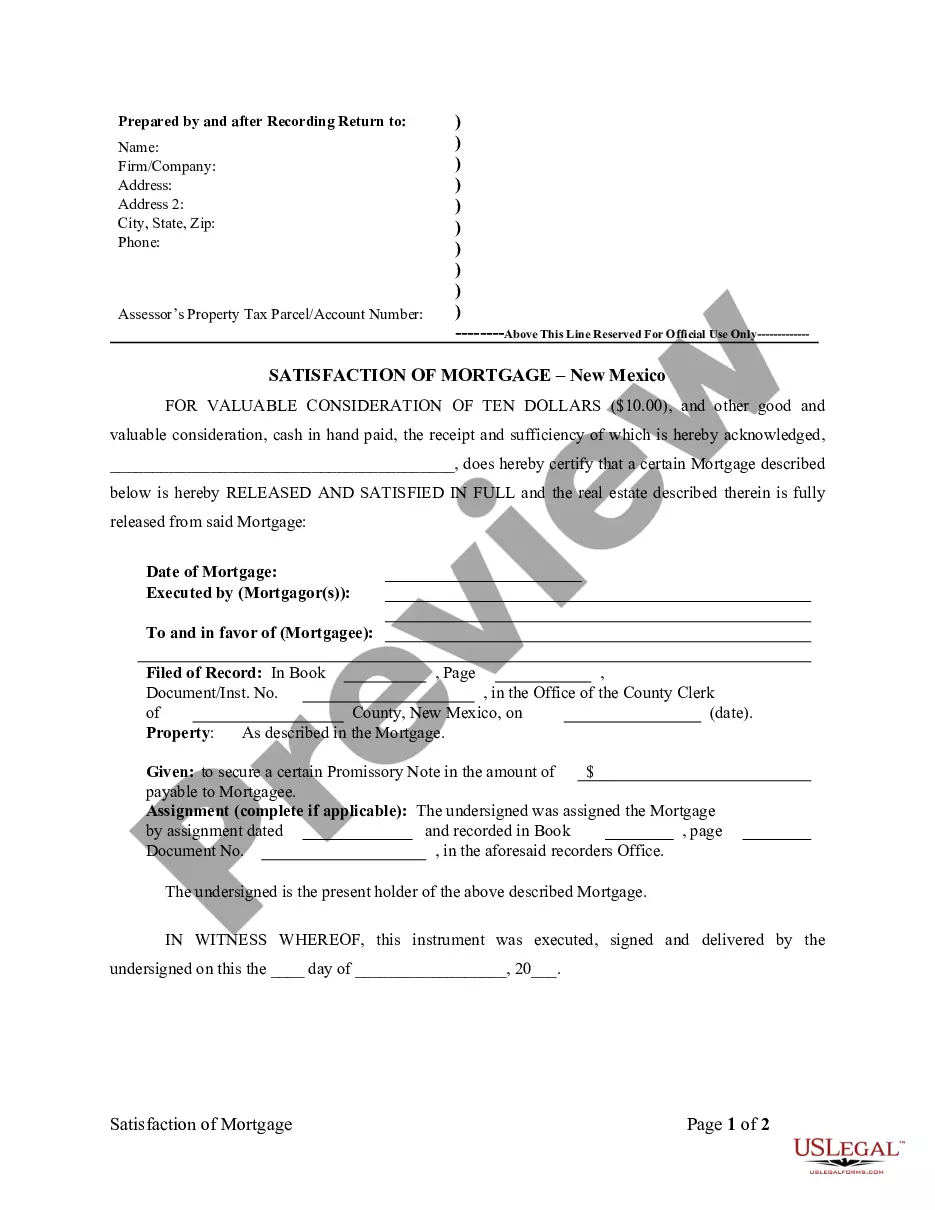

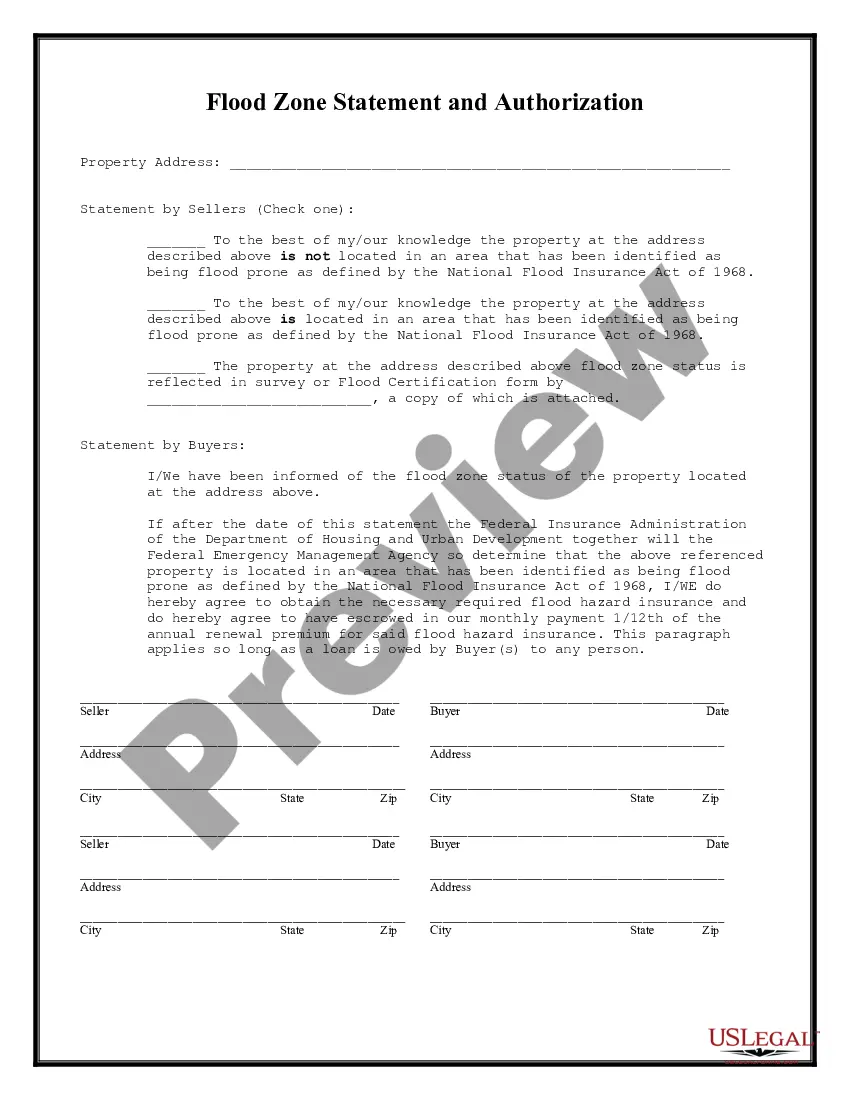

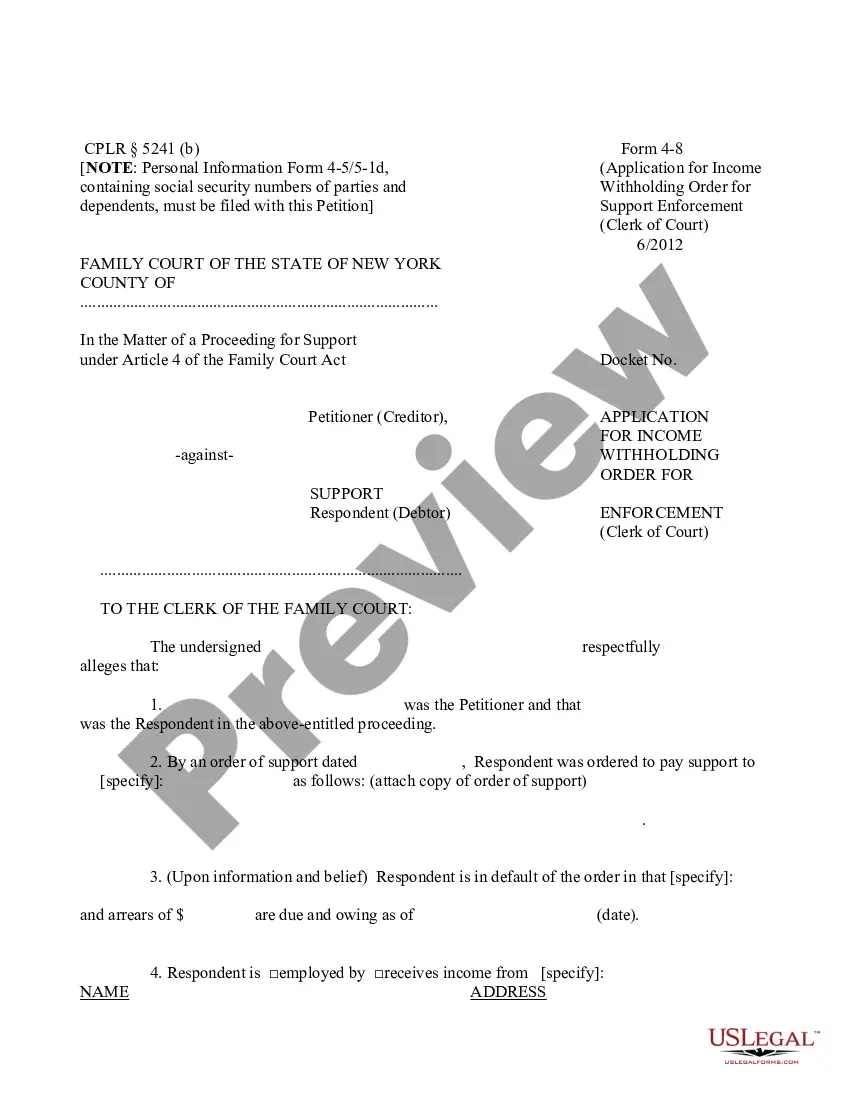

