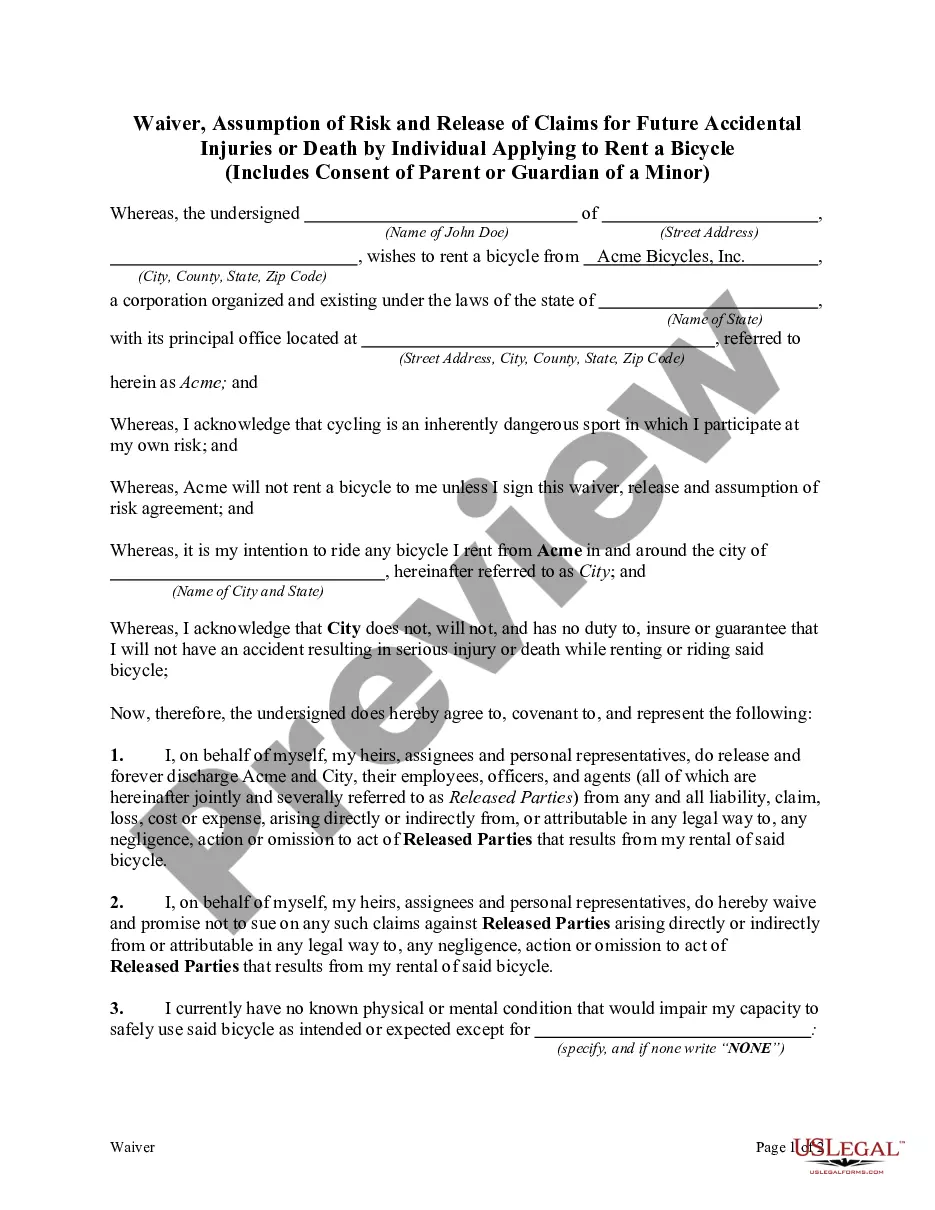

This form is a sample letter in Word format covering the subject matter of the title of the form.

Sample Letter Payoff Mortgage Form With Credit Card In Suffolk

Description

Form popularity

FAQ

There's a process to getting the mortgage payoff statement. First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

To request a payoff statement, you will need to contact your lender or credit card company. You can typically request a payoff statement online, over the phone, or by mail. Make sure to provide your account information and specify that you are requesting a payoff statement.

What are Suffolk Building Society's bank details? For all accounts, the Society bank details are: Sort Code: 23-44-48, Account Number: 00004000. Please remember to always quote your 9 digit account number when making a transfer in to your Suffolk Building Society account.

If you want to change your correspondence address we will require a signed (wet) signature, please give us a call on 01473 278511 or complete our enquiry form. If you are changing your correspondence address because you wish to rent out your house, you will need the Society's consent to do so.

There's a process to getting the mortgage payoff statement. First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

How do I request a payoff letter? To get a payoff letter, ask your lender for an official payoff statement. Call or write to customer service or make the request online. While logged into your account, look for options to request or calculate a payoff amount, and provide details such as your desired payoff date.

First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

A Payoff Letter memorializes a debtor and lender's agreement regarding a debt obligation's early payment and termination. Typically, upon satisfaction of its terms, the Payoff Letter terminates the underlying debt instrument and releases the debtor from most continuing obligations.

There's a process to getting the mortgage payoff statement. First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

2% of your repayment. Let's say you're paying on a weekly or monthly basis. Let's say monthly basis you're paying roughly $2000. If you add extra 2% under $2000, that 2% extra can save you 14 to 15 years on interest.