Retirement For Elderly In Franklin

Description

Form popularity

FAQ

If you're unable to afford a nursing home or assisted living facility, you aren't out of senior care options. Some seniors get by with a mix of family caregivers, in-home care, and adult day health care.

In short, the 80/20 rule provides that at least 80% of the occupied homes have one resident who is 55 or older, and the community must continue to show intent to provide housing for adults 55 and older. The 20% is there as a cushion, allowing some flexibility in age requirements.

Who qualifies for the $3000 senior assistance program in California? Eligibility for the $3000 senior assistance program in California includes those who are 65 years or older, individuals who are blind or have a disability, or those residing in nursing homes or intermediate care facilities.

Older Americans Act and Aging Network The OAA set out specific objectives for maintaining the dignity and welfare of older individuals and created the primary vehicle for organizing, coordinating and providing community-based services and opportunities for older Americans and their families.

Government programs such as Medicare, Medicaid, Social Security, SSI, and SNAP make life more manageable. They reduce the number of seniors who go without enough food, clothing, and shelter.

Before you begin, please ensure you have: your Social Insurance Number (SIN) information about your spouse or common-law partner if you have one (Social Insurance Number, date of birth) information about where you have lived since age 18. your banking information to sign up for direct deposit.

The $1,000 per month rule is designed to help you estimate the amount of savings required to generate a steady monthly income during retirement. ing to this rule, for every $240,000 you save, you can withdraw $1,000 per month if you stick to a 5% annual withdrawal rate.

Ing to Statistics Canada's 2024 Canadian Income Survey, the average after-tax retirement income for senior families in 2022 was $74,200, or $6,183 per month. For individual seniors, it was $33,600, or $2,800 per month.

Here are some common ideas you can include on a retirement card: Congratulatory statements. Special memories, moments or events. Wishes for their success as they transition to the next phase of life. Comments on their contribution to the company.

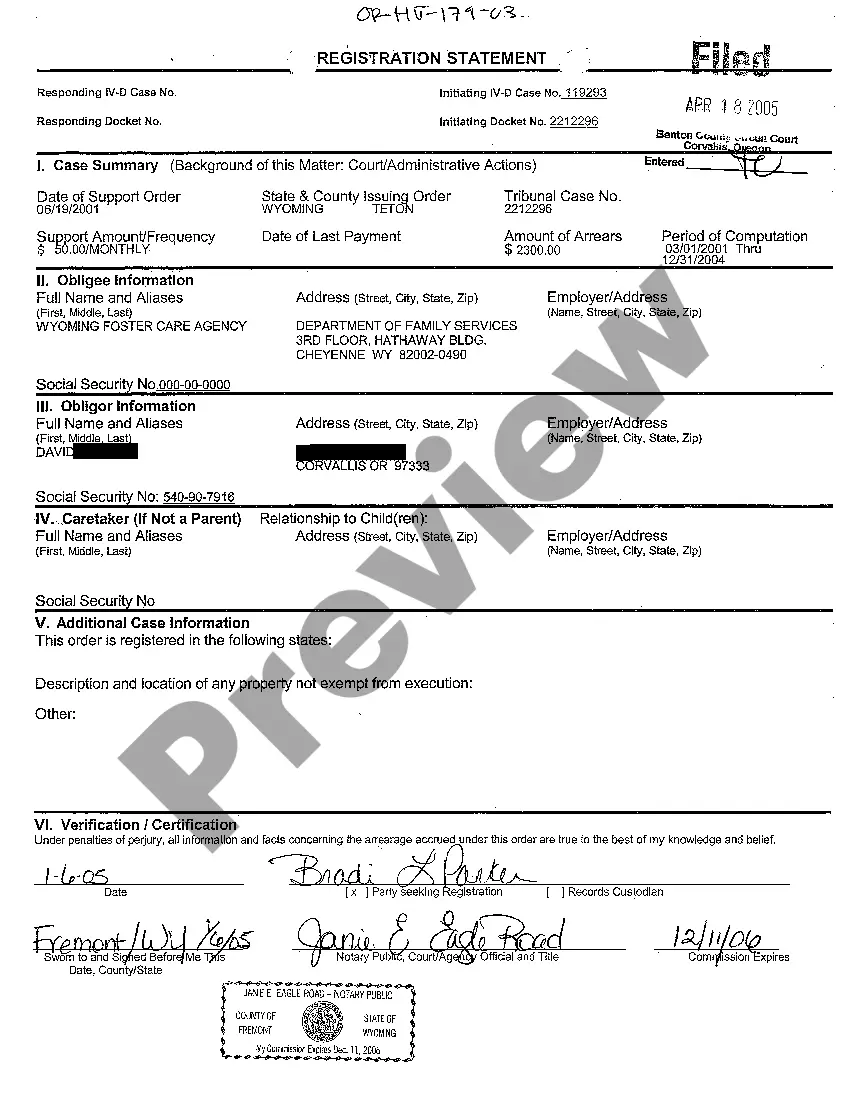

What Documents Do You Need to Apply for Retirement Benefits? (En espaol) Your Social Security card or a record of your number. Your original birth certificate, a copy certified by the issuing agency, or other proof of your age. If you were not born in the U.S., proof of U.S. citizenship or lawful alien status.