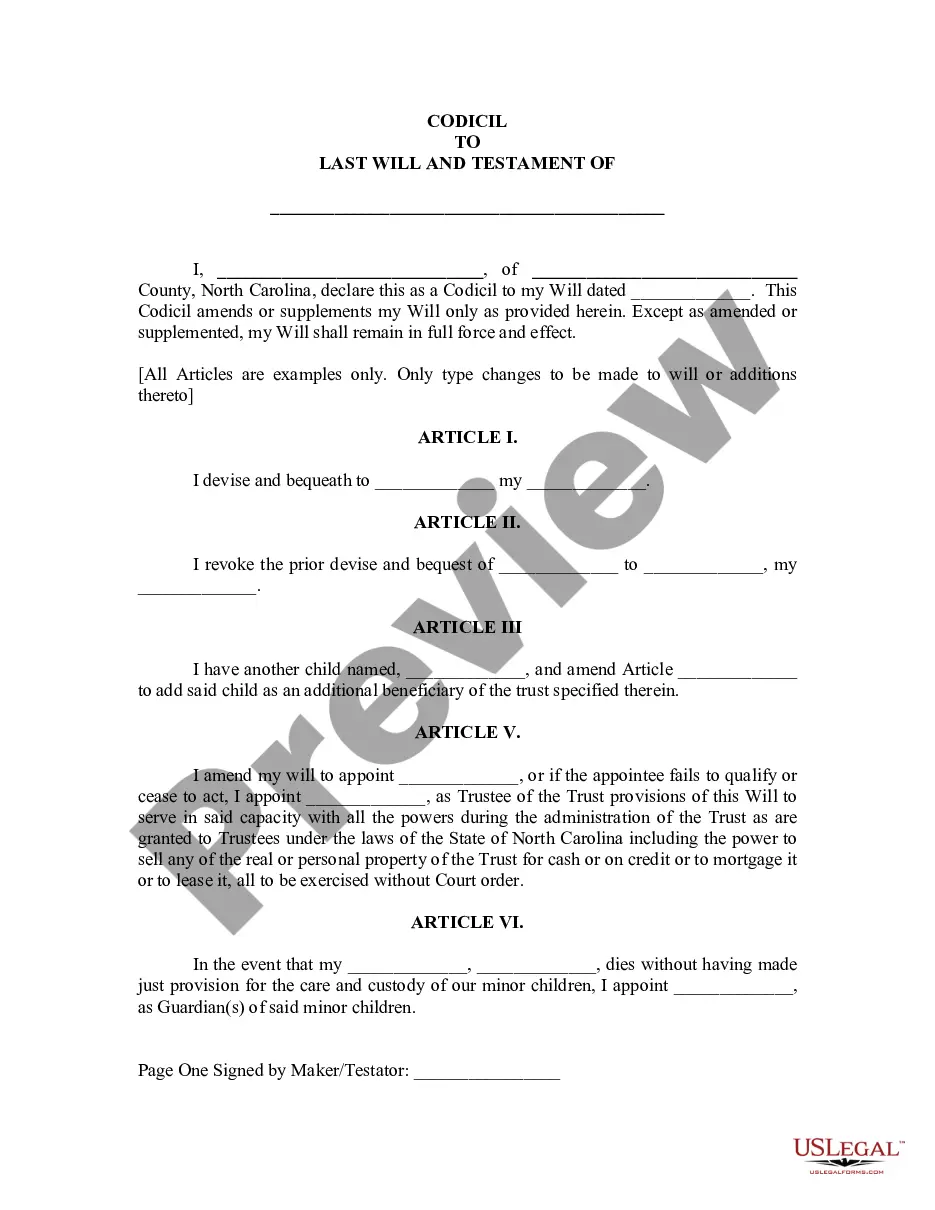

All parties to the original debt instrument normally execute a Payoff Letter before it becomes binding. The final version of the document often reflects specifics of the parties' negotiations. Payoff Letters provide detailed terms and procedures regarding the payoff process.

The letter of intent gives the mortgage lender more certainty about your income and the options for paying the mortgage. With an 'employer statement of intent', or employer's statement, there is a chance that you can also take out a mortgage without a permanent contract.

To get a payoff letter, ask your lender for an official payoff statement. Call or write to customer service or make the request online. While logged into your account, look for options to request or calculate a payoff amount, and provide details such as your desired payoff date.

Land contracts (aka “land installment contracts” or “contracts for deed”) are agreements in which a homebuyer makes regular payments to the seller but the deed does not transfer at the outset; instead, the seller retains full ownership of the property until the final payment.

A bank confirmation letter serves to assure all concerned parties in a business transaction that the bank's customer (the borrower) has, or has available, the necessary financial resources to conclude the transaction.

Most debt settlement letters include: The date, name, and address of the credit card company. A notation after the address that this is regarding a hardship letter. The credit card number and amount of the debt. A short statement of your financial situation, why you're in that situation, and why full payment is a hardship.