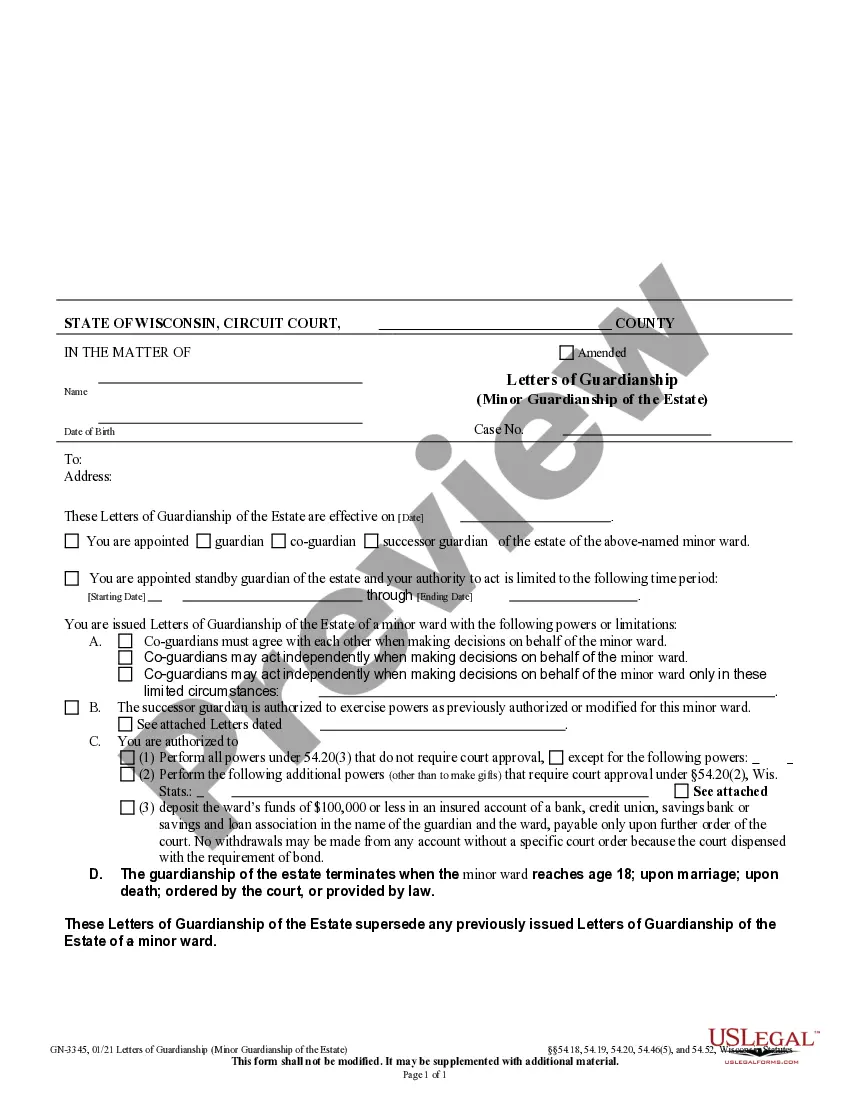

This form is a sample letter in Word format covering the subject matter of the title of the form.

Letter Of Authority In Gst In Cuyahoga

Description

Form popularity

FAQ

Contact Information (216) 443-8895 Main Probate. (216) 443-8785 Second Probate Number.

Ohio. Ohio imposes a six-month deadline from the date of death. Probate filings beyond this period may face hurdles, including court dismissal.

A letter of authority can only be obtained from the Master of the High Court when a person has died and the death has been reported. In that case, you and your siblings must agree on whom to nominate to represent you and receive the letter of authority.

Probate Court records are open to the public at the Probate Court Clerk's Office or at the Union County Records Center and Archives. For your convenience, please call ahead to confirm if the record you seek is available and where it is located: (937) 645-3029 ext.

Probatepublic@cuyahogacounty.

A Letter of Authority refers to the document (or Letter) that grants the personal representative authority to act on behalf of the estate of the person that died. Probate refers to the court procedure by which a decedent's estate gets administered after death.

To obtain your Ohio Certificate of Authority, you will submit an Application for Certificate of Authority, along with required certificates or certified copies from your home state. You will need to appoint a registered agent in order for your filing to be approved.

Ask for Your Property Tax Card. Don't Build. Limit Curb Appeal. Research Neighboring Homes. Allow the Assessor Access to Your Home. Walk the Home With the Assessor. Look for Exemptions. Appeal Your Tax Bill.

The Homestead Tax Exemption lets qualifying homeowners reduce their property taxes. The program is designed to help senior citizens, disabled homeowners and, in some cases, their surviving spouses. Income-eligible couples can qualify even if only one partner is a senior or disabled.

Senior and Disabled Persons Homestead Exemption protects the first $26,200 of your home's value from taxation.