Sample Payoff Letter For Mortgage Withdrawal In Tarrant

Description

Form popularity

FAQ

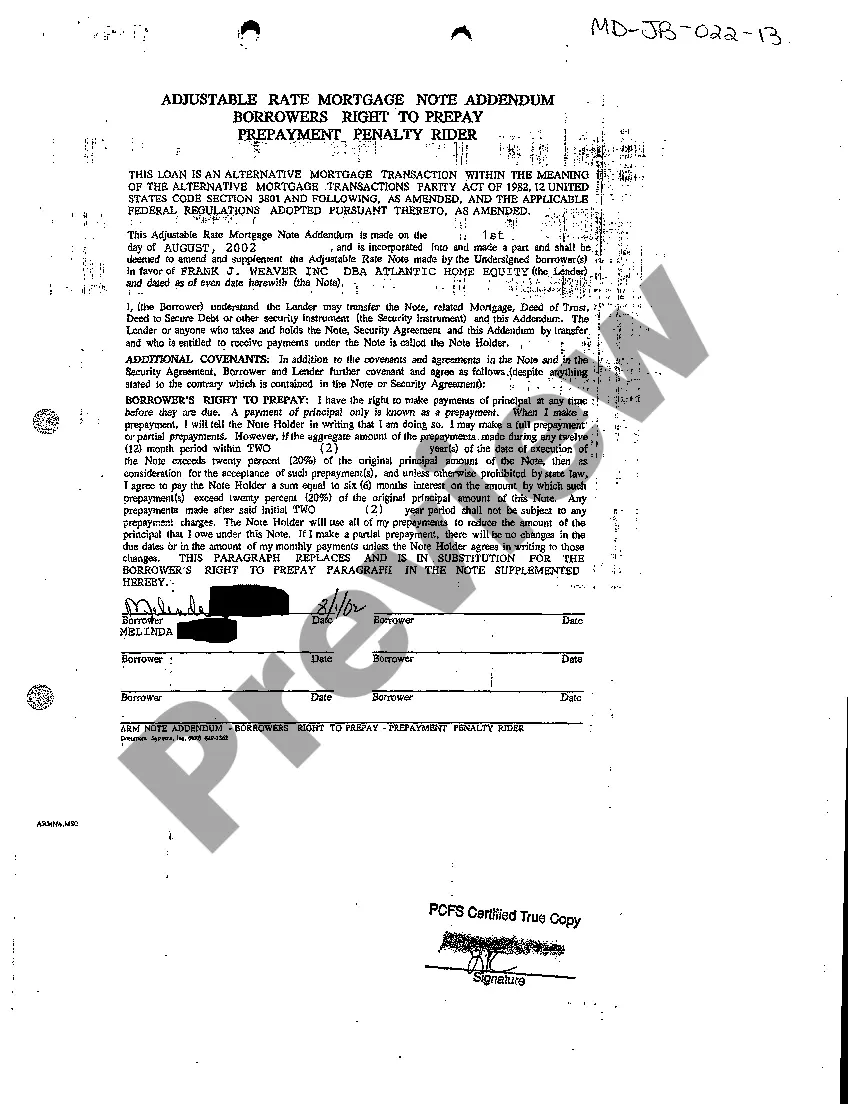

There's a process to getting the mortgage payoff statement. First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

How do I request a payoff letter? To get a payoff letter, ask your lender for an official payoff statement. Call or write to customer service or make the request online. While logged into your account, look for options to request or calculate a payoff amount, and provide details such as your desired payoff date.

Like the federal estate tax, all states that tax estates offer an exemption that excludes most estates from taxation (table 1). The lowest state exemptions in tax year 2022 were $1 million in Oregon and Massachusetts.

In contrast, the South and Mountain West regions generally have the lowest effective rates, with Hawaii (0.318%) and Alabama (0.359%) at the bottom, followed by Arizona (0.442%) and South Carolina (0.471%). A notable exception is Texas, which ranks seventh overall, with an effective property tax rate of 1.356%.

All of the data below comes from the Census Bureau's 2022 1-year American Community Survey (ACS) Estimates. Hawaii. Hawaii has the lowest property tax rate in the U.S. at 0.27%. Alabama. Alabama is generally one of the more affordable states in the country. Colorado. Nevada. Utah. West Virginia.

There's a process to getting the mortgage payoff statement. First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

There's a process to getting the mortgage payoff statement. First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.