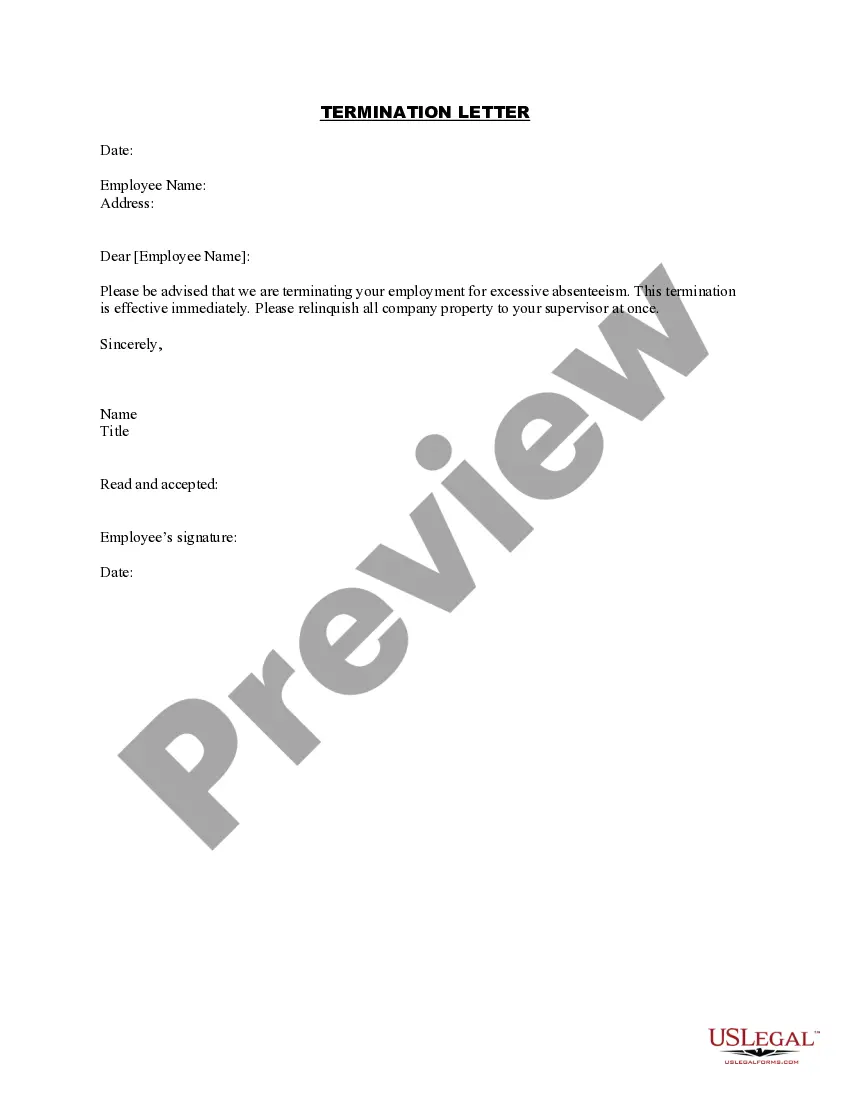

This form is a sample letter in Word format covering the subject matter of the title of the form.

Sample Mortgage Statement For Taxes In Nassau

Description

Form popularity

FAQ

NYS Mortgage Tax Rates CountyTax RateZone Nassau 1.05% 2 New York 2 Niagara 1.00% 1 Oneida 1.00% 158 more rows

There are 11 boxes to take note of when reviewing your statement. Box 1: Mortgage interest received from the borrower. Box 2: Outstanding mortgage principal. Box 3: Mortgage origination date. Box 4: Refund of overpaid interest. Box 5: Mortgage insurance premiums.

If you itemize your deductions on Schedule A (Form 1040), only include the personal part of your deductible mortgage interest on Schedule A (Form 1040), lines 8a or 8b.

If you are required and you do not file electronically, you may be subject to a penalty of up to $100 per 1098 form.

Deducting mortgage interest using Form 1098 You might be able to deduct the Form 1098 amounts if they meet the guidelines for that amount. Put Box 1, deductible mortgage interest, and Box 6, points, into your Schedule A (Form 1040), Line 8a.

Share: If you already have your Form 1098, Mortgage Interest Statement, you probably have everything you need to claim a mortgage interest deduction on your tax return.

The Mortgage tax is due and payable at the time of recording as described below: Mortgage Tax is equal to 1.05% of the total mortgage amount (minus a $30.00 deduction if applicable) which consists of the following: Basic Mortgage Tax is . 50% of mortgage amount.

No, you don't have to file Form 1098 or submit it with your tax return. You only have to indicate the amount of interest reported by the form. And you generally only report this interest if you are itemizing deductions on your tax return.