Retirement Rules For State Government Employees In Fulton

Description

Form popularity

FAQ

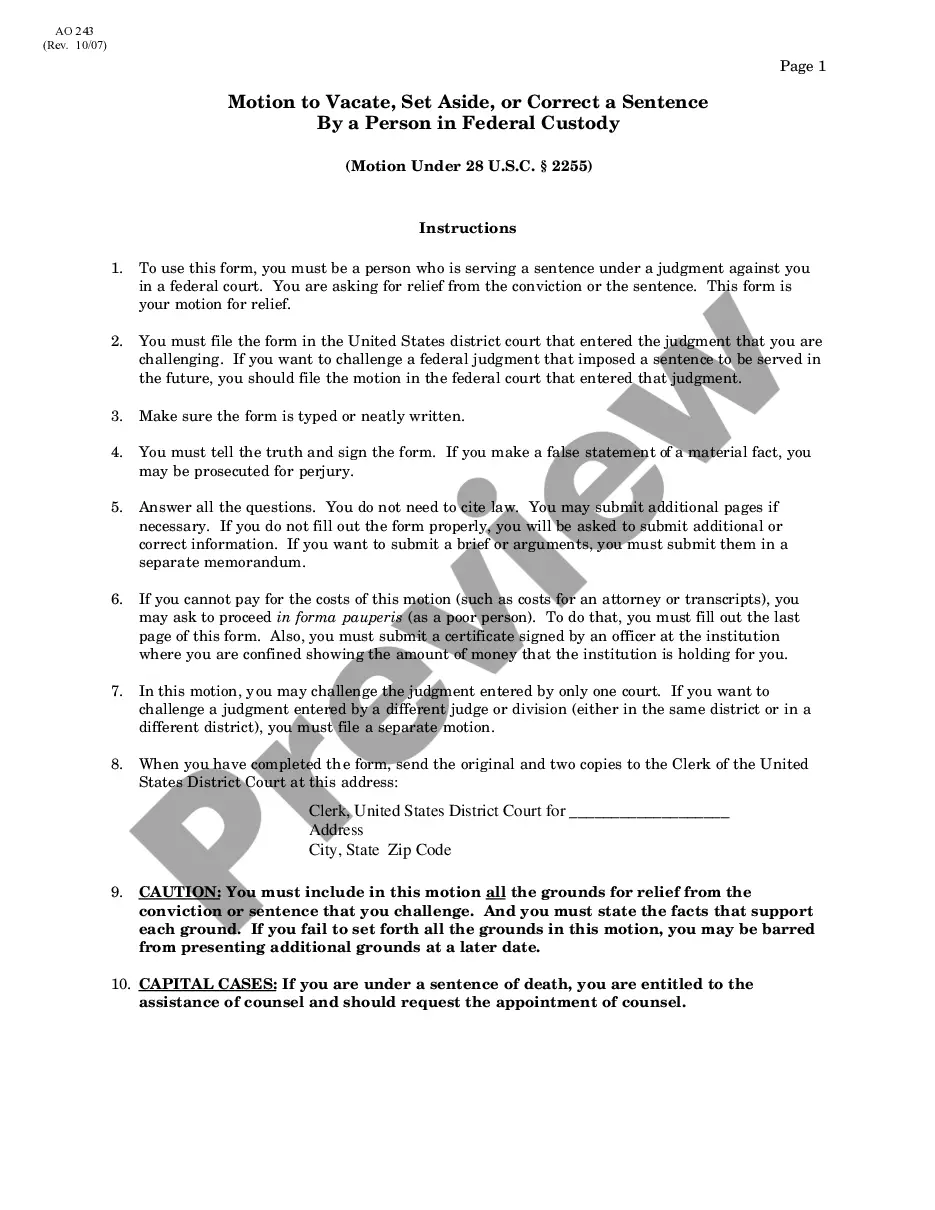

Federal Employees Retirement System (FERS) Forms (SF-3107), Application for Immediate Retirement (FERS) SF-3107-2, Spouse's Consent to Survivor Election This form is only required if you do not elect the full survivor benefit for your current spouse. (SF-2818), Continuation of Life Insurance Coverage.

Documents we may ask for include: Your Social Security card or a record of your number. Your original birth certificate, a copy certified by the issuing agency, or other proof of your age. We must see the original document(s), or copies certified by the agency that issued them.

