Sample Letter Payoff Mortgage File For Bankruptcies In San Antonio

Description

Form popularity

FAQ

There's a process to getting the mortgage payoff statement. First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

Under federal law, the servicer must generally send you a payoff statement within seven business days of your request, subject to a few exceptions. (12 C.F.R. § 1026.36.)

To qualify for Chapter 13, you must have regular income, have filed all required tax returns for tax periods ending within four years of your bankruptcy filing and meet other requirements set forth in the bankruptcy code.

The main cons to Chapter 7 bankruptcy are that most secured debts won't be erased, you may lose nonexempt property, and your credit score will likely take a temporary hit. Filing for bankruptcy is a very effective way to eliminate debt and get a fresh start.

An individual cannot file under chapter 13 or any other chapter if, during the preceding 180 days, a prior bankruptcy petition was dismissed due to the debtor's willful failure to appear before the court or comply with orders of the court or was voluntarily dismissed after creditors sought relief from the bankruptcy ...

Individuals can file bankruptcy without an attorney, which is called filing pro se. However, seeking the advice of a qualified attorney is strongly recommended because bankruptcy has long-term financial and legal outcomes.

Chapter 13 Eligibility Any individual, even if self-employed or operating an unincorporated business, is eligible for chapter 13 relief as long as the individual's combined total secured and unsecured debts are less than $2,750,000 as of the date of filing for bankruptcy relief.

Sir / Madam, I/We are the owner(s) of the property as mentioned above and wish to seek permission to mortgage the same in favour of ______________________________________ (Name of Bank). All the requisite documents are enclosed.

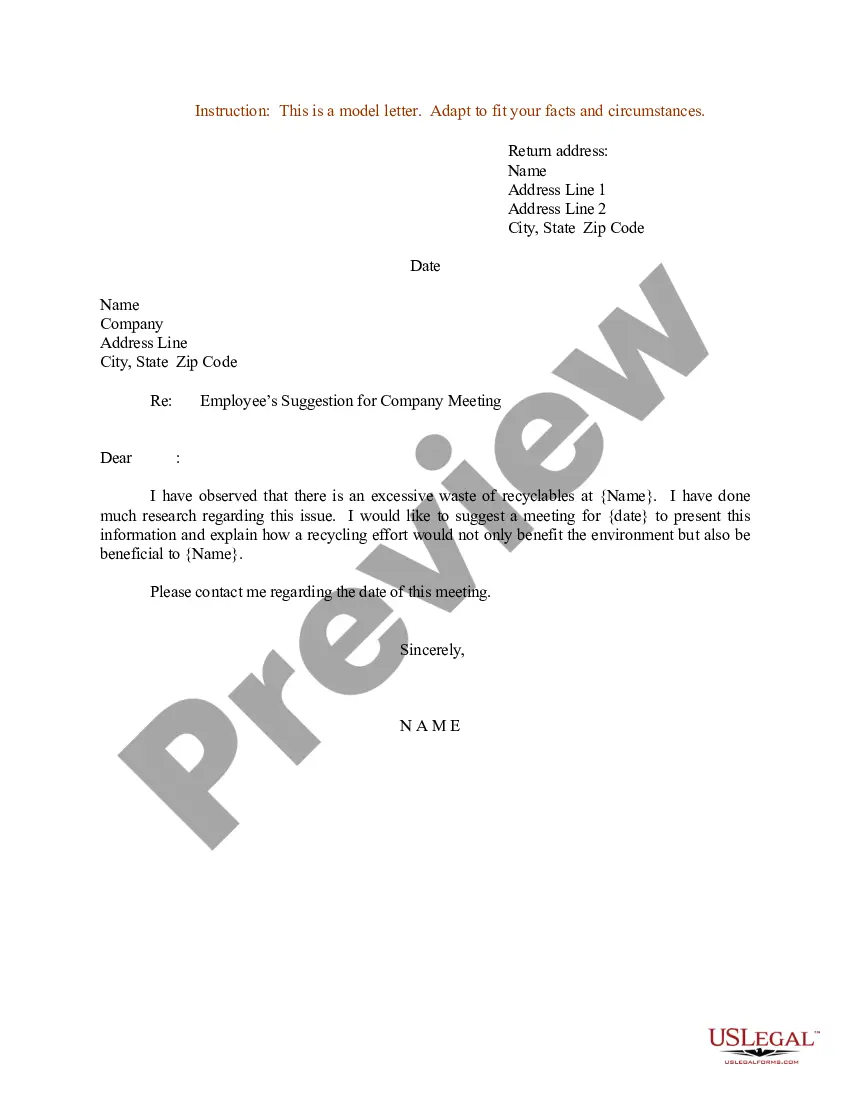

The letter should include an explanation regarding the negative event, the date it happened, the name of the creditor and your account number. It should also include an explanation of why you don't see this problem happening again.