Payoff Letter With Per Diem In Utah

Description

Form popularity

FAQ

There's no federal law from the Fair Labor Standards Act (FLSA) or Department of Labor requiring employers to offer per diem for business-related travel expenses. But employers must reimburse these travel expenses in some way (we'll discuss per diem alternatives later).

As an employee, you may qualify for a per diem tax deduction by using the per diem rates to determine your lodging, meal, and incidental expenses. To find per diem rates, visit .gsa. Report your per diem tax amounts on Form 2106. You don't need to keep a record of your actual costs.

Per diem rates in Utah CountyLodgingMeals & Incidentals rate Salt Lake County $128 $64 San Juan County $98 $59 Sanpete County $98 $59 Sevier County $98 $5925 more rows

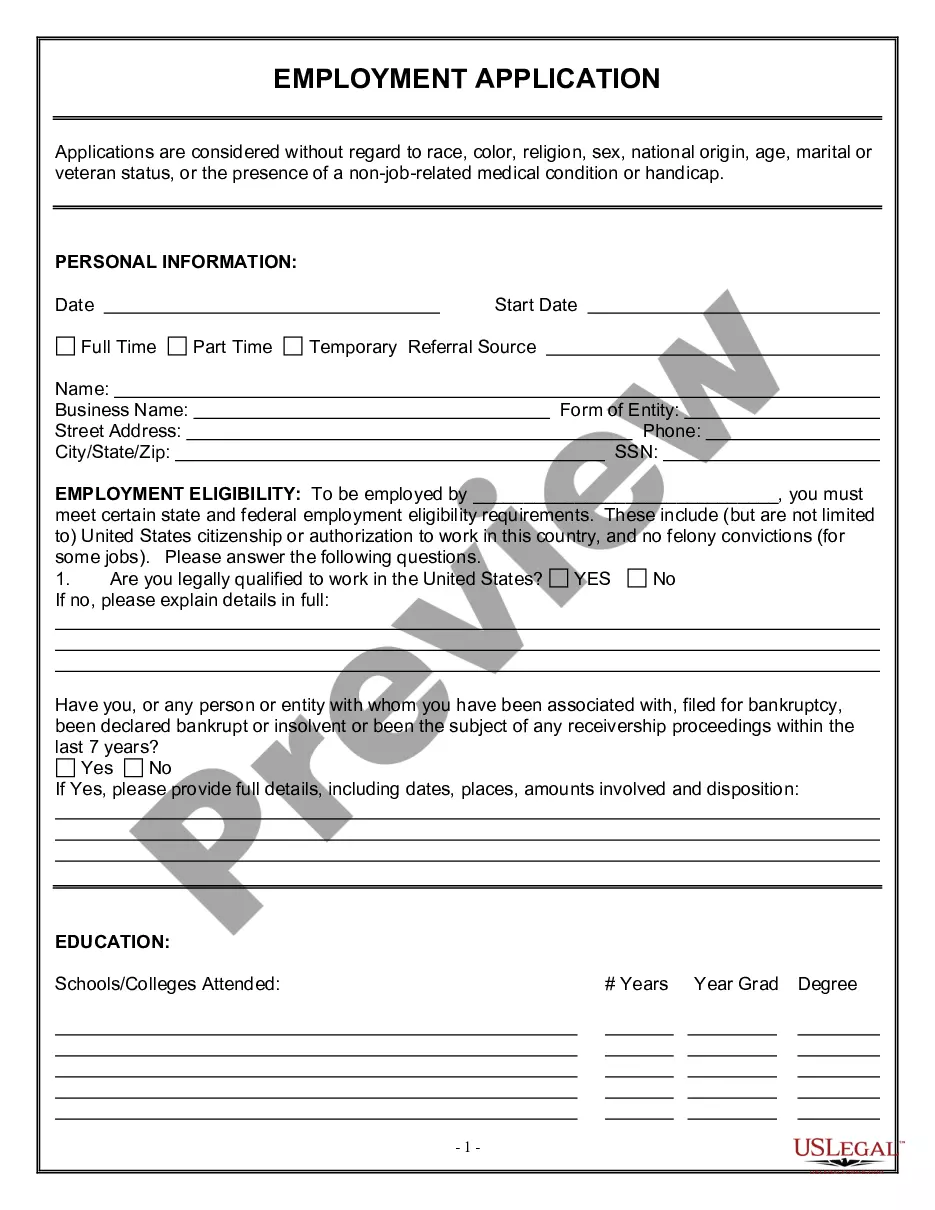

How Do I Write a Per Diem? When writing a per diem policy or entry, consider including: Eligibility: Define who qualifies for per diem allowances, such as full-time employees, contractors, etc. Rates: Specify daily rates or reference a standard rate, like those published by the IRS or GSA.

The term “Per Diem” is derived from Latin, meaning “per day”, and the method essentially assigns a daily monetary value to the pain, discomfort, and distress experienced by the victim post-injury.

Per Diem Employees. Per diem employees work on an as-needed basis. While per diem means "for each day" and not "as-needed," a per diem position applies to someone who may be needed one day but not the next. Per diem workers' schedules can vary significantly from week to week.

Per diem is an allowance for lodging, meals, and incidental expenses.

Per diem rates in Utah CountyLodgingMeals & Incidentals rate Salt Lake County $128 $64 San Juan County $98 $59 Sanpete County $98 $59 Sevier County $98 $5925 more rows