Management Business Examples In Phoenix

Description

Even though disasters cannot always be avoided, obligations can be made much clearer and responsibilities more easily understood with the presence of a written artist management agreement. Before you get an attorney to draft a contract for you, however, you should first take stock of what you are prepared to do with and for an artist and what you expect out of the relationship.

Form popularity

FAQ

A Statutory Agent is a person or business that has a physical address in Arizona. A Statutory Agent's responsibility is to accept Service of Process or legal documents on behalf of a corporation or limited liability company.

A Statutory Agent can be an individual, or an Arizona corporation or LLC, or a foreign corporation or LLC that is authorized to transact business in Arizona. A corporation or LLC cannot be its own Statutory Agent – it must appoint someone apart from itself.

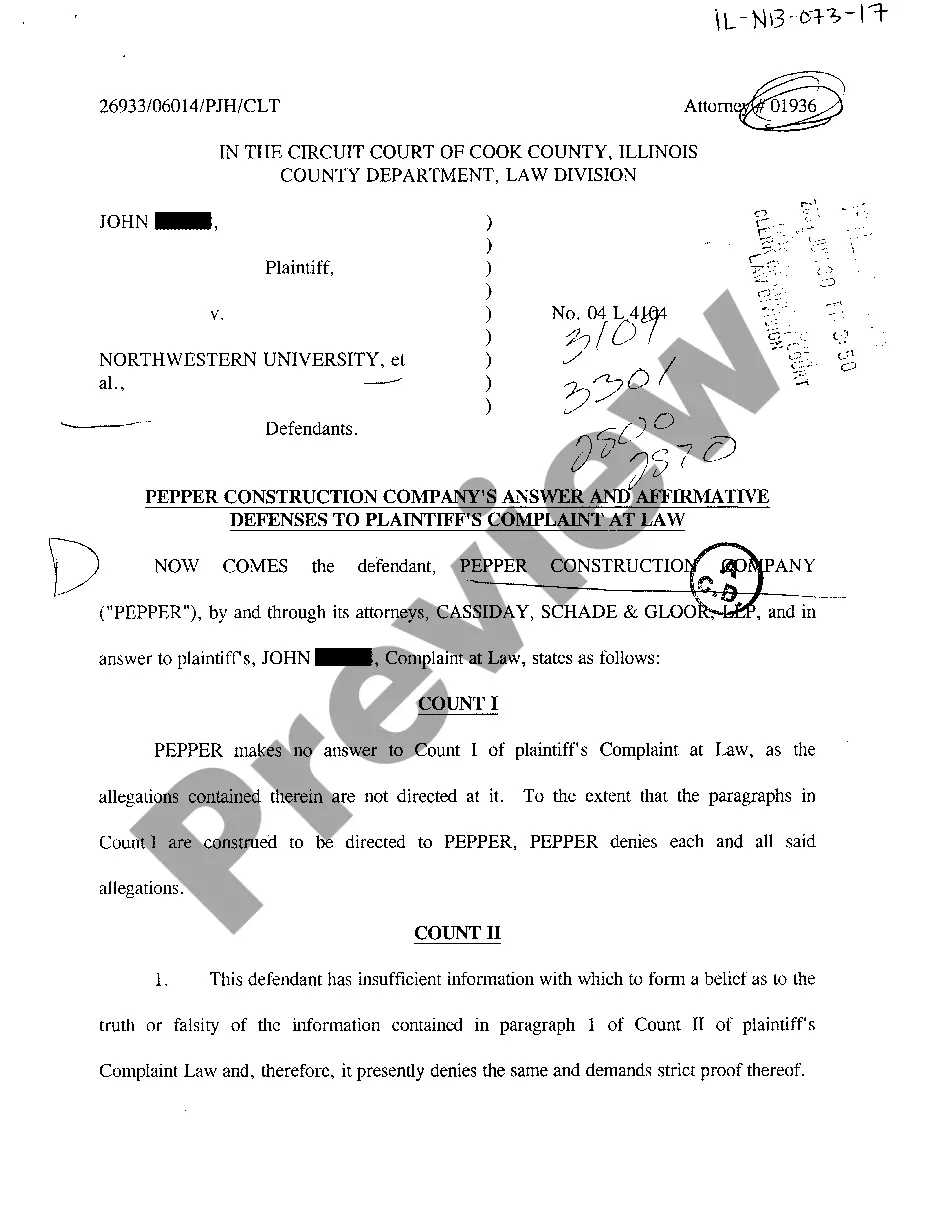

In United States business law, a registered agent (also known as a resident agent, statutory agent, or agent for service of process) is a business or individual designated to receive service of process (SOP) when a business entity is a party in a legal action such as a lawsuit or summons.

Finding an AZ Entity's Statutory Agent via the Arizona Corporation Commission. To locate an Arizona entity's statutory agent, use the Arizona Corporation Commission's official website: Visit Arizona Corporation Commission Entity Search. Enter the entity's name or file number in the search box.

Who Can Be a Statutory Agent in Arizona? Under Arizona law, a statutory agent must be “an individual resident of this state, a domestic corporation, a limited liability company or a foreign corporation or limited liability company authorized to transact business in this state” (ARS 29-604).

After an initial filing, some states—such as California, Iowa, and Indiana— require LLCs to file a report every other year. In some states, you'll file a report every two years from the year you formed your LLC.

Arizona LLCs are not required to file an annual report. Corporations and nonprofits file their Arizona Annual Reports with the Arizona Corporation Commission (ACC). LLPs, and LLLPs submit their Arizona Annual Reports to the Arizona Secretary of State.

Arizona LLCs have a default tax status as pass-through entities, which means the LLC's income is reported on the members' individual tax return. LLC members are taxed at a 15.3% rate, while LLCs that choose C-corp status are taxed at 4.9%.

The Most Profitable Small Business Ideas in Arizona Real Estate. Whether you want to buy and lease rental properties or help others find their perfect home as a real estate agent, Arizona's real estate market is hot. Pool Maintenance. Travel Agency. Arts and crafts. Online Teaching. Financial Planning. Courier. Insurance Sales.

Arizona LLCs are not required to file an annual report. Corporations and nonprofits file their Arizona Annual Reports with the Arizona Corporation Commission (ACC). LLPs, and LLLPs submit their Arizona Annual Reports to the Arizona Secretary of State.