This form is a sample letter in Word format covering the subject matter of the title of the form.

Mortgage Payoff Statement Form With Tax In Virginia

Description

Form popularity

FAQ

Please assemble your return in the following order: Form 760, Schedule ADJ and Schedule CR, Federal Schedule E and F (if necessary). Nonresident (Form 763) and Part-Year (Form 760PY) returns must include a complete copy of the Federal Form 1040, 1040A, or 1040EZ, as well as all other required Virginia attachments.

Do I need to file a Virginia State Income Tax Return? You must file if you are: Single and your VAGI (VA adjusted gross income) is $11,950 or more. Married filing jointly and your combined VAGI is $23,900 or more.

What am I required to attach to my Virginia State Income Tax Return? Every Resident return (Form 760), must include a complete copy of each Federal Schedule C, C-EZ, D, E or F, filed with your Federal return, and all other schedules and forms supporting gross receipts and depreciation.

Every Virginia resident whose Virginia adjusted gross income. is at or above the minimum threshold must file. Complete Form 760, Lines 1 through 9, to determine your. Virginia adjusted gross income (VAGI).

Nonresidents of Virginia must file a Form 763. (A person is considered a nonresident of Virginia if they lived in Virginia for less than 183 days in a calendar year). An instruction booklet with return mailing address is also available on the website. Part-Year Residents of Virginia file a Form 760PY.

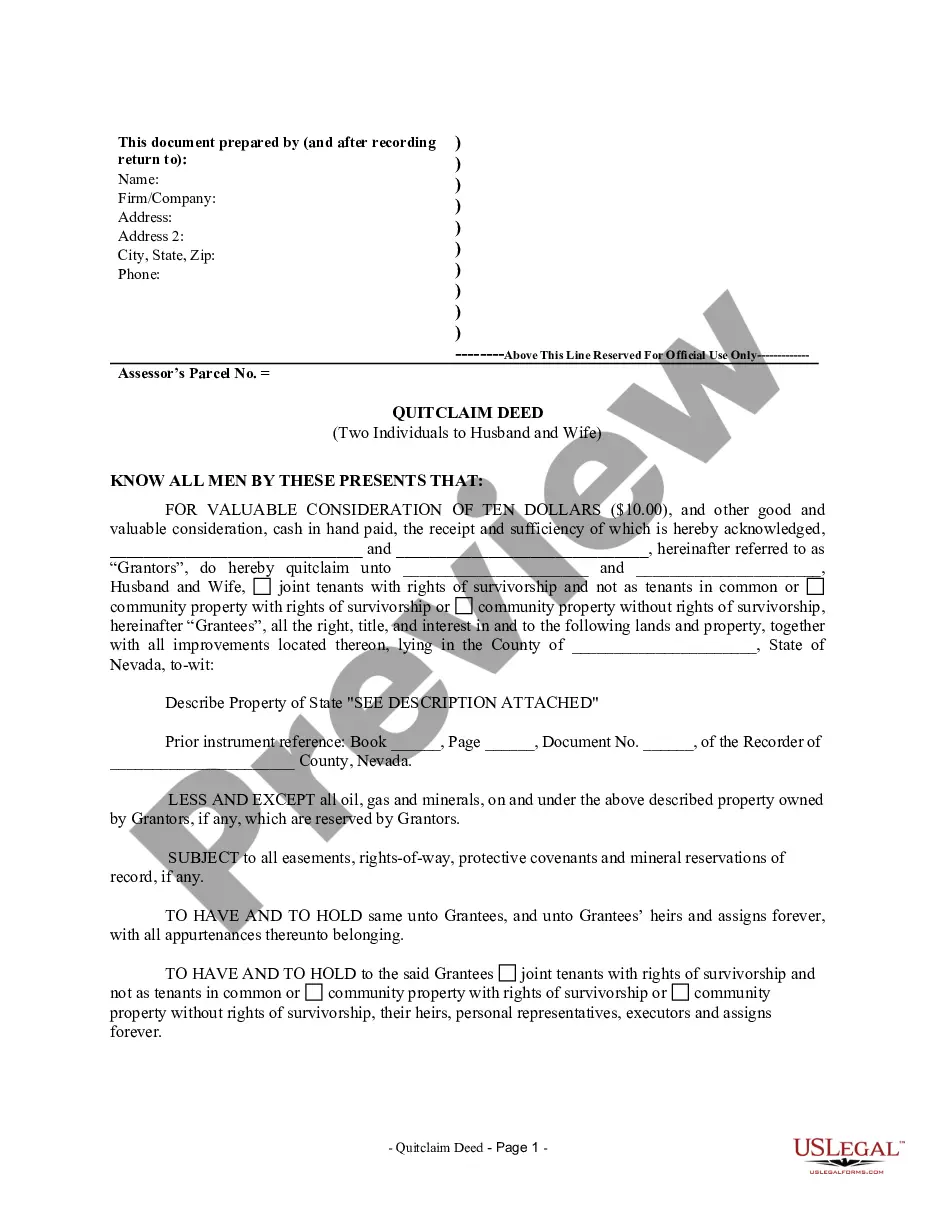

The Commonwealth of Virginia levies a tax on the recordation of deeds, deeds of trust, mortgages, leases and contracts for the sale, assignment, transfer, conveyance or vestment of lands, tenements or realty.

Unlike the potential credit ramifications of closing a credit card account, finishing your mortgage payments is more akin to closing student or auto loans, with only a minor effect, if any, on your credit.

You need to have the local land registry office remove your lender's interest in your property from the title. This procedure is called discharging a mortgage and involves you, your lender, and your provincial or territorial land registry office.

Nonresidents of Virginia must file a Form 763. (A person is considered a nonresident of Virginia if they lived in Virginia for less than 183 days in a calendar year). An instruction booklet with return mailing address is also available on the website. Part-Year Residents of Virginia file a Form 760PY.