Wisconsin Agreement To Donate Real Estate To City Without Mortgage In San Jose

Description

Form popularity

FAQ

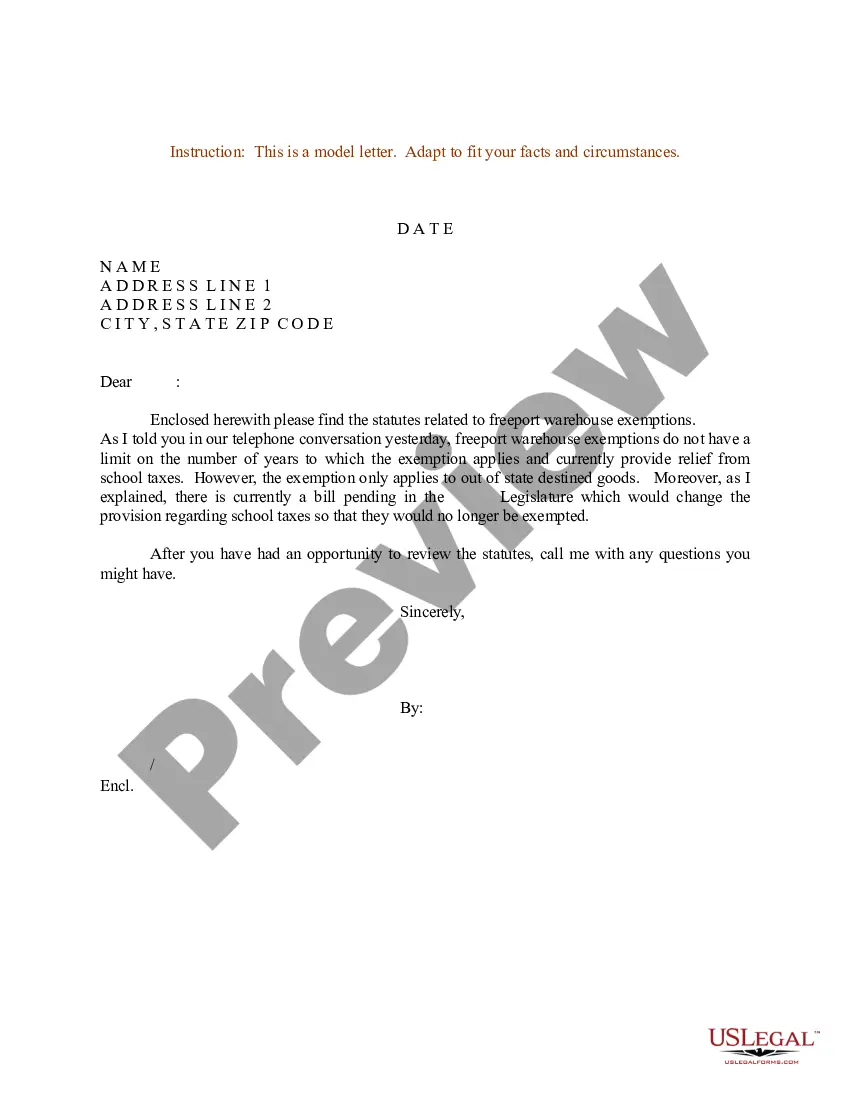

A deed and an Electronic Wisconsin Real Estate Transfer Return (eRETR) must be completed to convey title to real estate. If you need additional information in regards to your inquiry you will have to consult with a title company or an attorney. You can also contact the Register of Deeds at (608) 266-4141.

Prepare the Deed: – The deed must include the full legal description of the property, the names of the grantor and grantee, and a statement of consideration (even if it's a gift). – It's crucial to use the correct legal language and ensure that the deed complies with California law.

Generally, land trusts will prevent real estate transfer taxes in states where transfer taxes apply.

It involves drafting key legal paperwork, having your land appraised, finding an eligible land trust or nonprofit to enforce the easement, and consulting with a CPA to maximize your tax deduction. Fortunately, Giving Property specializes in working with donors to make the process as easy as possible.

Parents can make an outright gift of a home to an adult child. Any gift that exceeds the 2024 annual exclusion of $18,000 will be subject to gift tax and require that a gift tax return be filed.

Wisconsin Inheritance and Gift Tax There is no gift tax in Wisconsin either. The federal gift tax has an annual exemption of $19,000 in 2025. If you give more than $19,000 to any one person in a year, you have to report the gift to the IRS.

Donate real estate in CA in just a few steps Submit the online form with some basic info about your real estate. We'll review the property to determine if our charity can accept it. We'll take care of the paperwork & mail closing documents over for you to sign.

