Form with which the stockholders of a corporation waive the necessity of a first meeting of stockholders.

Annual Meeting Corporate With Ird In Utah

Description

Form popularity

FAQ

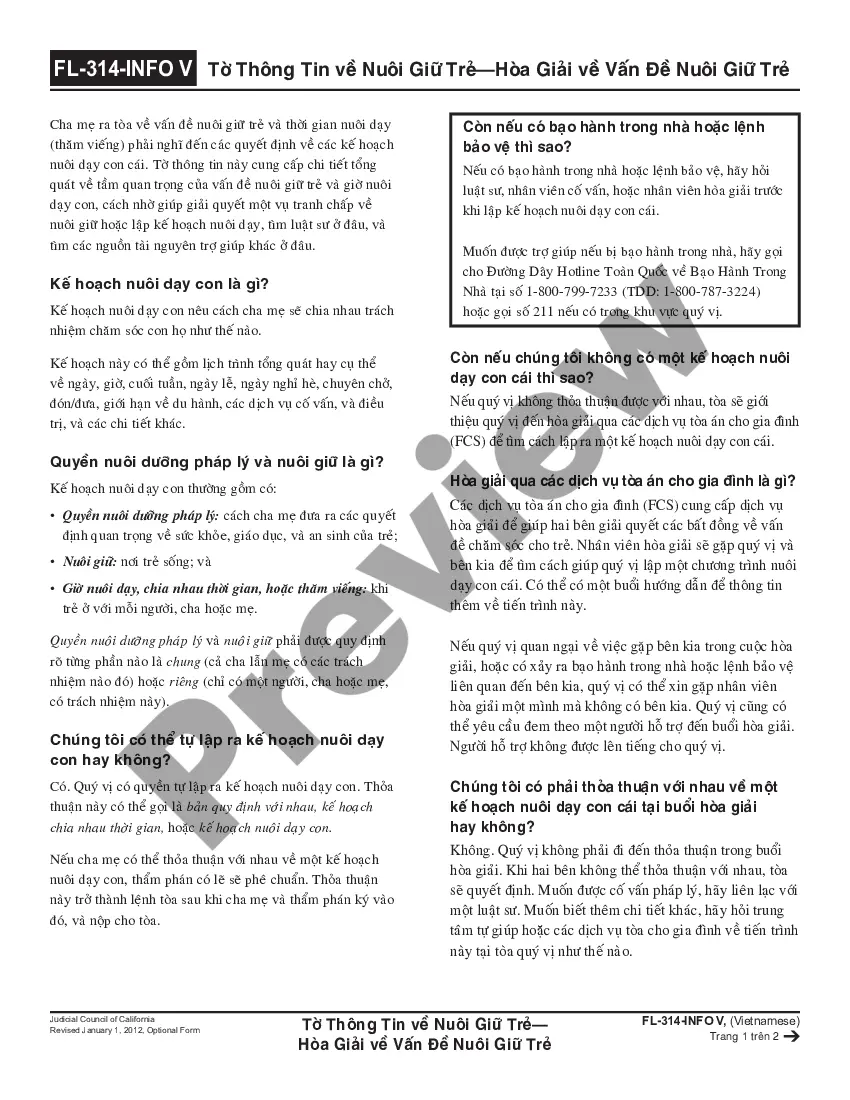

Delaware corporations are required to hold an annual meeting of shareholders, where the corporation's officers and directors are elected and other important matters of operation are discussed.

Yes, it is possible to establish an S-corp as a one-person business. While traditionally S corporations are formed with multiple shareholders, the IRS allows a single individual to set up an S corporation. As an individual, you can be the sole shareholder, director, and employee of the S-corp.

How to File as an S Corp in Utah in 6 Steps Step 1: Choose a Business Name. Step 2: Appoint Directors and a Registered Agent. Step 3: File Certificate of Organization. Step 4: Create an S Corp Operating Agreement. Step 5: Apply for an Employer Identification Number. Step 6: File Form 2553 for S Corporation Election.

To form a Utah S corp, you'll need to ensure your company has a Utah formal business structure (LLC or corporation), and then you can elect S corp tax designation. If you've already formed an LLC or corporation, file Form 2553 with the Internal Revenue Service (IRS) to designate S corp taxation status.

S Corporation in Utah: Key Points S corp status is a tax classification that applies to an LLC or a C corporation. Entrepreneurs must create one of the two business entities before electing S corp status. Entrepreneurs must file form 2553 to select S corp status within 75 days of creating their LLC or C corporation.

Most management actions are protected from judicial scrutiny by the business judgement rule: absent bad faith, fraud, or breach of a fiduciary duty, the judgement of the managers of a corporation is conclusive.

How to create a Utah LLC in 6 steps Step 1: Choose your business name. Step 2: Appoint a registered agent. Step 3: File certificate of organization. Step 4: Create an operating agreement. Step 5: Obtain an EIN and open a separate business bank account. Step 6: Register for state taxes and business licenses.

Here are other benefits that an LLC provides: It limits the owners' personal liability for the company's obligations. It allows the transferring of ownership of the company. It allows the business to continue even beyond your lifetime. The members do not have to be U.S. citizens or permanent residents of Utah.

Board meetings vs. general meetings: what's the difference? While a directors' board meeting will only usually involve board members, the same cannot be said for an annual general meeting. In contrast, general meetings may also involve shareholders and key stakeholders.

While the shareholder is the owner of the company, the directors control the company's internal affairs and management, including the completion of various tax, regulatory and legal compliances. The same person can assume both the roles unless articles of association of the company explicitly prohibits it.