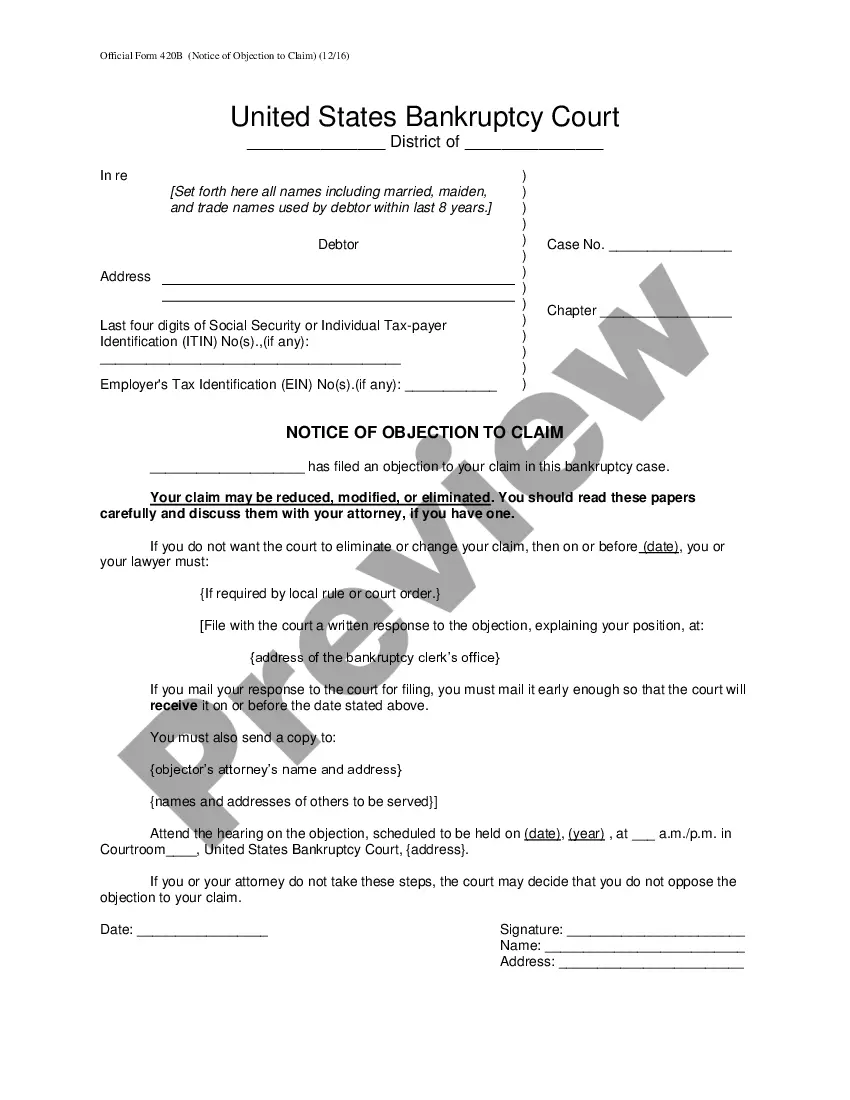

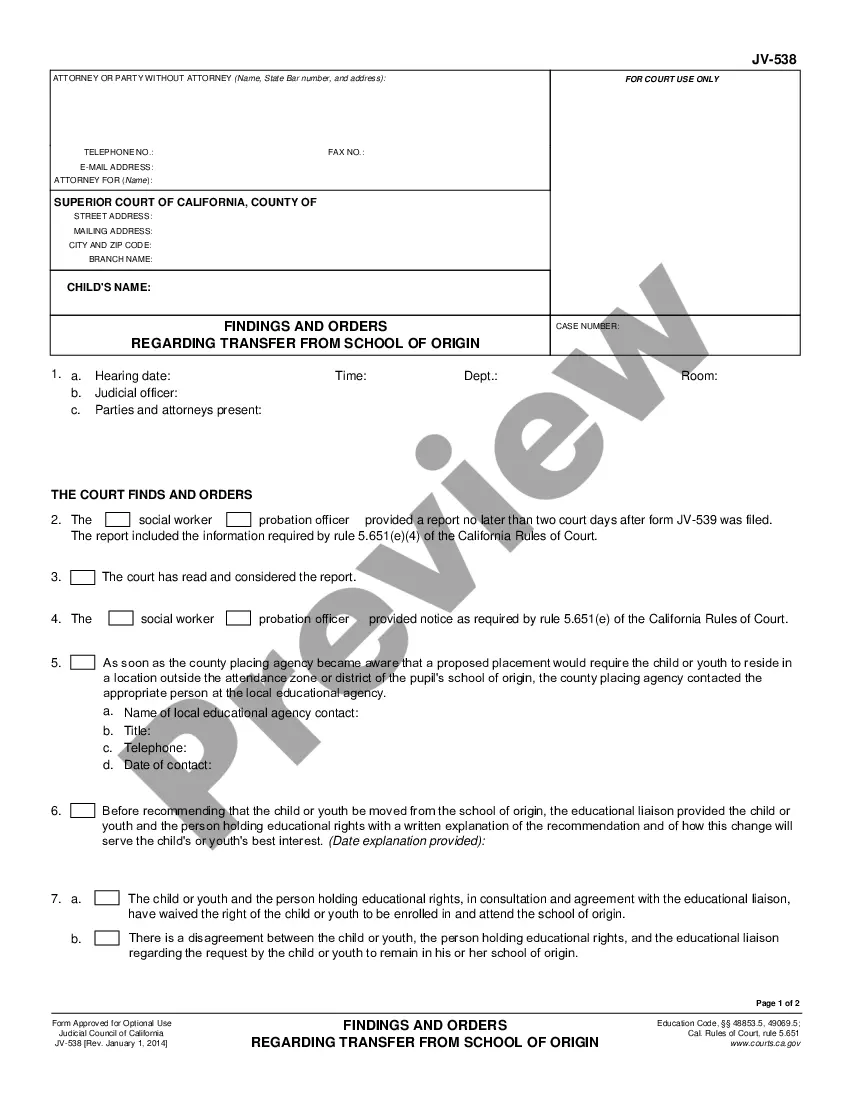

This form is a sample letter in Word format covering the subject matter of the title of the form.

Loan Amortization Schedule Excel With Compound Interest In Wake

Description

Form popularity

FAQ

The compound interest is found using the formula: CI = P( 1 + r/n)nt - P. In this formula, P( 1 + r/n)nt represents the compounded amount. the initial investment P should be subtracted from the compounded amount to get the compound interest.

Similarly, you can adapt the compound interest formula to handle monthly or daily compounding periods. For monthly compounding, the formula becomes: FV = P (1 + r/12)^(12t). For daily compounding, the formula is: FV = P (1 + r/365)^(365t).

If you started with $100 in your savings account that offers 1% annual interest compounded daily and made $100 deposits once a month for a year, you'd add the deposit to the last balance and run the calculation again: $100 + $101.01 ( 1 + ( 1% ÷ 365 ) )365 = $203.03. $100 + $203.03 ( 1 + ( 1% ÷ 365 ) )365 = $306.07.

Multiply your principal balance by your interest rate. Divide your answer by 365 days (366 days in a leap year) to find your daily interest accrual or your per diem.

Fortunately, Excel can be used to create an amortization schedule. The amortization schedule template below can be used for a variable number of periods, as well as extra payments and variable interest rates.

Amortization and compound interest are two different ways to calculate interest. Amortization is usually for medium-term financings, such as auto loans. Compound interest is typically for much longer loans, like a 30-year mortgage (it's also possible to get an amortizing or simple interest mortgage).