Deed Of Donation Without Land Title In Queens

Description

Form popularity

FAQ

The grantor must sign the deed form and that signature must be properly acknowledged by a notary public. All signatures must be original; we cannot accept photocopies. A complete description of the property including the village, town, county and state where the property is located must also be included on the form.

Many people assume that a property deed and title are the same, but they are not. One is a document, while the other is a legal concept. When someone owns a property outright, they have both legal title and a deed. However, there are circumstances where you can have one without the other.

When you buy a home, you need both the deed and the title; one isn't better than the other. The title is the concept of legal ownership while the deed is the document that proves ownership. Moreover, you can't have a valid house deed if you don't hold title.

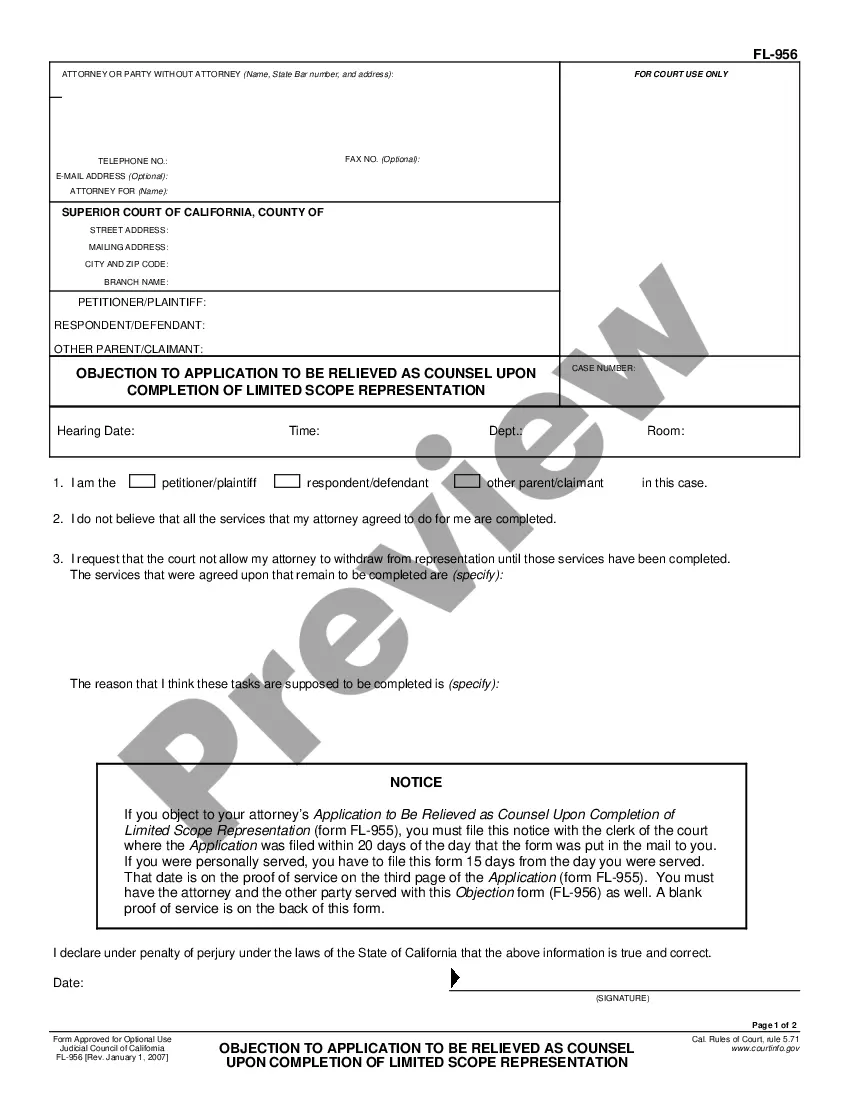

For a quitclaim deed in NY to be valid, it needs to be in writing. The document would also need to include the following details: A legal description and address of the property being deeded.

