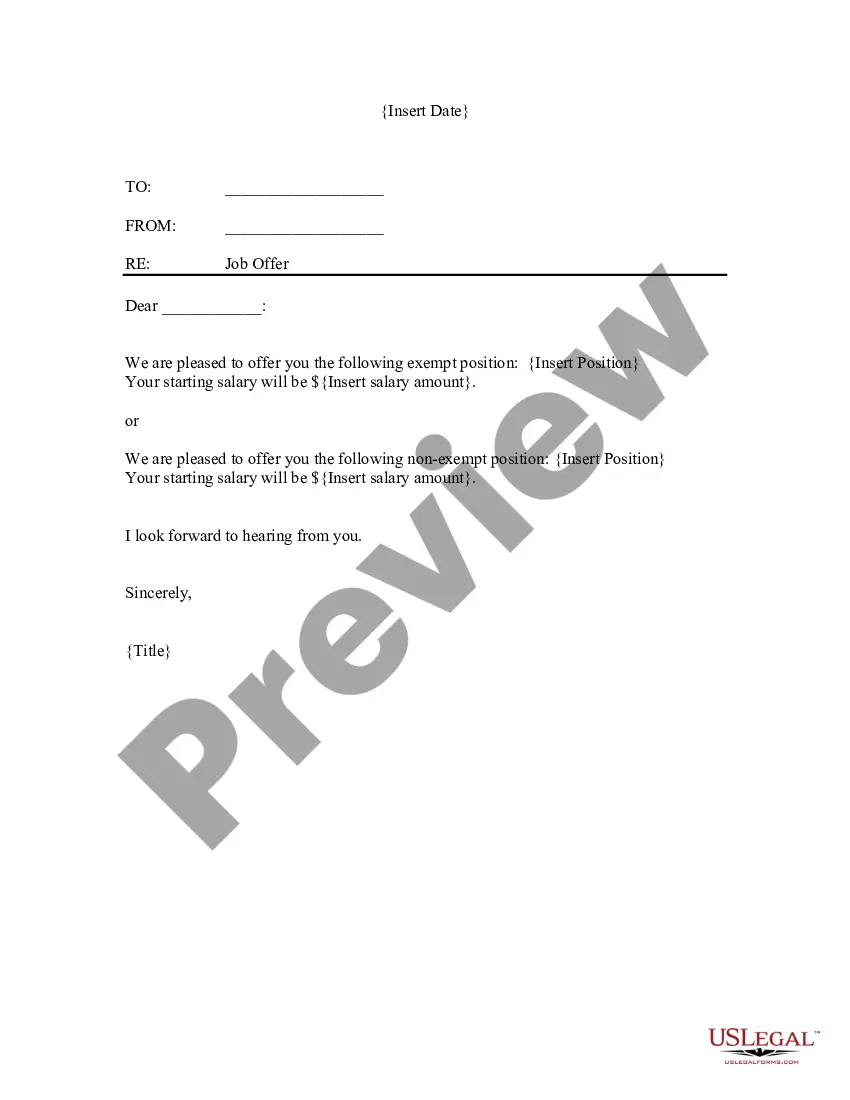

This form is a sample letter in Word format covering the subject matter of the title of the form.

Mortgage Payoff Form With Decimals In Maryland

Description

Form popularity

FAQ

There's a process to getting the mortgage payoff statement. First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

How do I request a payoff letter? To get a payoff letter, ask your lender for an official payoff statement. Call or write to customer service or make the request online. While logged into your account, look for options to request or calculate a payoff amount, and provide details such as your desired payoff date.

Comptroller of Maryland Revenue Administration Division 110 Carroll Street Annapolis, MD 21411-0001 (Write Your FEIN On Check Using Blue Or Black Ink.)

Comptroller of Maryland Revenue Administration Division 110 Carroll Street Annapolis, MD 21411-0001 (Write Your FEIN On Check Using Blue Or Black Ink.)

If you lived in Maryland only part of the year, file Form 502. If you are a nonresident, file Form 505 and Form 505NR.

When and Where to File File Form 500 by the 15th day of the 3rd month following the close of the tax year or period, or by the original due date required for filing the federal return. The return must be filed with the Comptroller of Maryland, Revenue Administration Division, Annapolis, Maryland 21411-0001.

Make checks payable to and mail to: Comptroller Of Maryland Revenue Administration Division 110 Carroll Street Annapolis, Maryland 21411-0001 (Write Your Federal Employer Identification Number On Check Using Blue Or Black Ink.)

Should April 15 fall on a weekend, the return will be due on the Monday immediately following. The due date for the 2023 return is April 17, 2023. If mailing your return please send to Department of Assessments and Taxation, Personal Property Division, P.O. Box 17052, Baltimore, MD 21297- 1052.

through entity must file Maryland Form 510, “Passthrough Entity Income Tax Return,” if the entity is formed or incorporated in Maryland, does business in Maryland, or has Maryland income (or losses). The form is due by the 15th day of the 4th month following the close of the tax year or period.

There's a process to getting the mortgage payoff statement. First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.