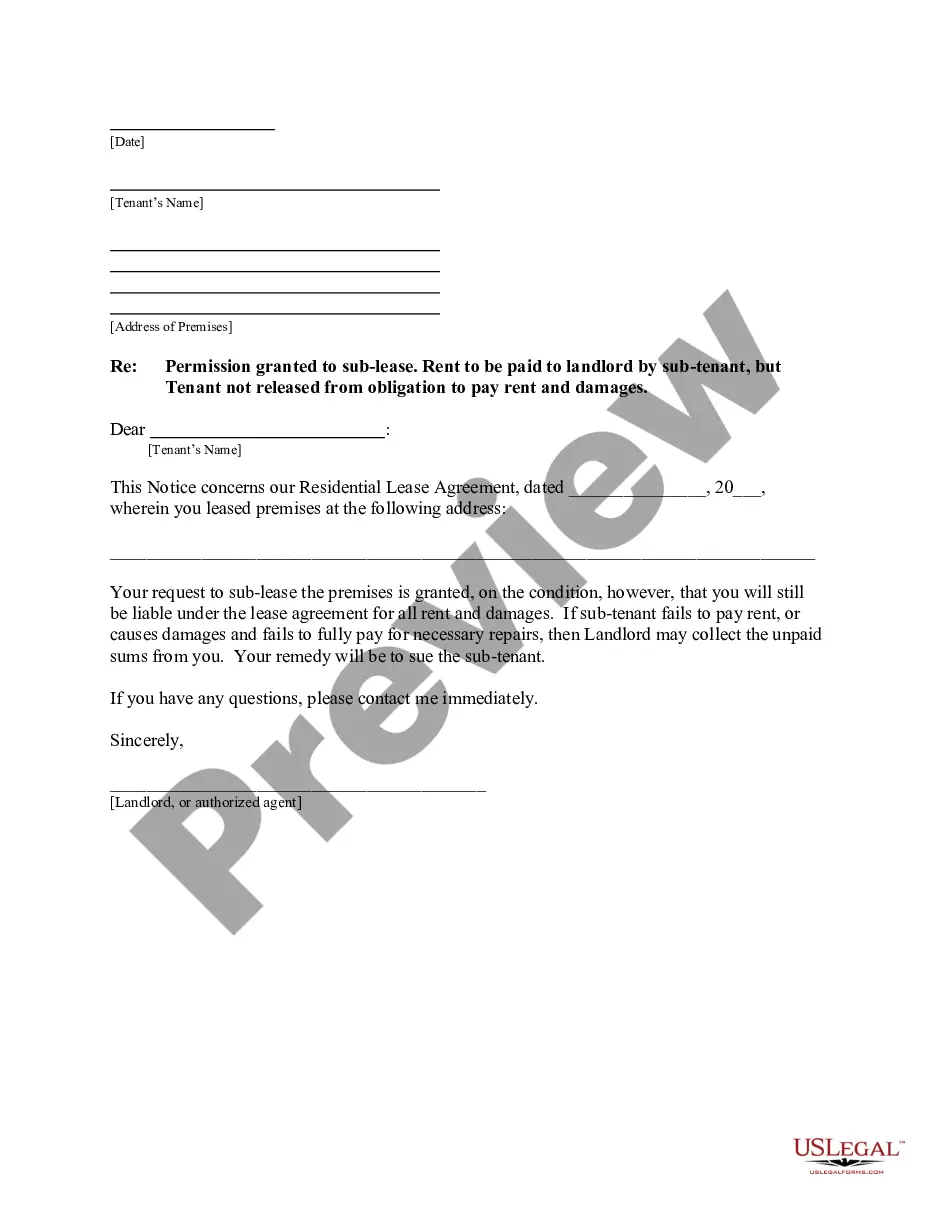

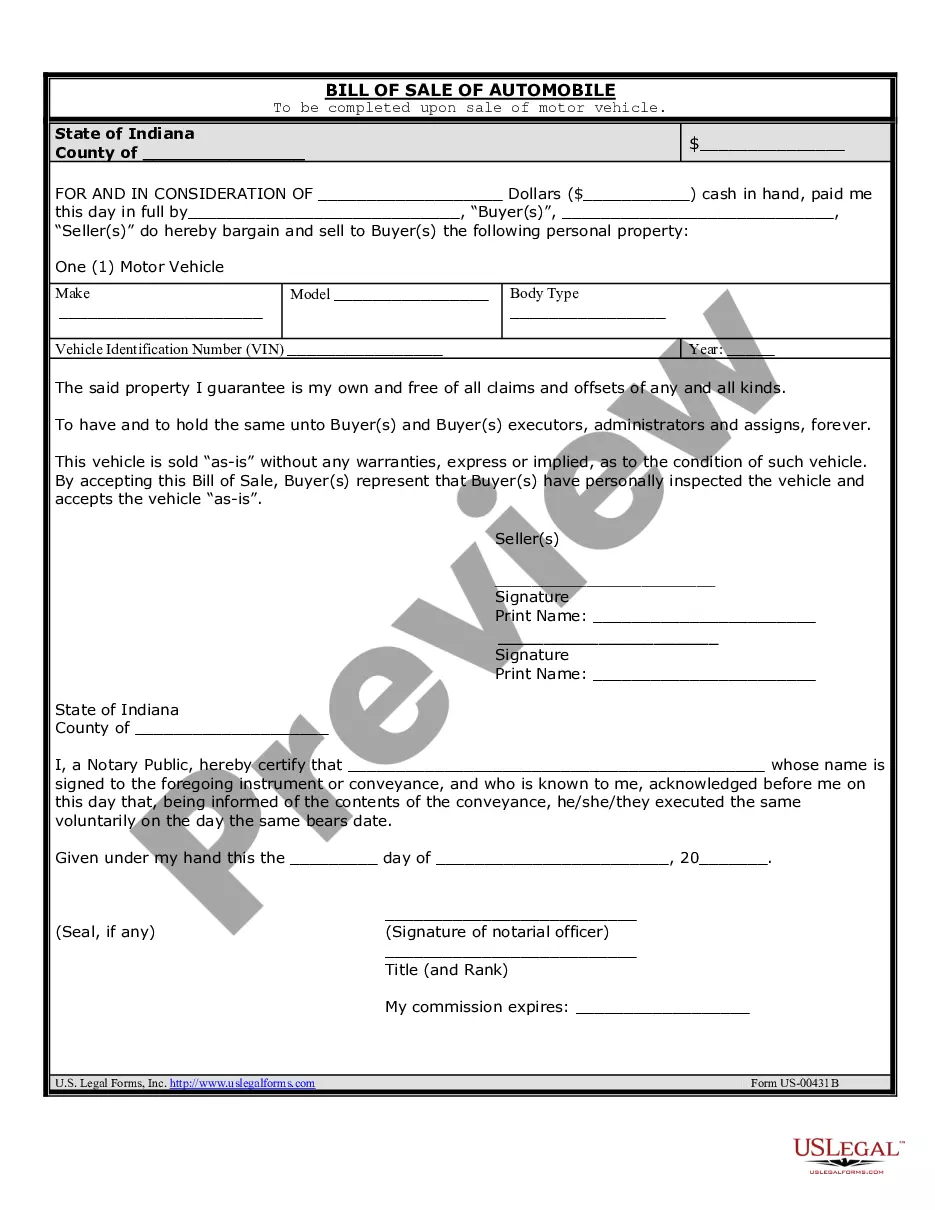

This form is a sample letter in Word format covering the subject matter of the title of the form.

Donation Receipt For Taxes In Michigan

Description

Form popularity

FAQ

Charitable contributions or donations can help taxpayers to lower their taxable income via a tax deduction. To claim a tax-deductible donation, you must itemize on your taxes. The amount of charitable donations you can deduct may range from 20% to 60% of your AGI.

This deduction is not added back to reach Michigan taxable income. For tax year 2021 a $300 (single) or $600 (joint) charitable contribution deduction is not deducted to arrive at adjusted gross income (AGI), but is instead deducted to arrive at federal taxable income.

Proof can be provided in the form of an official receipt or invoice from the receiving qualified charitable organization, but it can also be provided via credit card statements or other financial records detailing the donation.

Ing to the IRS, any kind of donation above $250 should require a donation receipt. The same applies to stock gifts/donations.

Your deduction for charitable contributions generally can't be more than 60% of your AGI, but in some cases 20%, 30%, or 50% limits may apply.

Technically, if you do not have these records, the IRS can disallow your deduction. Practically, IRS auditors may allow some reconstruction of these expenses if it seems reasonable. Learn more about handling an IRS audit.

Donating is worth the dollar amount times your marginal tax rate (current bracket for the next dollar) IF, and only IF, you itemize deductions. Most Americans don't, because the standard deduction is far higher.