Donate Land For Tax Write Off In Santa Clara

Description

Form popularity

FAQ

Generally, you can only deduct charitable contributions if you itemize deductions on Schedule A (Form 1040), Itemized Deductions. Gifts to individuals are not deductible. Only qualified organizations are eligible to receive tax deductible contributions.

If you give property to a qualified organization, you can generally deduct the fair market value (FMV) of the property at the time of the contribution.

To claim charitable donations, you'll need to itemize your deductions on your tax return instead of taking the standard deduction. List your total itemized deductions, including charitable contributions. If that amount exceeds the standard deduction amount for your filing status, you should itemize.

Proof can be provided in the form of an official receipt or invoice from the receiving qualified charitable organization, but it can also be provided via credit card statements or other financial records detailing the donation.

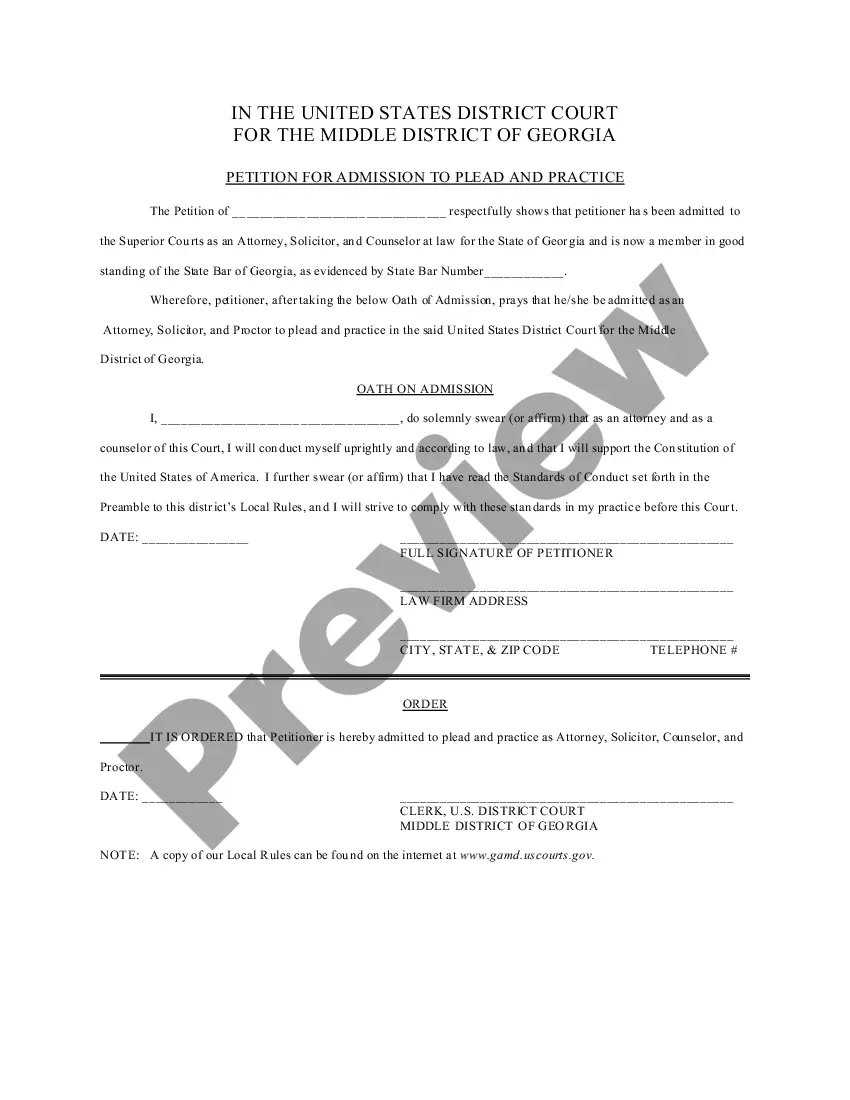

It involves drafting key legal paperwork, having your land appraised, finding an eligible land trust or nonprofit to enforce the easement, and consulting with a CPA to maximize your tax deduction. Fortunately, Giving Property specializes in working with donors to make the process as easy as possible.

If you give property to a qualified organization, you can generally deduct the fair market value (FMV) of the property at the time of the contribution.

Donating is worth the dollar amount times your marginal tax rate (current bracket for the next dollar) IF, and only IF, you itemize deductions. Most Americans don't, because the standard deduction is far higher.

Your deduction for charitable contributions generally can't be more than 60% of your AGI, but in some cases 20%, 30%, or 50% limits may apply.

Real Estate Donation A landowner may be interested in gifting a property to a charity or land trust. When a charity or land trusts accepts a real estate donation, the landowner can deduct the fair market value of the land from his or her federal taxes.