Deed Of Donation Without Land Title In San Antonio

Description

Form popularity

FAQ

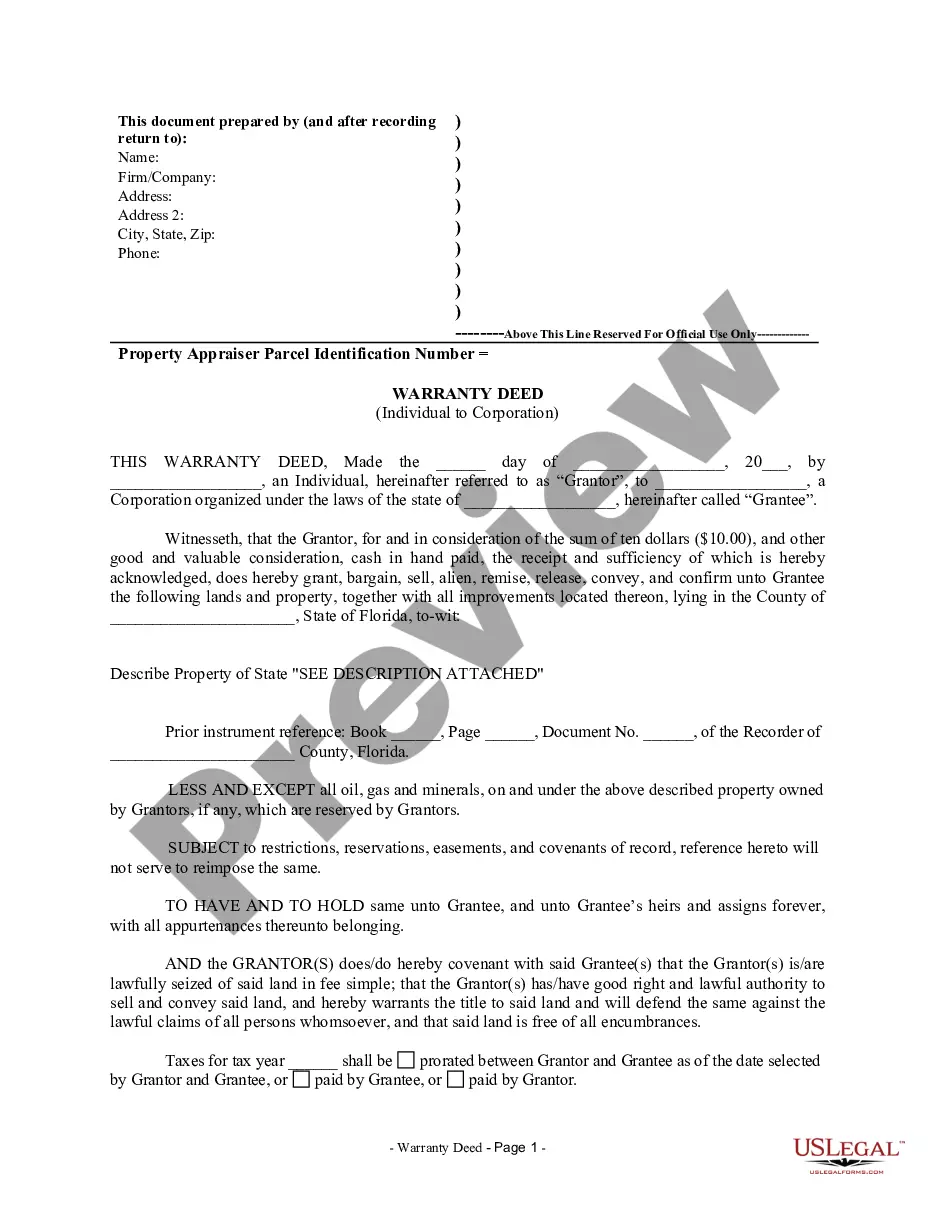

The Gift Deed needs to be in writing. It must include the full name of the current owner and the full name, mailing address and vesting of the new owner. The property needs to be properly described.

When you buy a home, you need both the deed and the title; one isn't better than the other. The title is the concept of legal ownership while the deed is the document that proves ownership. Moreover, you can't have a valid house deed if you don't hold title.

A gift deed must be (1) in writing, (2) signed, (3) describe the property, and (4) delivered. TPC §5.021. Texas further requires the document set forth (1) the intent of the grantor, (2) the delivery of the property to the grantee, and (3) the gift to be accepted by the grantee.

There are also some disadvantages to using gift deeds: It is irrevocable post-execution, which can lead to complications if problems arise in the future between the donor and donee. There are extra costs in the form of stamp duty, which vary from state to state.

