Lien Release Letter From Bank In Orange

Description

Form popularity

FAQ

It depends. If the court has invalidated the lien then it could be instantaneous. If you need to contact the “lienholder ” and negotiate then it could take as long as it takes. Unless the courts have invalidated the lien it will be up to how fast the “lienholder” moves.

Liens are legal claims against property by creditors that allow them to collect what they're owed. Liens can be general or specific, and voluntary or involuntary. If a homeowner doesn't settle an obligation, then the lienholder may legally seize and dispose of the property.

It can take roughly two to six weeks to get your title after paying off a car.

If the bank failed within the last two years and another bank purchased or acquired the failed bank, you should contact the acquiring bank (see the Failed Bank List). If the lien is for a subsidiary of a failed bank, the FDIC may also be able to assist you. Please contact FDIC DRR Customer Service at 888-206-4662.

The easiest way to eliminate the lien amount is to rectify the issue by contacting the bank executive or clearing the dues.

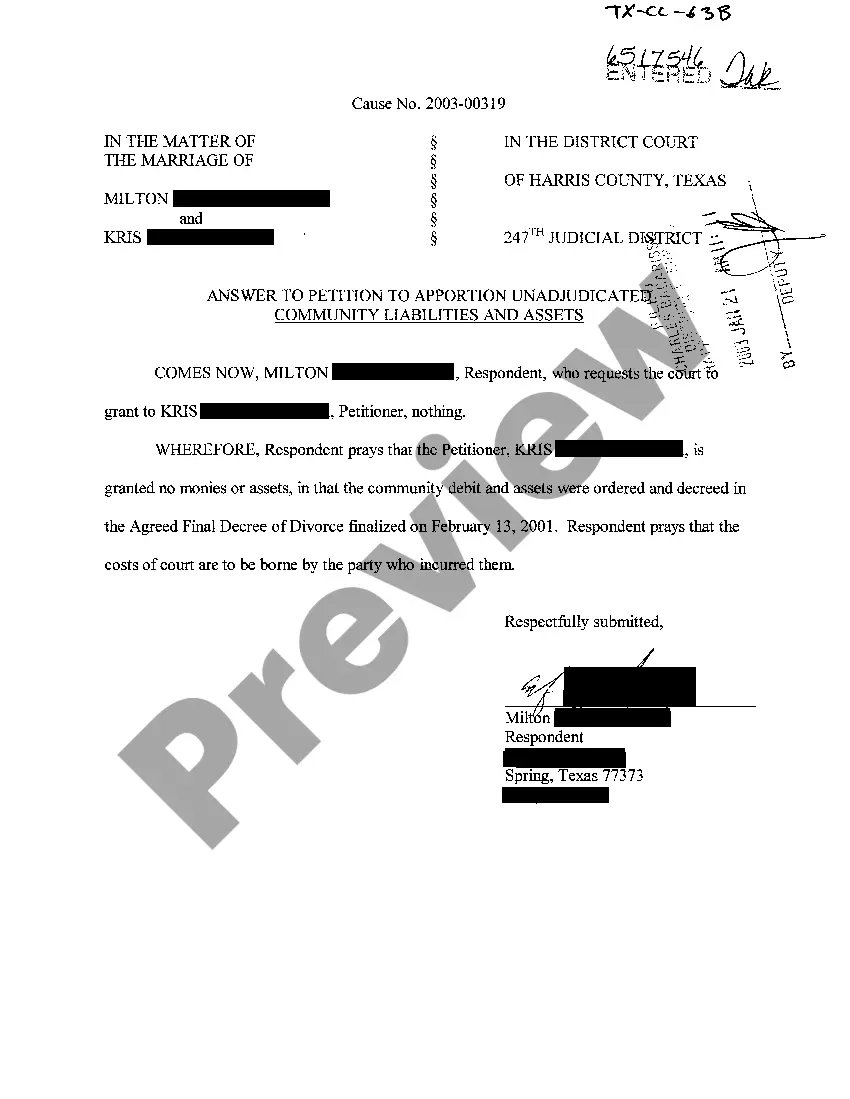

We would like to release the lien in respect of the below mentioned units pledged in our favour by the Investor, and we therefore, request you to kindly release the lien marked on the below mentioned units.

Wyoming, Texas, and Mississippi are the only states that require a person signing a lien waiver to have it notarized. The notarization requirement does not apply in Washington and Oregon, the two states we primarily serve at Northwest Lien.