This form is a sample letter in Word format covering the subject matter of the title of the form.

Sample Letter Payoff Mortgage File With Irs In Los Angeles

Description

Form popularity

FAQ

The first place to search for a tax lien in California is the clerk-recorder's office in the county where a taxpayer resides or where a property is physically located.

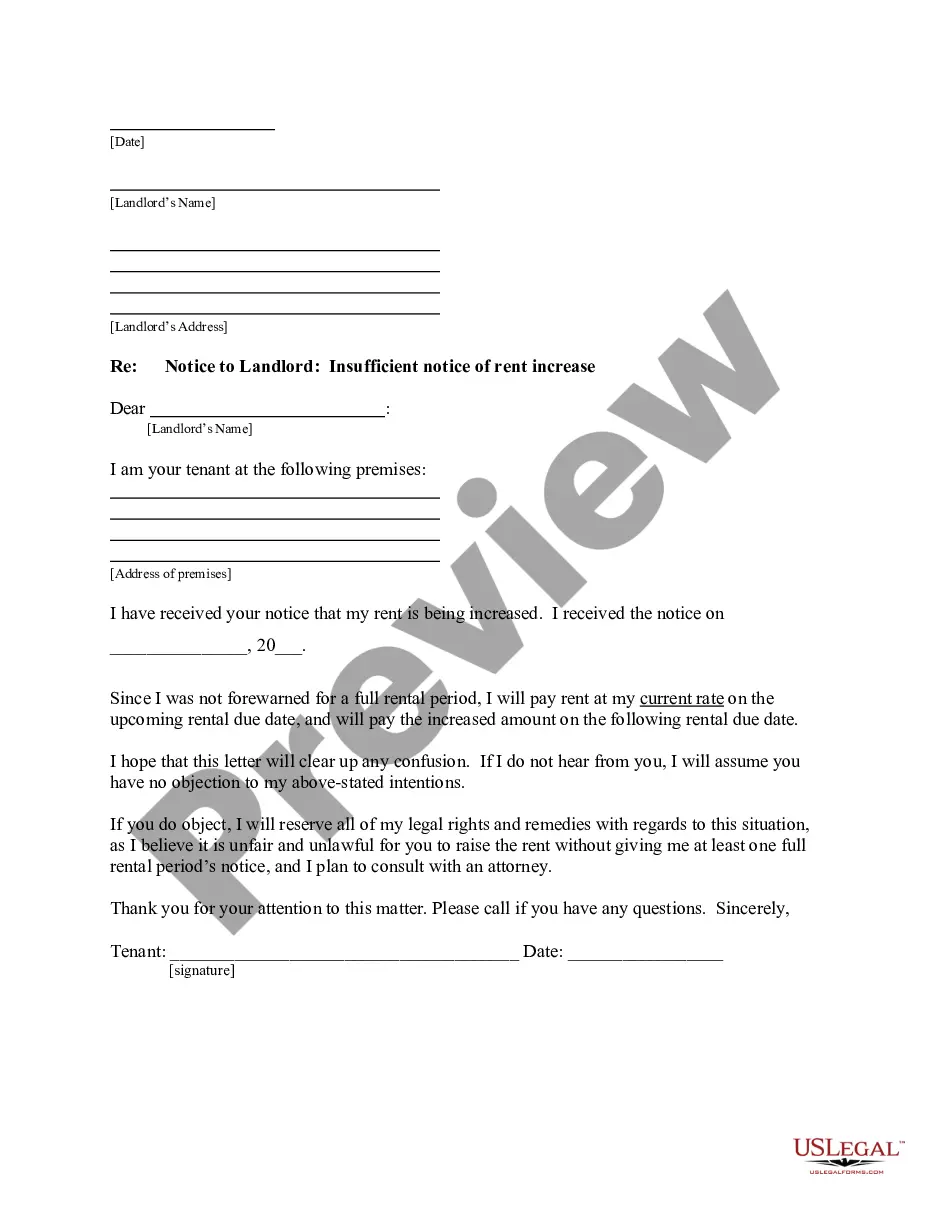

There's a process to getting the mortgage payoff statement. First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

Under California Revenue and Taxation Code Section 19255, the statute of limitations to collect unpaid state tax debts is 20 years from the assessment date, but there are situations that may extend the period or allow debts to remain due and payable.

You fill out IRS form 12277 and mail it in to the address specified. You don't need the lien number; include as much info as you have when you fill the form. They'll file a notice of withdrawal and send it to you. You then send that notice of withdrawal in a dispute to the three credit bureaus.

A lien expires 10 years from the date of recording or filing, unless we extend it. If we extend the lien, we will send a new Notice of State Tax Lien and record or file it with the county recorder or California Secretary of State. We will not release expired liens. Expired liens are not listed in MyFTB.

Lien Release: After a lien has been filed, the California claimant can release or cancel the lien by filing a Mechanics Lien Release form with the county recorder's office where the lien was originally recorded.

There's a process to getting the mortgage payoff statement. First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

To get a payoff letter, ask your lender for an official payoff statement. Call or write to customer service or make the request online. While logged into your account, look for options to request or calculate a payoff amount, and provide details such as your desired payoff date.

Taxpayers can also view digital copies of select IRS notices by logging into their IRS Online Account.