Mortgage Payout Statement Template In Nassau

Description

Form popularity

FAQ

Form TP-584 must be filed for each conveyance of real property from a grantor/transferor to a grantee/transferee.

There's a process to getting the mortgage payoff statement. First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

To get a payoff letter, ask your lender for an official payoff statement. Call or write to customer service or make the request online. While logged into your account, look for options to request or calculate a payoff amount, and provide details such as your desired payoff date.

There's a process to getting the mortgage payoff statement. First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

The statement is provided by the mortgage servicer and can be requested at any time. Accurate payoff information is crucial for managing financial decisions related to property ownership.

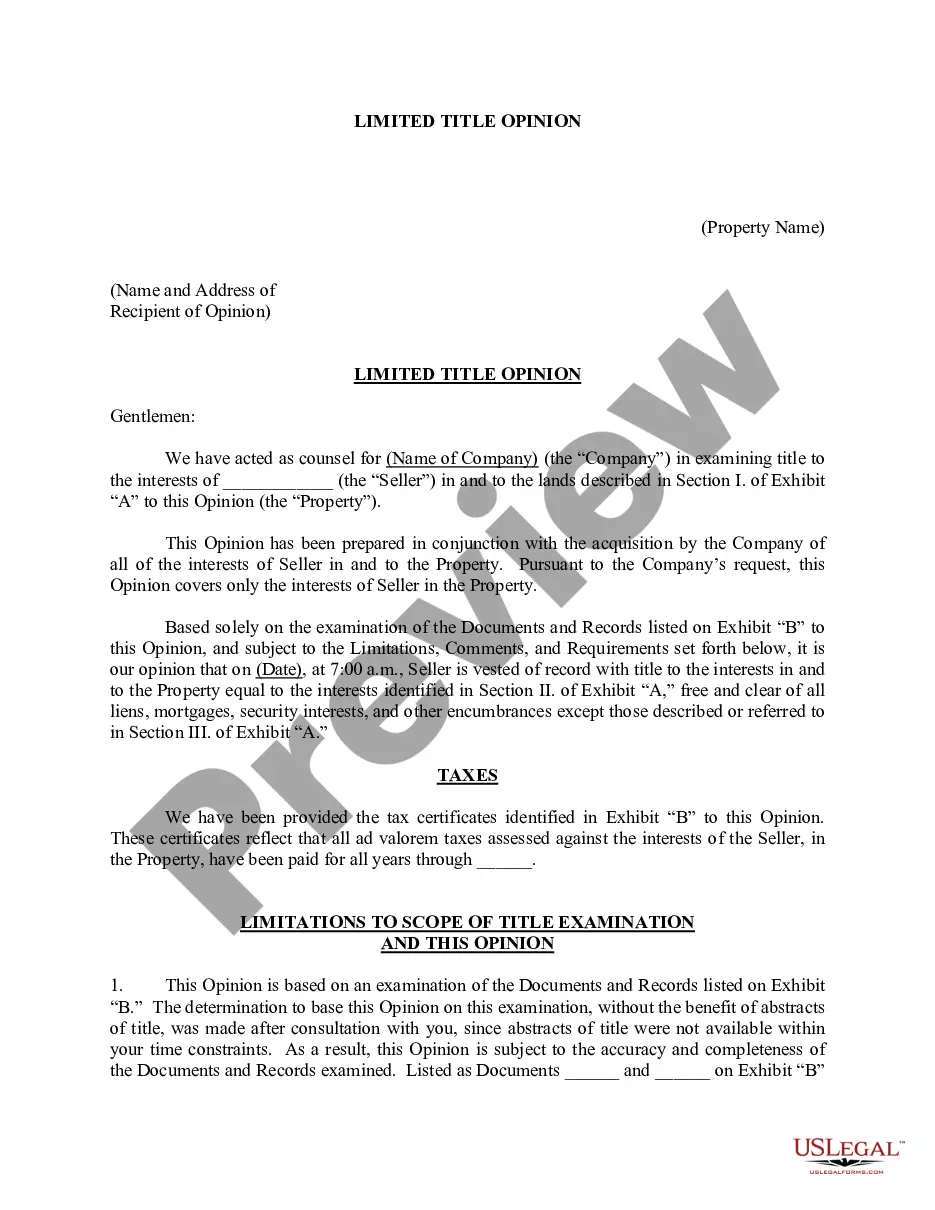

This is a standard form of mortgage payout statement provided by a lender to a borrower. This mortgage payout statement sets out the monies owed by the borrower to the lender as of the date of the statement. This Standard Document has integrated notes with important explanations and drafting and negotiating tips.

The median property tax rate in Long Island City, NY is 4.16%, considerably higher than both the national median of 0.99% and the New York state median of 2.39%. With the median home value in Long Island City, the typical annual property tax bill reaches $6,951, exceeding the national median of $2,690.

You have to provide names, dates of birth and current addresses for you, your spouse and your children. You also need to provide information about your job title and the name of your employer as well as your spouse's job title and employer's name. You MUST provide the MONTHLY amount for the expenses.