Wisconsin Agreement To Donate Real Estate To City Without Mortgage In Minnesota

Description

Form popularity

FAQ

Documenting gifts Both parties should sign and date the document, and the document should be notarized. If the gifted property is a titled asset such as a vehicle or real estate, transferring the title serves as documentation that a gift has been made.

Real Estate Donation A landowner may be interested in gifting a property to a charity or land trust. When a charity or land trusts accepts a real estate donation, the landowner can deduct the fair market value of the land from his or her federal taxes.

The contributions must be made to a qualified organization and not set aside for use by a specific person. If you give property to a qualified organization, you can generally deduct the fair market value (FMV) of the property at the time of the contribution.

It involves drafting key legal paperwork, having your land appraised, finding an eligible land trust or nonprofit to enforce the easement, and consulting with a CPA to maximize your tax deduction. Fortunately, Giving Property specializes in working with donors to make the process as easy as possible.

Donate Real Estate Even if you owe back taxes, have a mortgage balance or have deferred maintenance, it's no problem.

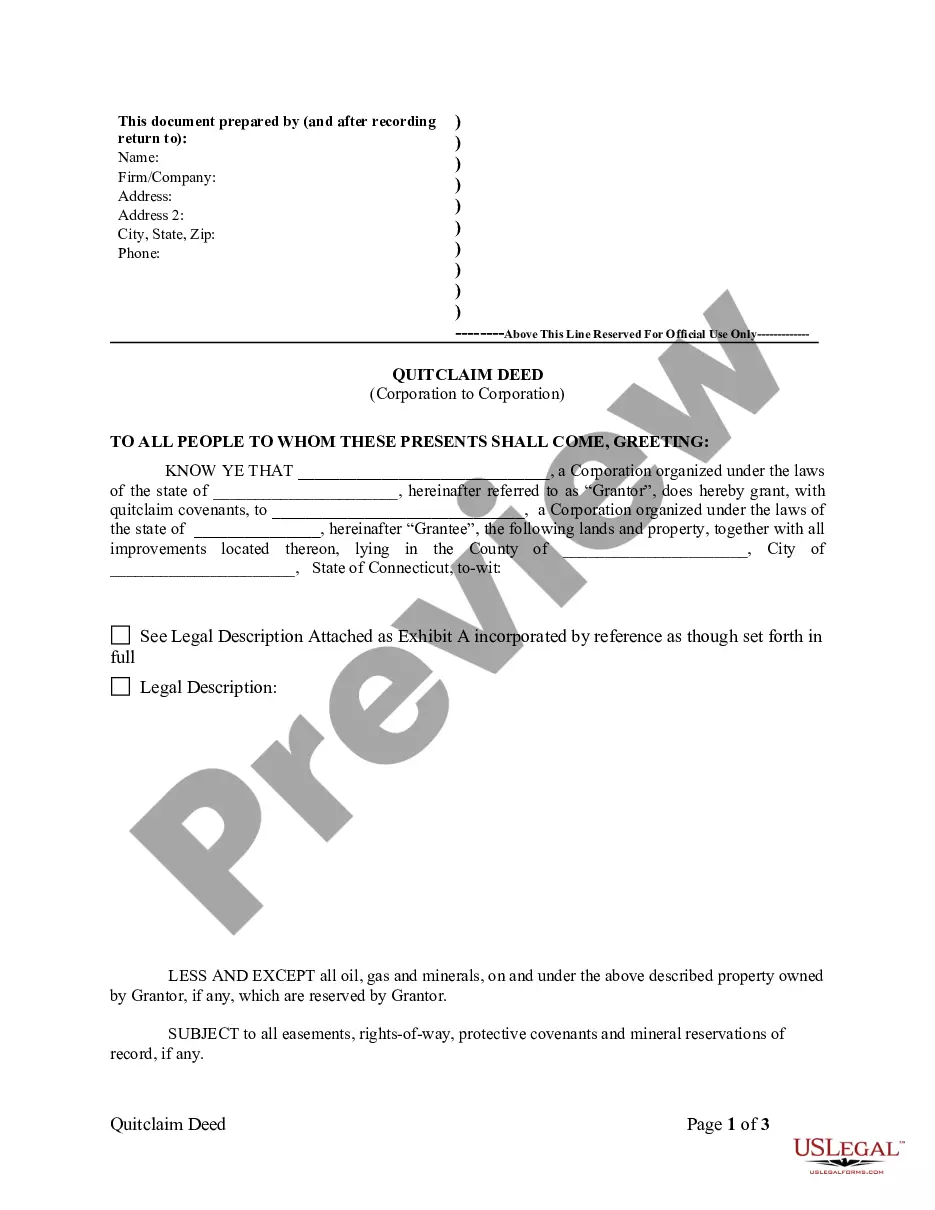

Wisconsin Gift Deed Overview. A gift deed, or deed of gift, is a legal document voluntarily transferring title to real property from one party (the grantor or donor) to another (the grantee or donee). A gift deed typically transfers real property between family or close friends.

Work with a real estate attorney or a title company to complete the transfer of ownership. This typically involves signing a deed and filing it with the local government. To claim a tax deduction, report the donation on your tax return. You may need to fill out IRS Form 8283 for donations over $500.

She cannot donate her house with a mortgage on it without the bank or mortgage company's written permission. Then the new owner(s) would have to take out a new mortgage. She would have to sell it to them.

A deed and an Electronic Wisconsin Real Estate Transfer Return (eRETR) must be completed to convey title to real estate. If you need additional information in regards to your inquiry you will have to consult with a title company or an attorney. You can also contact the Register of Deeds at (608) 266-4141.