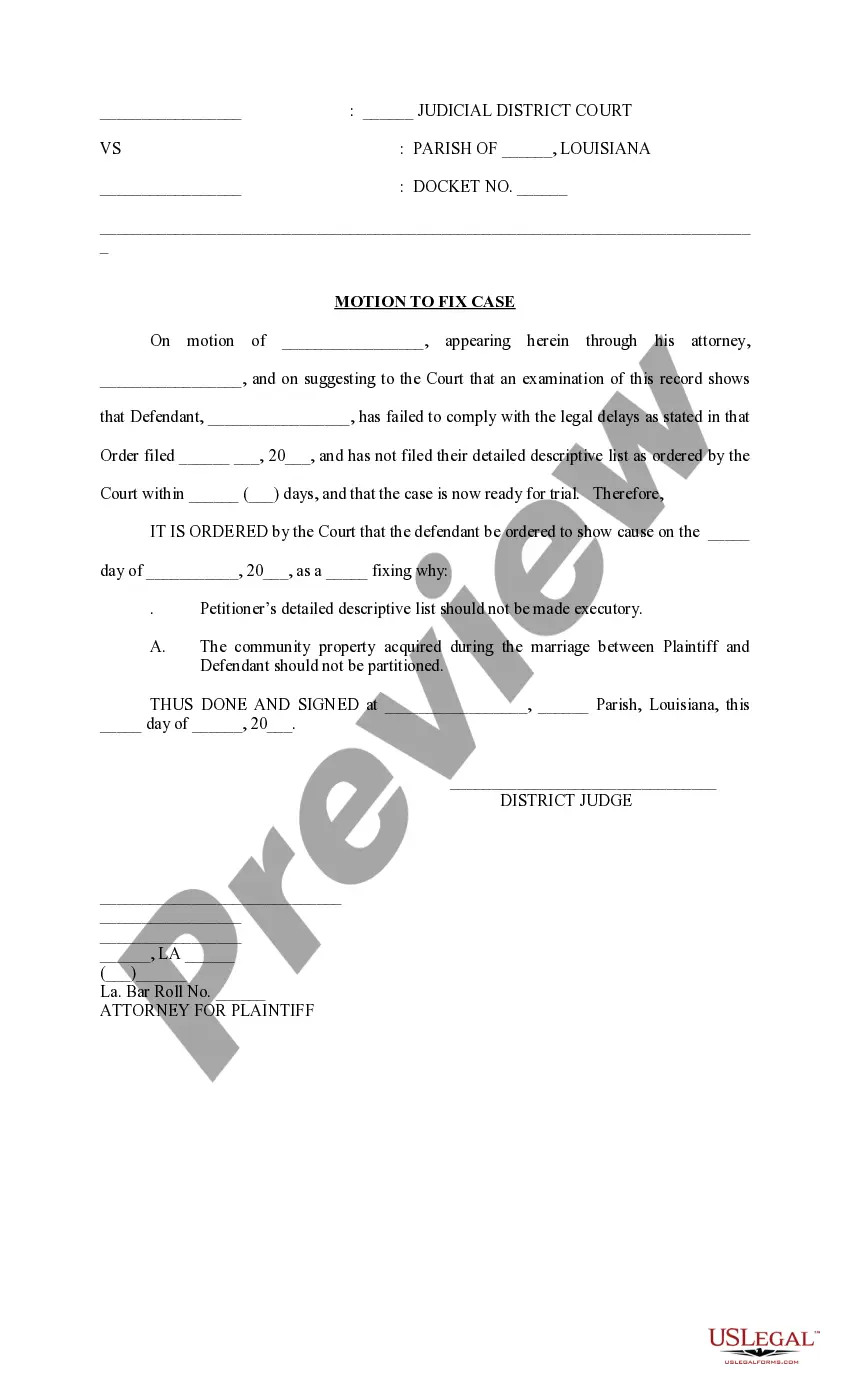

For a deed to be valid, it must contain several essential elements, including the operative words of conveyance, description of the property, signatures, delivery, proper formatting and execution, absence of defects and encumbrances, legal capacity of parties, proper recording, and voluntary execution.

As a general matter, no. A deed transfer is not valid unless it's delivered and accepted.

Visit the City Register Office in the borough where the property is located. Visit the Queens City Register Office to view Brooklyn property record books. If you have the Liber/Reel and page, date recorded, type of document, and number of pages, you should visit the Brooklyn City Register Office for microfilm records.

– Quitclaim deed must be written and signed by grantor before a notary public. – Must include legal description, property address, county, date, grantor and grantee names, and transfer amount (if any). – File the quitclaim deed with the County Clerk or City Registrar.

Donor's Tax: One of the main costs in a Deed of Donation is the donor's tax. Under the current Philippine Tax Code, donations between parents and children are taxed at a flat rate of 6% of the fair market value (FMV) or zonal value of the property, whichever is higher.