Sample Letter For Loan Payoff In Washington

Description

Form popularity

FAQ

It is possible to obtain an official payoff letter from the IRS. To request this, you can use the IRS's Form 12277 (Application for the Withdrawal of Filed Form 668(Y), Notice of Federal Tax Lien) or contact the IRS directly for the payoff amount, as it can vary depending on your case.

Frequently Asked Questions (FAQ) Type your letter. Concisely review the main facts. Be polite. Write with your goal in mind. Ask for exactly what you want. Set a deadline. End the letter by stating you will promptly pursue legal remedies if the other party does not meet your demand. Make and keep copies.

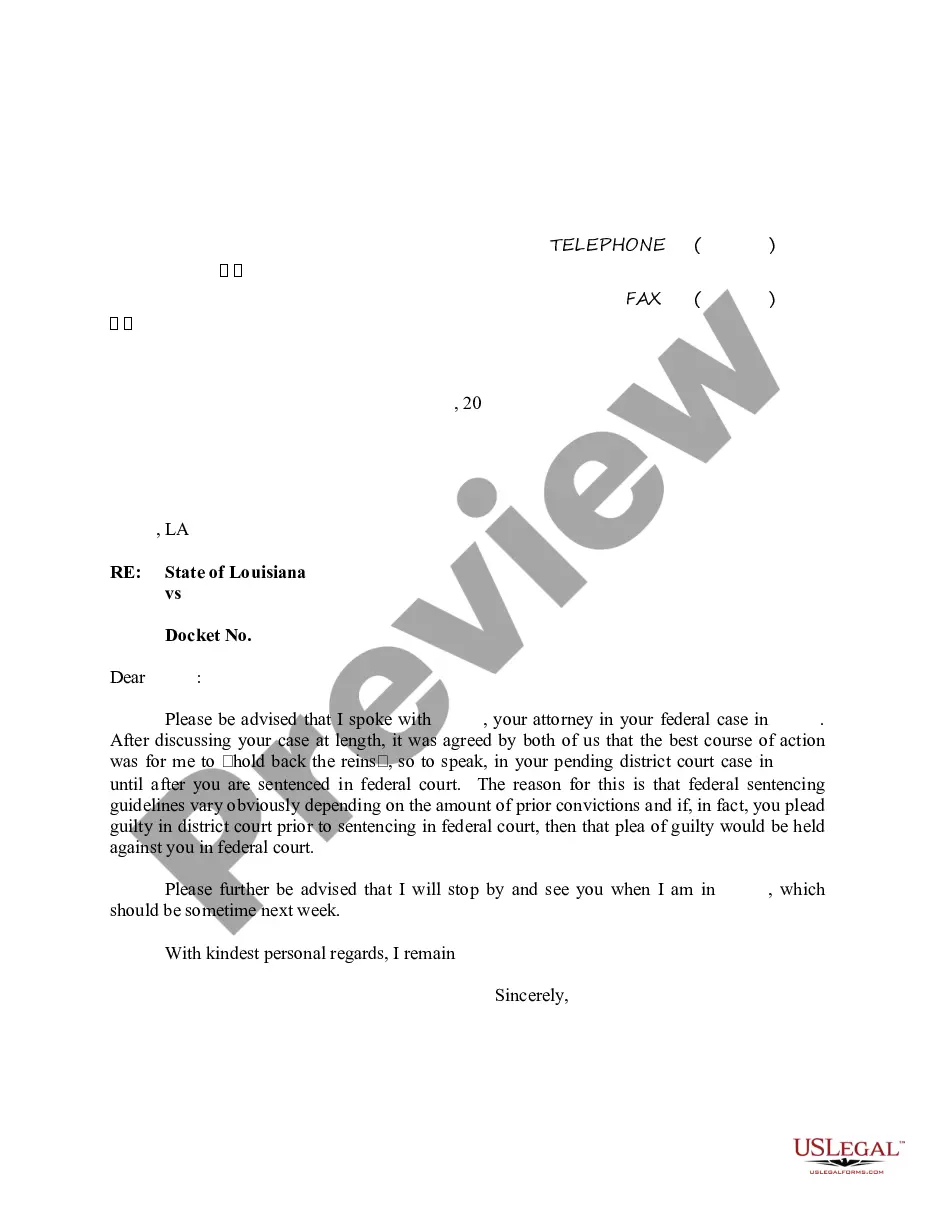

First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

Instead, you have to get a 10-day payoff estimate from your current lender, which includes the amount you owe, as well as any interest that might accrue on the principal balance in the next 10 days.