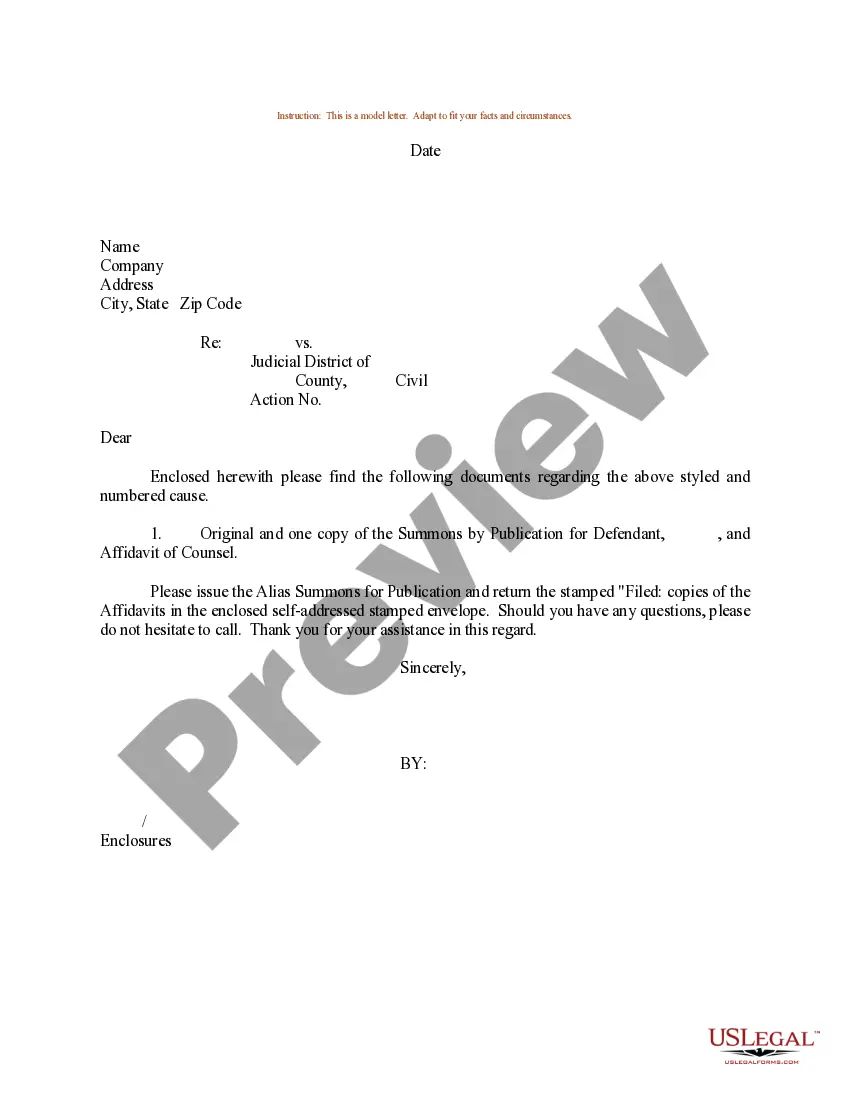

This form is a sample letter in Word format covering the subject matter of the title of the form.

Authority Letter Format For Bank In Chicago

Description

Form popularity

FAQ

Go online or talk to a bank representative in person to add another person to your account. In order to add a co-owner, you'll need to fill out forms that are signed by both parties.

Contact your bank for a power of attorney form. You'll provide information on to whom you're granting power of attorney, which transactions you want the person to be able to take, and for how long they're authorized to have access to your account.

Opening a business bank account generally requires visiting the bank in person, as does adding an authorized signer to an account. Banks may allow you to have an authorized signer pre-authorized without their presence and visit the bank to be authorized later.

Authorization Letter Format I, (Your Full Name), hereby authorize (Authorized Person's Full Name) to act on my behalf for (specific task or responsibility). (He/She) is authorized to (describe the task, e.g., collect my documents, handle financial transactions, etc.) on (date(s) or time period).

The procedure for adding someone to your bank account varies by financial institution. Typically, it includes the following: Visit a bank branch together or call together (though some banks or credit unions allow you to do it online). Request to add the other person to your savings or checking account.

Formal Authorization Letter Format Your Name Your Address City, State, PIN Code Email Address Phone Number Date To, Recipient's Name Recipient's Designation Company/Organization Name Company Address ... Sincerely, Your Signature (if sending a hard copy) Your Name Your Designation, if applicable

The format of an authorization letter should include the date, the name of the person to whom it is addressed, details about the person who has been authorized (such as name and identity proof), the reason for his absence, the duration of the authorized letter, and the action to be performed by another person.

The most common types of access are: Power of attorney – gives someone the legal authority to make decisions on behalf of the account holder. Third-party mandate – allows someone limited access to current and savings accounts. Court order – to appoint someone to act on behalf of the account holder, if they are unable.

Dear Recipient's Name, I, Your Name, hereby authorize Recipient's Name to act on my behalf in Specify the task or action, effective from Start Date to End Date. Receiver's Name is authorized to carry out all essential tasks and make all choices related to Name the activity or action.

5 steps to write a letter of authorization. Identify the parties involved. Specify the authority granted. Define the duration of the agreement. Include any necessary details. Sign the document.