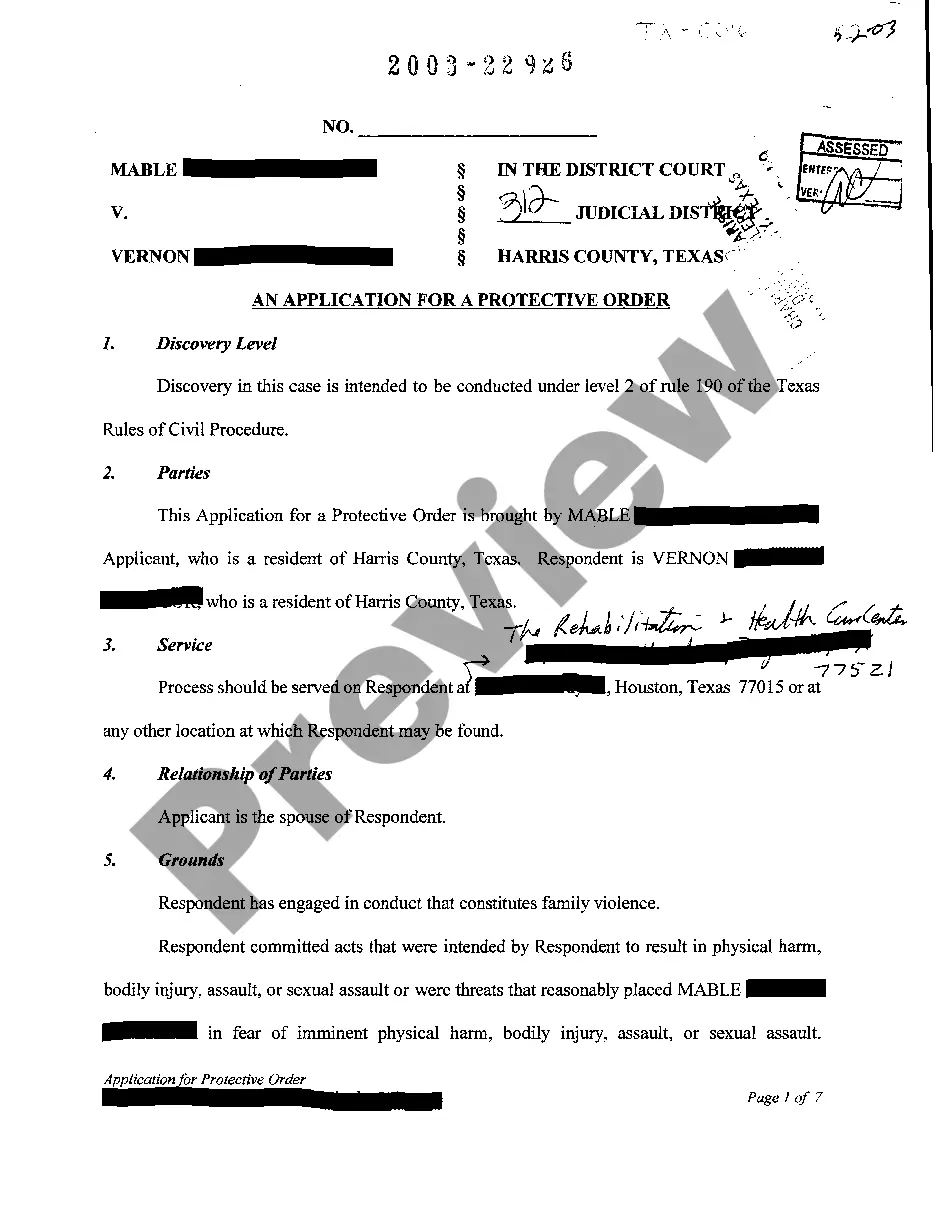

Texas law states a clear distinction between forged deeds and fraudulent deeds. Forged deeds are declared as void, passes no title, and are treated as null. A fraudulent deed is voidable and will be passable until set aside or struck down by the Court.

A gift deed must be (1) in writing, (2) signed, (3) describe the property, and (4) delivered. TPC §5.021. Texas further requires the document set forth (1) the intent of the grantor, (2) the delivery of the property to the grantee, and (3) the gift to be accepted by the grantee.

Once a deed has been recorded by the County Clerk's Office, copies of the deed may be requested if the original deed has been misplaced. Plain copies can be found by using the Official Public Records Search and selecting "Land Records". A certified copy may be purchased through request either in person or by mail.

To complete a title gift transfer in Texas, identify the property, obtain and fill out a quitclaim deed, sign it in the presence of a notary, file the deed with the county clerk's office, and notify the local tax assessor of the ownership change.