Management Agreement In Investment In California

Description

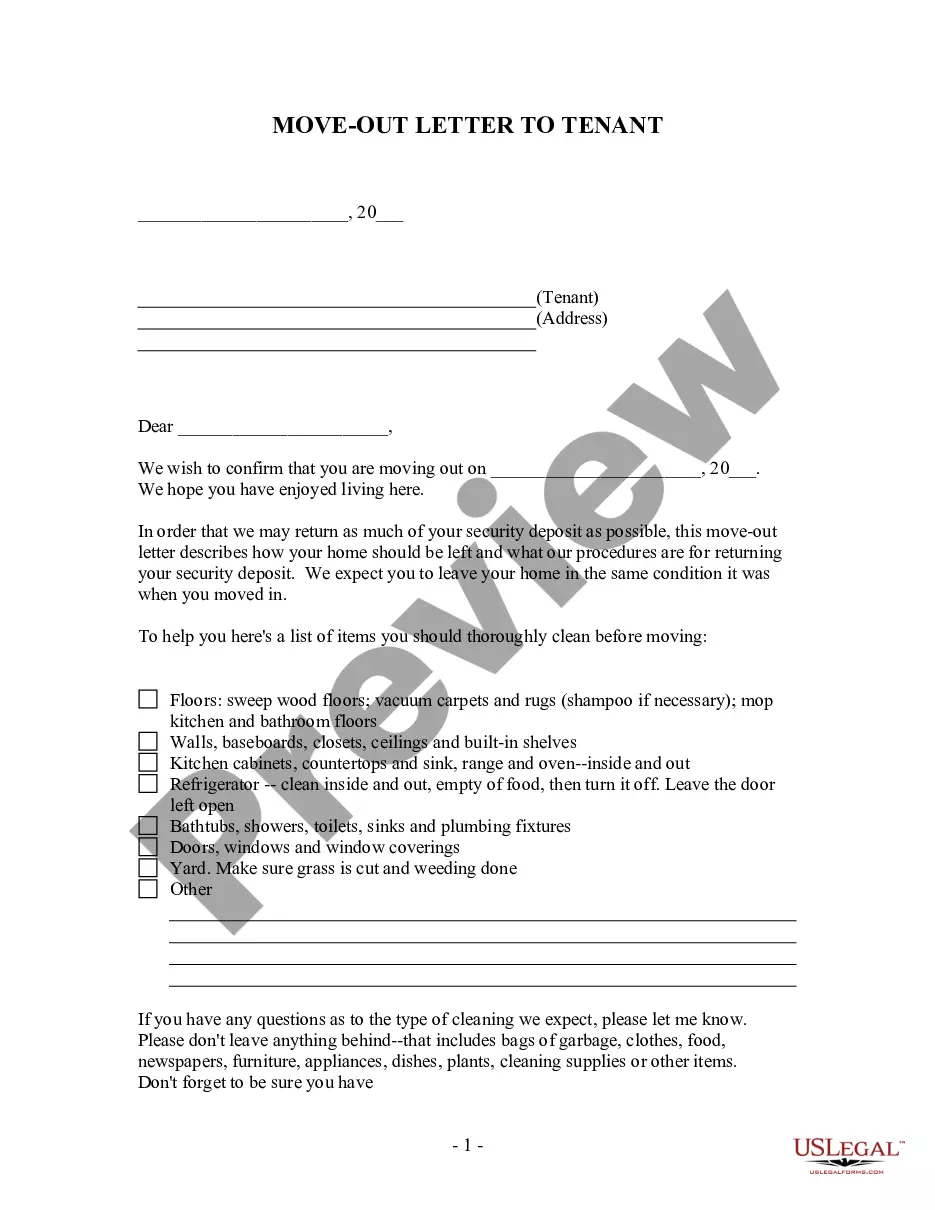

Even though disasters cannot always be avoided, obligations can be made much clearer and responsibilities more easily understood with the presence of a written artist management agreement. Before you get an attorney to draft a contract for you, however, you should first take stock of what you are prepared to do with and for an artist and what you expect out of the relationship.

Form popularity

FAQ

Investment management refers to the handling of financial assets and other investments by professionals for clients. Clients of investment managers can be either individual or institutional investors. Investment management includes devising strategies and executing trades within a financial portfolio.

Examples of Investment Management This involves in-depth research and ongoing adjustments based on market conditions. For example, an investment manager might decide to buy shares in a growing tech company, an undervalued utility provider, and a promising biotech firm.