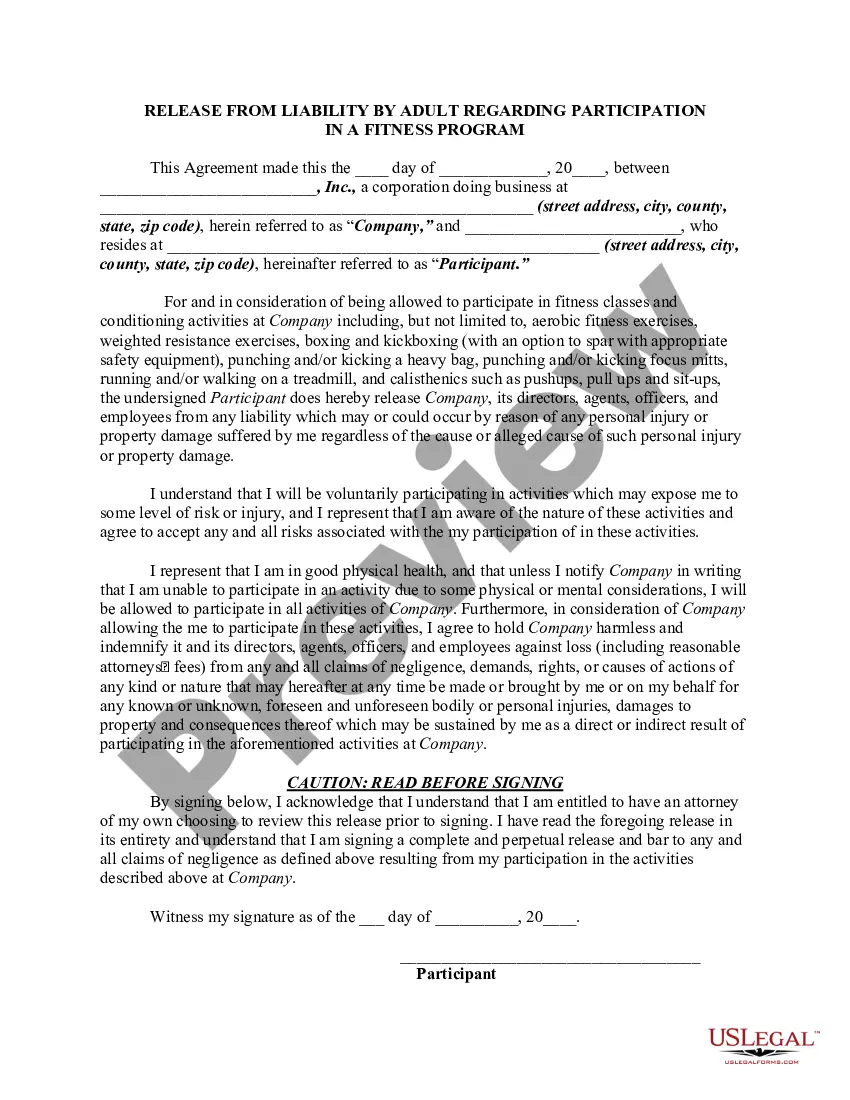

Use form SF 3107, FERS Application for Immediate Retirement, to apply for immediate retirement. You can obtain the form from your employing agency. Submit the completed application to your employing agency. Give your agency at least 60 days notice before the date you intend to retire.

You can apply for retirement benefits up to 4 months before you want to start receiving your benefits. Even if you are not ready to retire, you still should sign up for Medicare 3 months before your 65th birthday. The easiest and most convenient way to apply for retirement benefits is by using our online application.

Officially, you'll start the retirement process with your employer, letting them know when you plan to stop working. Depending on your employer and your tenure, you may need to write an official letter of resignation, document your contacts, processes, and files, and maybe even train a replacement.

Officially, you'll start the retirement process with your employer, letting them know when you plan to stop working. Depending on your employer and your tenure, you may need to write an official letter of resignation, document your contacts, processes, and files, and maybe even train a replacement.

FERS Retirement Eligibility Types of RetirementAgeYears of Service Optional (Voluntary) MRA 60 62 30 20 5 Early Out (Voluntary) 50 Any 20 25 Discontinued Service (Involuntary) 50 Any 20 25 Disability Any 18 months

The full retirement age is 66 if you were born from 1943 to 1954. The full retirement age increases gradually if you were born from 1955 to 1960 until it reaches 67. For anyone born 1960 or later, full retirement benefits are payable at age 67.

Financial Planning Review your retirement accounts, social security, pension, etc. and get the most up-to-date projections. Test your plan! Create a retirement budget and, for a couple of months, practice living within this budget.

The $1,000 per month rule is designed to help you estimate the amount of savings required to generate a steady monthly income during retirement. ing to this rule, for every $240,000 you save, you can withdraw $1,000 per month if you stick to a 5% annual withdrawal rate.