This form is a sample letter in Word format covering the subject matter of the title of the form.

Letter Of Authorization To Withdraw Money In Massachusetts

Description

Form popularity

FAQ

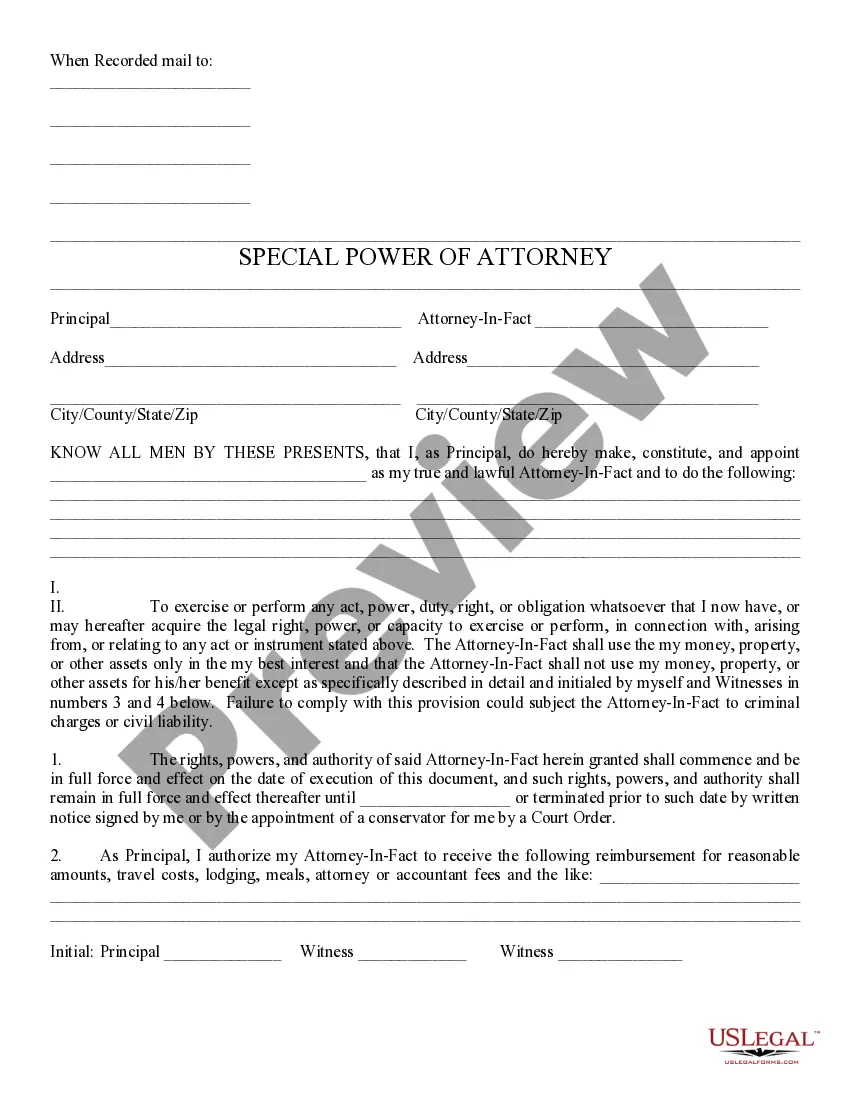

Contact your bank for a power of attorney form. You'll provide information on to whom you're granting power of attorney, which transactions you want the person to be able to take, and for how long they're authorized to have access to your account.

An authorization letter is a written document that grants someone the power to act on your behalf. It is commonly used when you are unable to personally attend to a specific task or when you want to delegate certain responsibilities to another person.

Step-1: The remitter fills in the EFT Application form giving the particulars of the beneficiary (city, bank, branch, beneficiary's name, account type and account number) and authorises the branch to remit a specified amount to the beneficiary by raising a debit to the remitter's account.

The Electronic Funds Transfer Authorization Form contains a form that may be used to gather information from your employees that is needed to establish an electronic funds transfer program.

What you need Electronic Funds Transfer Form. Providers must complete the authorized-signature (and date) field on the EFT form. Include the following documentation: Voided check. Bank letter that includes the bank name, provider name, bank account number, and routing number. Bank statement from the designated account.

What you need Electronic Funds Transfer Form. Providers must complete the authorized-signature (and date) field on the EFT form. Include the following documentation: Voided check. Bank letter that includes the bank name, provider name, bank account number, and routing number. Bank statement from the designated account.

EFT (Electronic Fund Transfer) formats are used to output a text file in a format to suit banking software. In some countries, each bank has a different format; in others the format is consistent.

An EFT requires two parties to execute a transaction: one to send funds, and another to receive them. The sender must also offer up a few important details to successfully execute the transfer, including the recipient's bank name, bank account number, routing number, and account type.