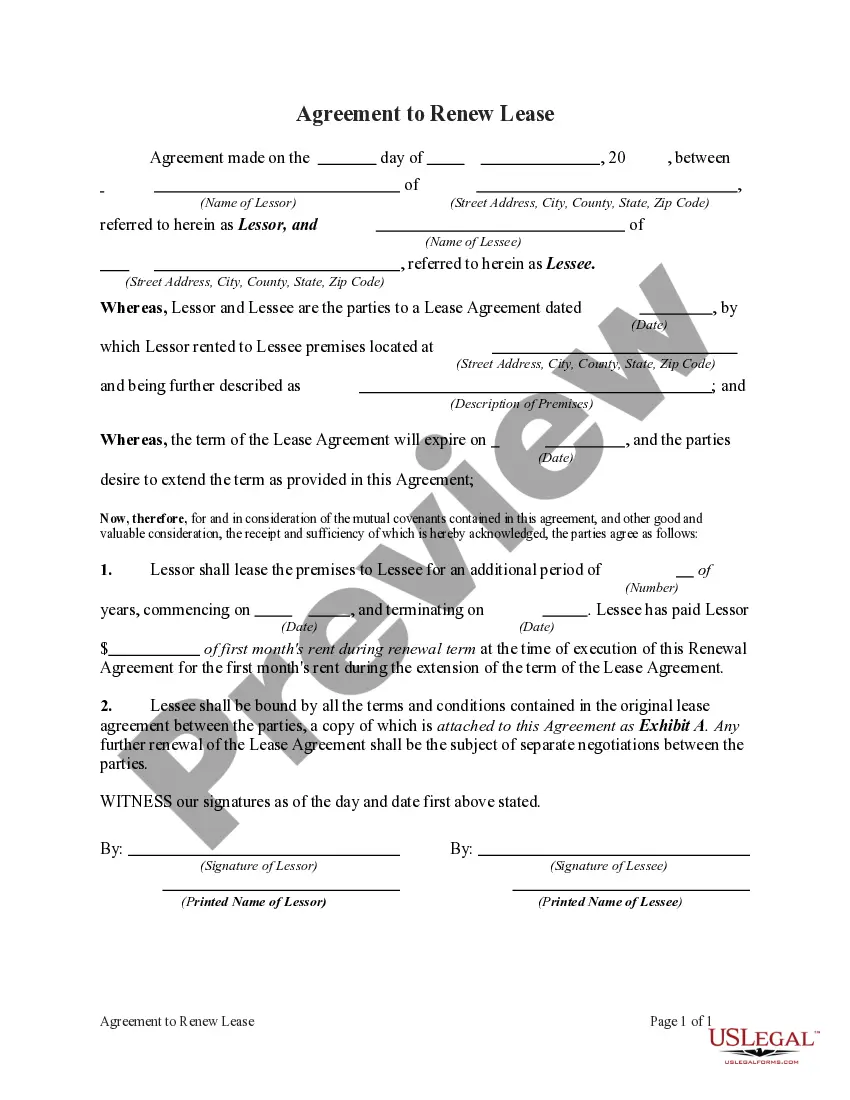

She cannot donate her house with a mortgage on it without the bank or mortgage company's written permission. Then the new owner(s) would have to take out a new mortgage. She would have to sell it to them.

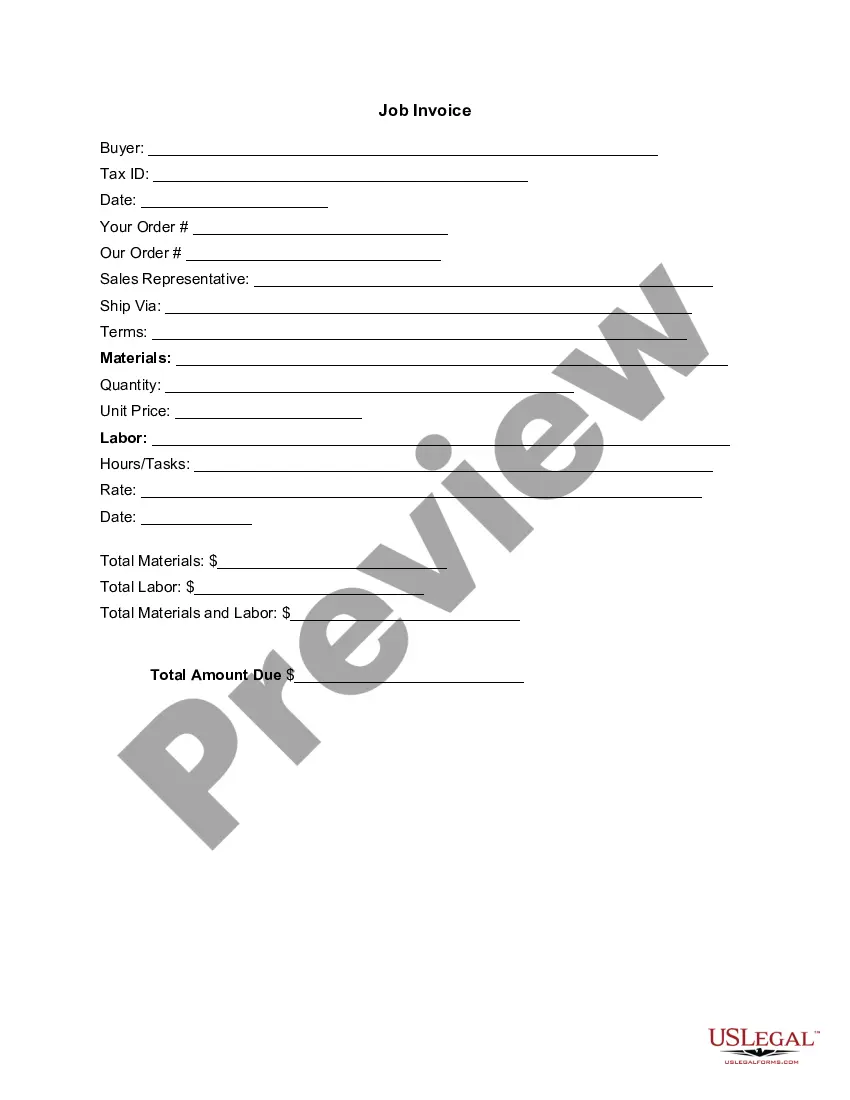

Work with a real estate attorney or a title company to complete the transfer of ownership. This typically involves signing a deed and filing it with the local government. To claim a tax deduction, report the donation on your tax return. You may need to fill out IRS Form 8283 for donations over $500.