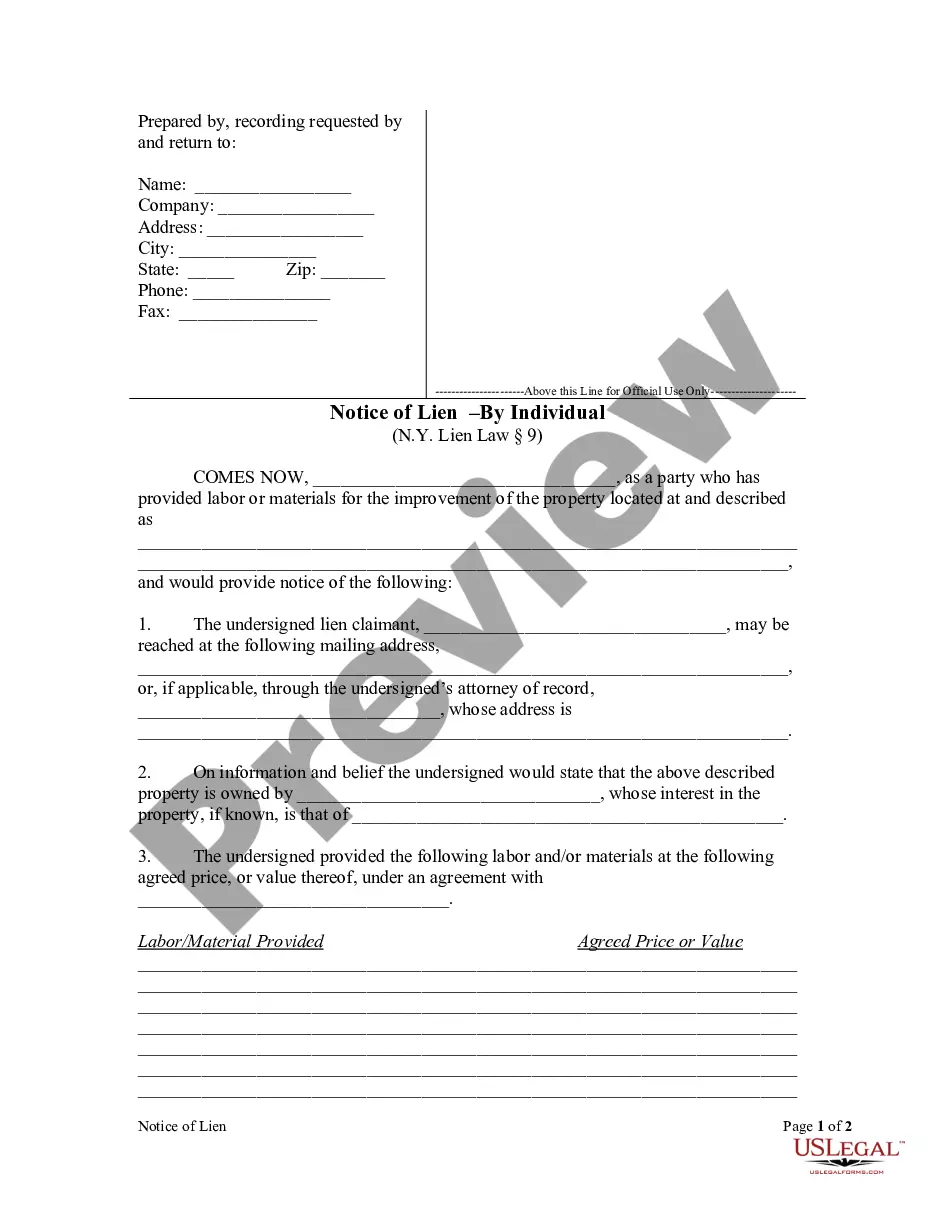

This form is a sample letter in Word format covering the subject matter of the title of the form.

Sample Mortgage Statement Withholding Tax In Phoenix

State:

Multi-State

City:

Phoenix

Control #:

US-0019LTR

Format:

Word;

Rich Text

Instant download