This Handbook provides an overview of federal laws affecting the elderly and retirement issues. Information discussed includes age discrimination in employment, elder abuse & exploitation, power of attorney & guardianship, Social Security and other retirement and pension plans, Medicare, and much more in 22 pages of materials.

Early Retirement Rules In Pakistan In Wake

Description

Form popularity

FAQ

Old-Age Benefits The minimum monthly old-age pension is 5,250 rupees. Early pension (except in Sindh province): The pension is reduced by 0.5% for each month it is claimed before the normal retirement age. Benefit adjustment: Benefits are adjusted on an ad-hoc basis.

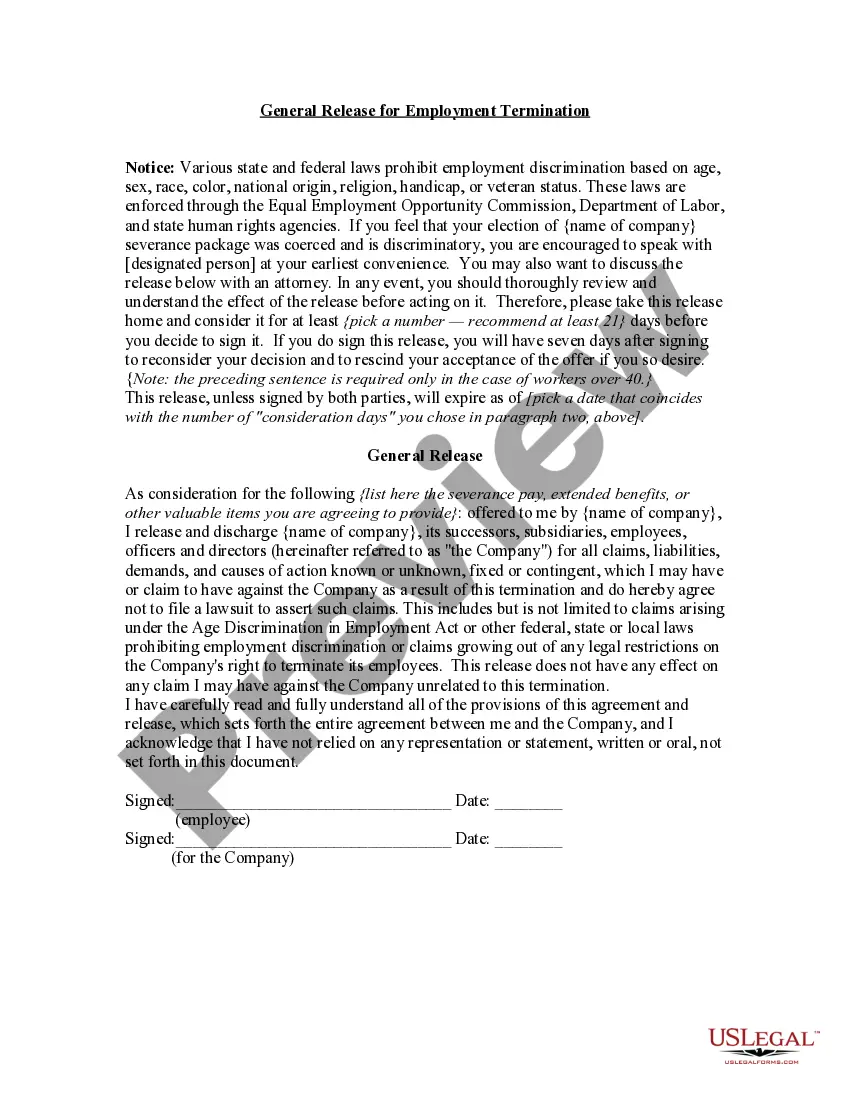

Employers can offer voluntary retirement programs, such as early retirement incentives, but employees must not be coerced or forced into participating. The programs must be truly voluntary and not designed to circumvent anti-discrimination laws.

A worker can choose to retire as early as age 62, but doing so may result in a reduction of as much as 30 percent. Starting to receive benefits after normal retirement age may result in larger benefits. With delayed retirement credits, a person can receive his or her largest benefit by retiring at age 70.

The option for pre-mature/voluntary retirement after rendering 25 years of qualifying service shall be submitted along with all requisite documents mentioned above at least 06 months before the date of voluntary retirement with specific recommendations of the concerned Head of the field formation.

You can stop working before your full retirement age and receive reduced benefits. The earliest age you can start receiving retirement benefits is age 62. If you file for benefits when you reach full retirement age, you will receive full retirement benefits.

A worker can choose to retire as early as age 62, but doing so may result in a reduction of as much as 30 percent. Starting to receive benefits after normal retirement age may result in larger benefits. With delayed retirement credits, a person can receive his or her largest benefit by retiring at age 70.

A worker can choose to retire as early as age 62, but doing so may result in a reduction of as much as 30 percent. Starting to receive benefits after normal retirement age may result in larger benefits. With delayed retirement credits, a person can receive his or her largest benefit by retiring at age 70.

Allowed to modify or withdraw. However, he can withdraw his application before former accepting of the request by the competent authority. Government servant who is entitled or compelled, by rule, to retire at a particular age i.e 60 years.

One frequently used rule of thumb for retirement spending is known as the 4% rule. It's relatively simple: You add up all of your investments, and withdraw 4% of that total during your first year of retirement. In subsequent years, you adjust the dollar amount you withdraw to account for inflation.