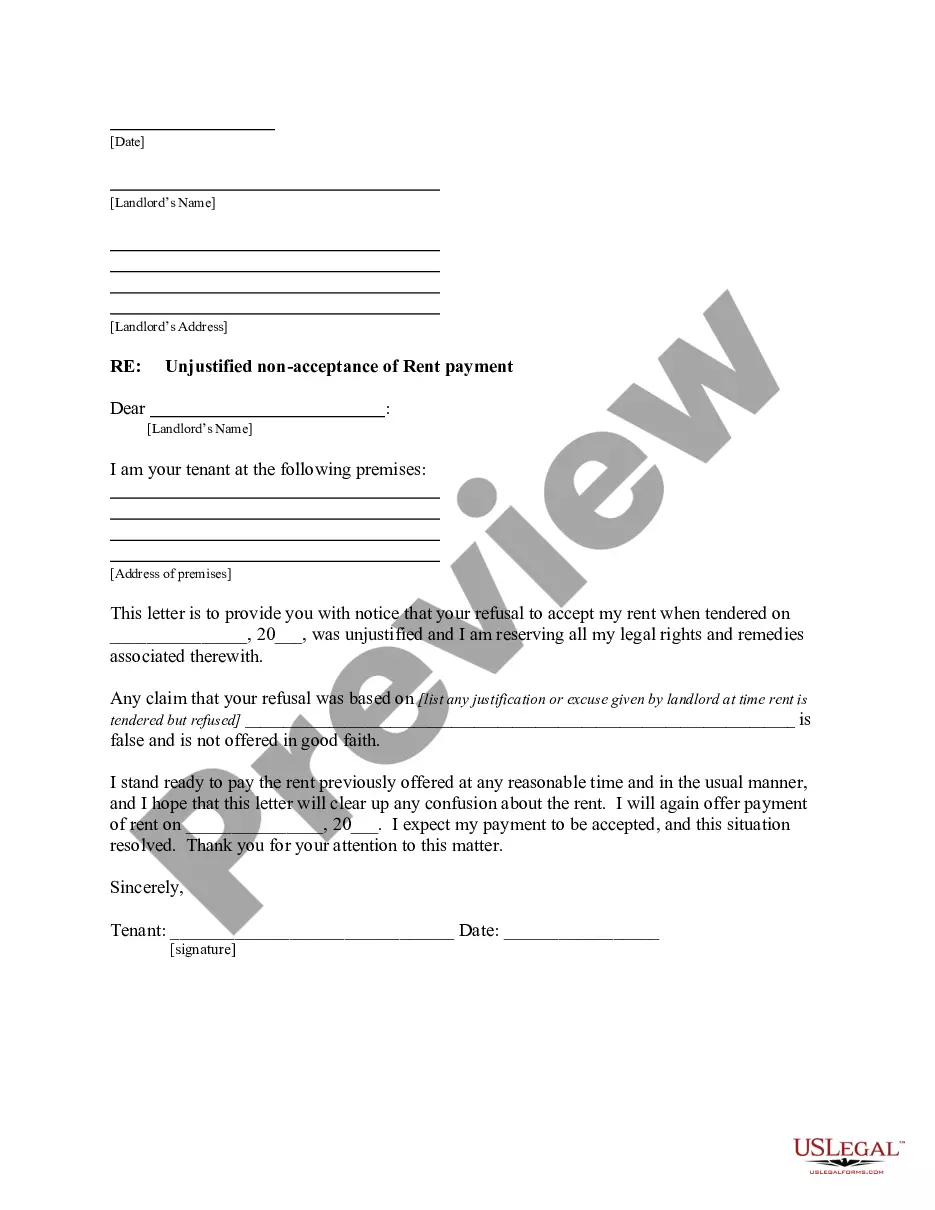

This form is a sample letter in Word format covering the subject matter of the title of the form.

Lien Release Letter Ford Motor Company In North Carolina

Description

Form popularity

FAQ

Ford Ford United States. Hours: Monday-Friday: am-pm EST. Phone: +1-800-392-3673. Address: Ford Motor Company, Customer Relationship Center, P.O. Box 6248, Dearborn, MI 48126. Ford Canada. Hours: Monday-Friday: am-pm EST. Phone: +1-800-565-3673. Address: Ford Motor Company of Canada Ltd.

If they are not timely renewed, they expire. In CA that is 10 years. However, when a judgment lien has been recorded against your property, it has no expiration date.

If there truly is no one with the legal authority to release the lien, then the remedy lies with the court. The property owner will need to file a lawsuit to quiet title. There are unique challenges involved with suing a defunct entity, but an experienced real estate attorney will be able to navigate those challenges.

With North Carolina ELT and its connection with the North Carolina DMV, finance companies that receive a vehicle payoff will be able to release the lien on the vehicle through the ELT system. Upon lien release, titles will automatically be printed and mailed.

Obtaining a Lien Release 1 Confirm the FDIC has the authority to assist with a lien release. 2 Compile Required Documents and Prepare Request for a Lien Release. 3 Register/Mail request to FDIC DRR Customer Service and Records Research.

We would like to release the lien in respect of the below mentioned units pledged in our favour by the Investor, and we therefore, request you to kindly release the lien marked on the below mentioned units.

Please contact us at 800-727-7000 and provide the following information to a representative: The year, make and model of the vehicle. The VIN (Vehicle Identification Number) Your full name, current address and telephone number. The name or names on the account (if different from those provided in your email request)

When all the liabilities shown on the Notice of Federal Tax Lien are satisfied, the IRS will issue a Certificate of Release of Federal Tax Lien for filing in the same location where the notice of lien was filed. If the IRS has not released the lien within 30 days, you can ask for a certificate of release.

Generally, expect receiving your title to take two to six weeks. As with title-holding states, it will be quicker if your lender is able to use the ELT system.