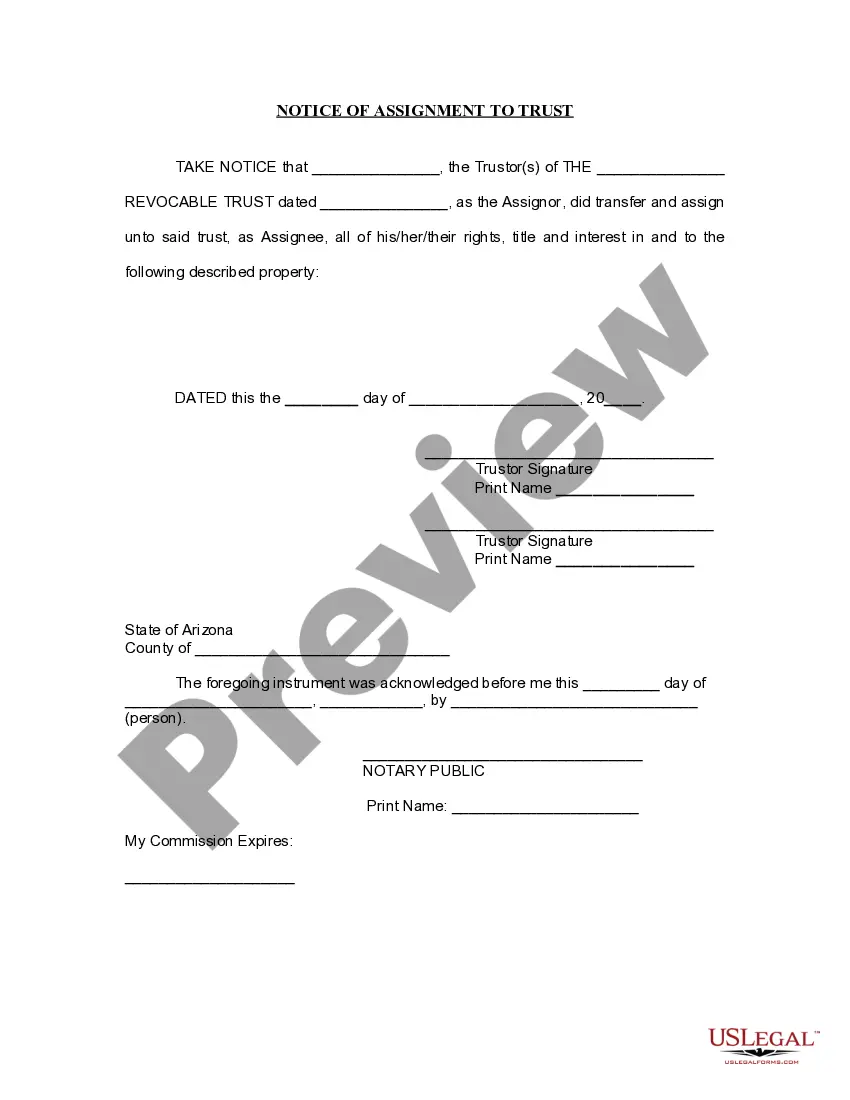

This form is a sample letter in Word format covering the subject matter of the title of the form.

Loan Amortization Schedule Excel In Rupees In Suffolk

Description

Form popularity

FAQ

Journal entry for depreciation records the reduced value of a tangible asset, such a office building, vehicle, or equipment, to show the use of the asset over time. In a depreciation journal entry, the depreciation account is debited and the fixed asset account is credited.

On the income statement, typically within the “depreciation and amortization” line item, will be the amount of an amortization expense write-off. On the balance sheet, as a contra account, will be the accumulated amortization account. It is located after the intangible assets line item.

For example, if you borrow Rs. 10,000 at an annual interest rate of 6% for 3 years (36 months), the monthly EMI would be EMI = 10,000 (0.06/12) (1 + 0.06/12)^36 / ((1 + 0.06/12)^36 - 1) = Rs. 303.87.

How to create a budget in Excel using templates Navigate to the "File" tab. The "File" tab is on the top ribbon in Excel. Search for budgets. You can expect to see a bar on the new interface. Select a suitable template. Microsoft Excel has various budget templates to suit your specific situation. Fill the template.

Select the template that you'd like to open and click open. You can then use the template to createMoreSelect the template that you'd like to open and click open. You can then use the template to create a version of the workbook.

Fortunately, Excel can be used to create an amortization schedule. The amortization schedule template below can be used for a variable number of periods, as well as extra payments and variable interest rates.