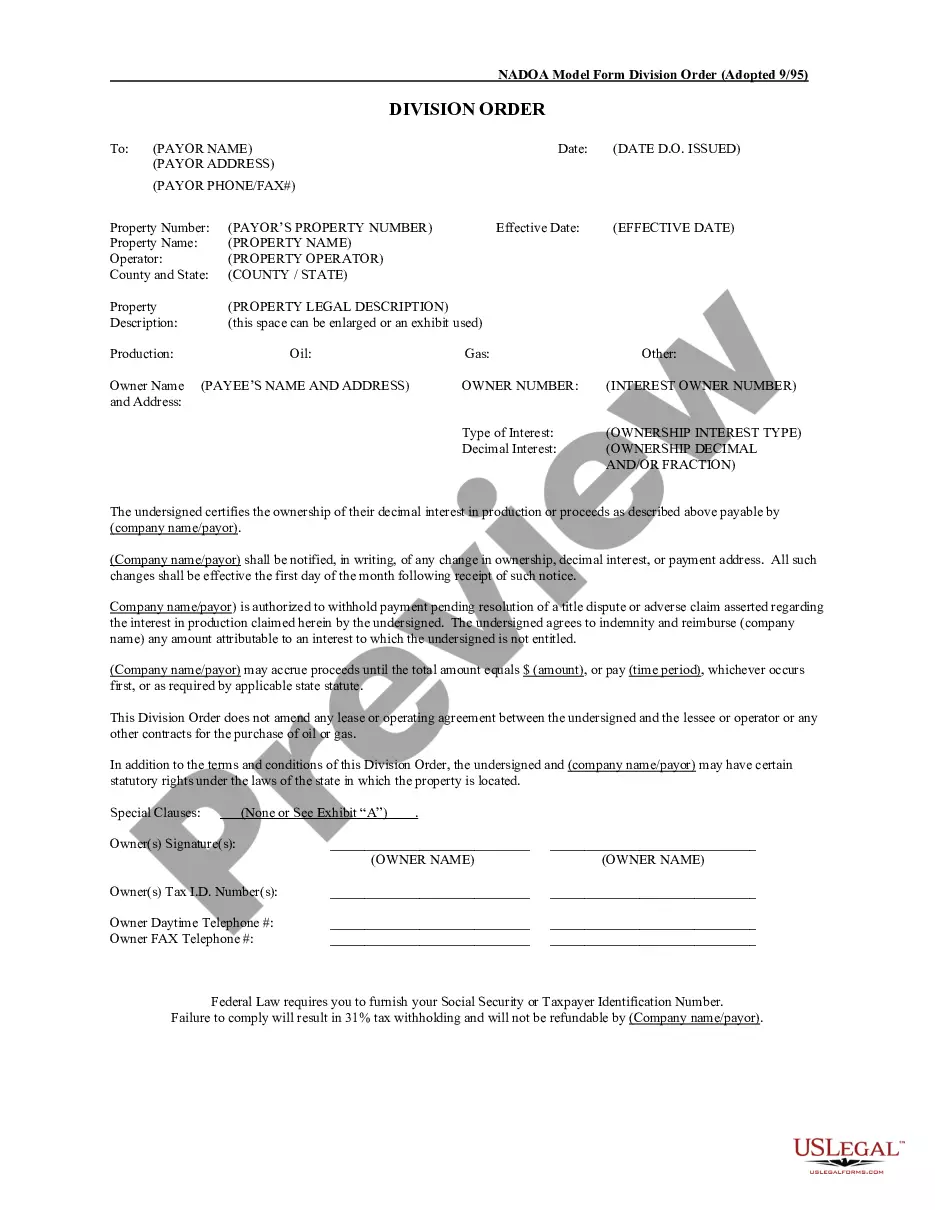

Essential clauses of a property management agreement Introduction. The intro part identifies the document as a property management agreement. Recitals. Description of rental property. Property manager's duties; obligations. Owner's obligations. Reimbursement of expenses. Term. Compensation.

What to include in an investor agreement. A well-executed agreement should include the basics, such as names and addresses, the amount and purpose of the investment, and each party's signatures. In addition, when drafting an investor agreement, the Kumar Law Firm said to be concise and not leave room for ambiguity.

Investment Arrangement means an Annuity Contract or Custodial Account that satisfies the requirements of Treasury Regulation Section 1.403(b)-3 and that is issued or established for funding amounts held under the Plan and specifically approved by the Employer for use under the Plan.

How does TCJA affect the deductibility of investment management fees? The implementation of the TCJA brought significant changes for investors in terms of tax deductions, policies, rates, and credits. Now, the law doesn't allow deductions of investment management fees and other related expenses.

What does Investment management agreement mean? Agreement between an investment manager and the trustees of a scheme that sets out the basis on which the manager will manage a portfolio of investments for the trustees.

A model investment management agreement (IMA) between the plan administrator of an employer's qualified pension plan (as defined under the Employee Retirement Income Security Act of 1974 (ERISA) and the Internal Revenue Code of 1986 (Code)) and an investment manager for the plan.

Investment management is the maintenance of an investment portfolio, or a collection of financial assets. It can include purchasing and selling assets, creating short- or long-term investment strategies, overseeing a portfolio's asset allocation and developing a tax strategy.