Mortgage Payoff Statement With Mortgage In Suffolk

Description

Form popularity

FAQ

Take the principal of your mortgage, which is the total amount you are borrowing from a lender, and divide it by 100. Next, round up the quotient to the nearest whole number. Take the result and multiply it by your state's specific mortgage recording tax rate. Finally, check for allowances.

The typical Suffolk County homeowner pays $10,000 annually in property taxes. That is due, in part, to high home values, as the median value in the county is $413,900. Even so, the average effective property tax rate in Suffolk County is 2.42%, far above both state and national averages.

The Record & Return To box (number 6) on the Suffolk County Recording and Endorsement Form must be properly completed for the timely return of your recorded mortgage. NOTE: Must be printed on legal size (8 1/2 x 14) paper. Mortgage Tax is computed by a formula based on 1.05% of the amount of the mortgage.

How do I obtain a copy of my property deed? Property deeds are recorded in the Suffolk County Clerk's Office in Riverhead, NY. The direct phone number is (631) 852-2000.

Mortgage Tax is computed by a formula based on 1.05% of the amount of the mortgage. If mortgage amount is less than $10,000.00, mortgage tax is figured at three-quarters percent.

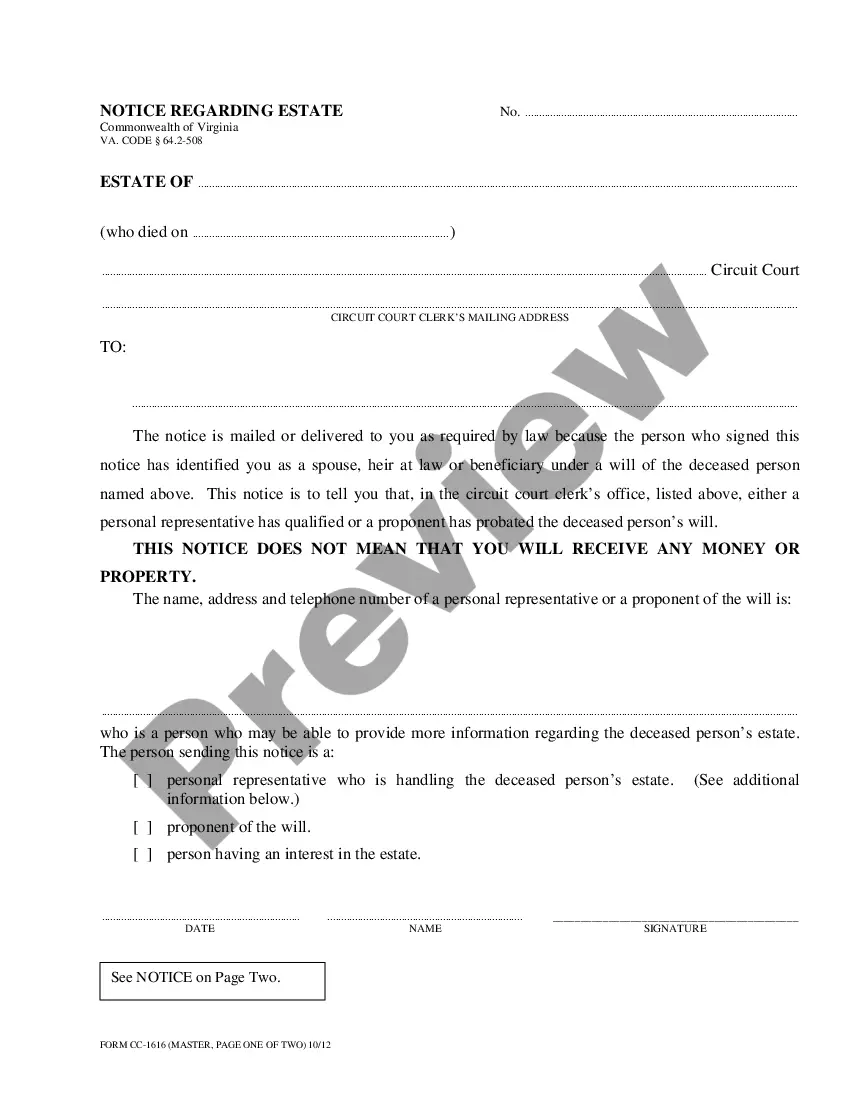

Satisfactions of Mortgage should be recorded in the Office of the County Clerk of the county in which the mortgage has been recorded.

If a Transcript of Judgment has been filed with the County Clerk, once the Debtor pays off the Judgment, the Creditor has a legal responsibility to prepare and sign a Satisfaction of Judgmentfor the benefit of the Debtor, so that all liens and record of Judgment can be removed from the County Clerk's office.

There's a process to getting the mortgage payoff statement. First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

Mortgage Tax is computed by a formula based on 1.05% of the amount of the mortgage. If mortgage amount is less than $10,000.00, mortgage tax is figured at three-quarters percent.

The statement is provided by the mortgage servicer and can be requested at any time. Accurate payoff information is crucial for managing financial decisions related to property ownership.