Judgement Lien On My Property In Contra Costa

Description

Form popularity

FAQ

If they are not timely renewed, they expire. In CA that is 10 years. However, when a judgment lien has been recorded against your property, it has no expiration date. This means that it is possible to no longer have a judgment against you, but still have a judgment lien on your property.

Lien Release: After a lien has been filed, the California claimant can release or cancel the lien by filing a Mechanics Lien Release form with the county recorder's office where the lien was originally recorded.

Most judgments (the court order saying what you're owed) expire in 10 years. This means you can't collect on it after 10 years. To avoid this, you can ask the court to renew it. A renewal lasts 10 years.

If you put liens on the other side's property, you or the other side must remove them. To remove a lien, file a certified copy of the Acknowledgment of Satisfaction of Judgment (form EJ-100) with each county recorder's office where you put the lien on their property.

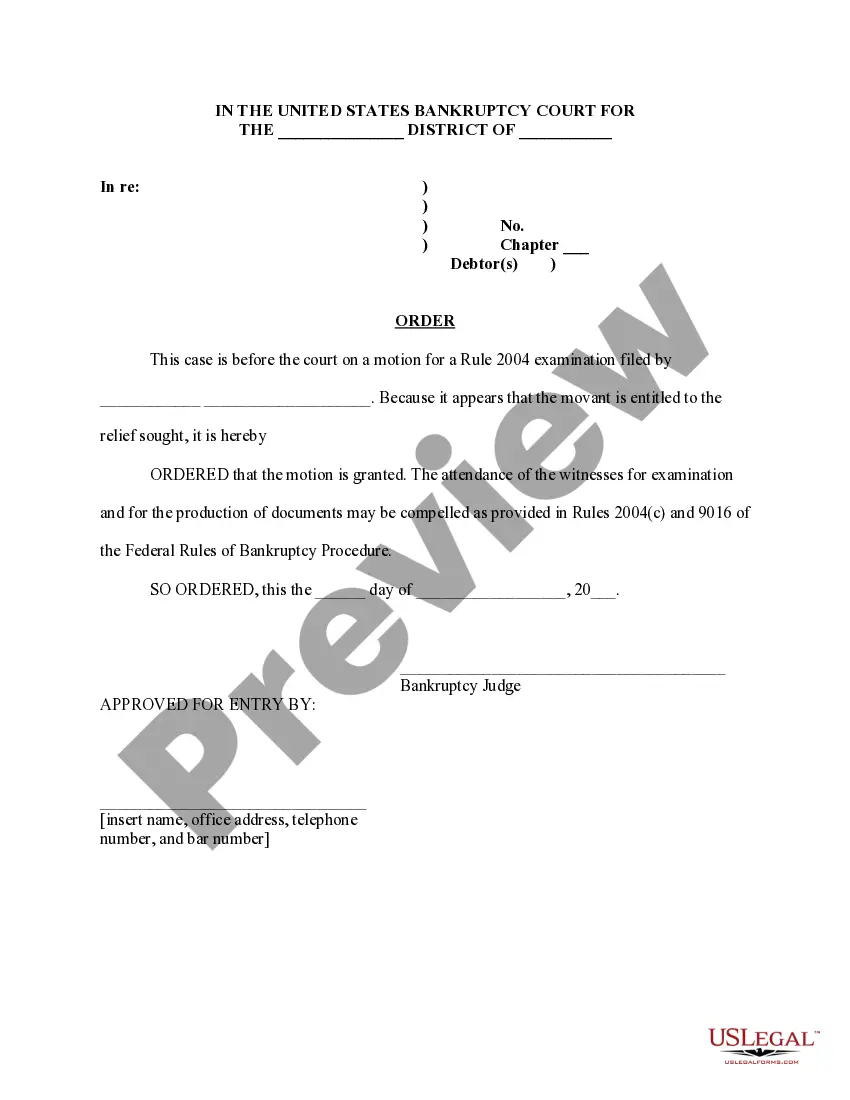

Here are a few ways to remove the lien: Invalidate the lien. If the lien is invalid or was obtained in a manner that doesn't follow the procedural requirements under the law, an attorney may be able to strip the lien from the property. Satisfy the debt. Negotiate a lower payoff. File for bankruptcy.

Most judgments (the court order saying what you're owed) expire in 10 years. This means you can't collect on it after 10 years. To avoid this, you can ask the court to renew it. A renewal lasts 10 years.

Options Invalidate the lien. If the lien is invalid or was obtained in a manner that doesn't follow the procedural requirements under the law, an attorney may be able to strip the lien from the property. Satisfy the debt. This is the simplest way to have the lien cleared. Negotiate a lower payoff. File for bankruptcy.

Here are a few ways to remove the lien: Invalidate the lien. If the lien is invalid or was obtained in a manner that doesn't follow the procedural requirements under the law, an attorney may be able to strip the lien from the property. Satisfy the debt. Negotiate a lower payoff. File for bankruptcy.

Complying with California's lien procedures allows a creditor to obtain a lien on any real property owned by the debtor in the county in which it is recorded. The lien attaches to all real property in the debtor's name. See CCP § 697.310(a). The lien remains effective for 10 years.

A lien expires 10 years from the date of recording or filing, unless we extend it. If we extend the lien, we will send a new Notice of State Tax Lien and record or file it with the county recorder or California Secretary of State. We will not release expired liens.