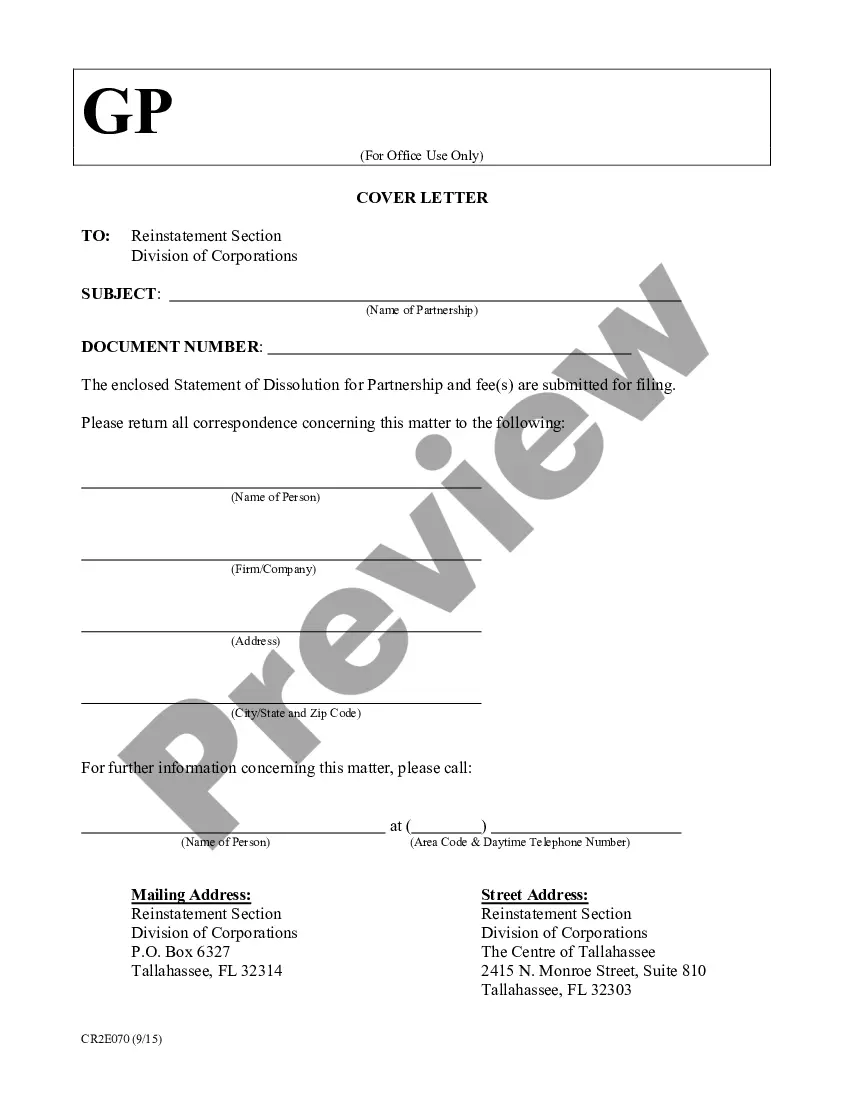

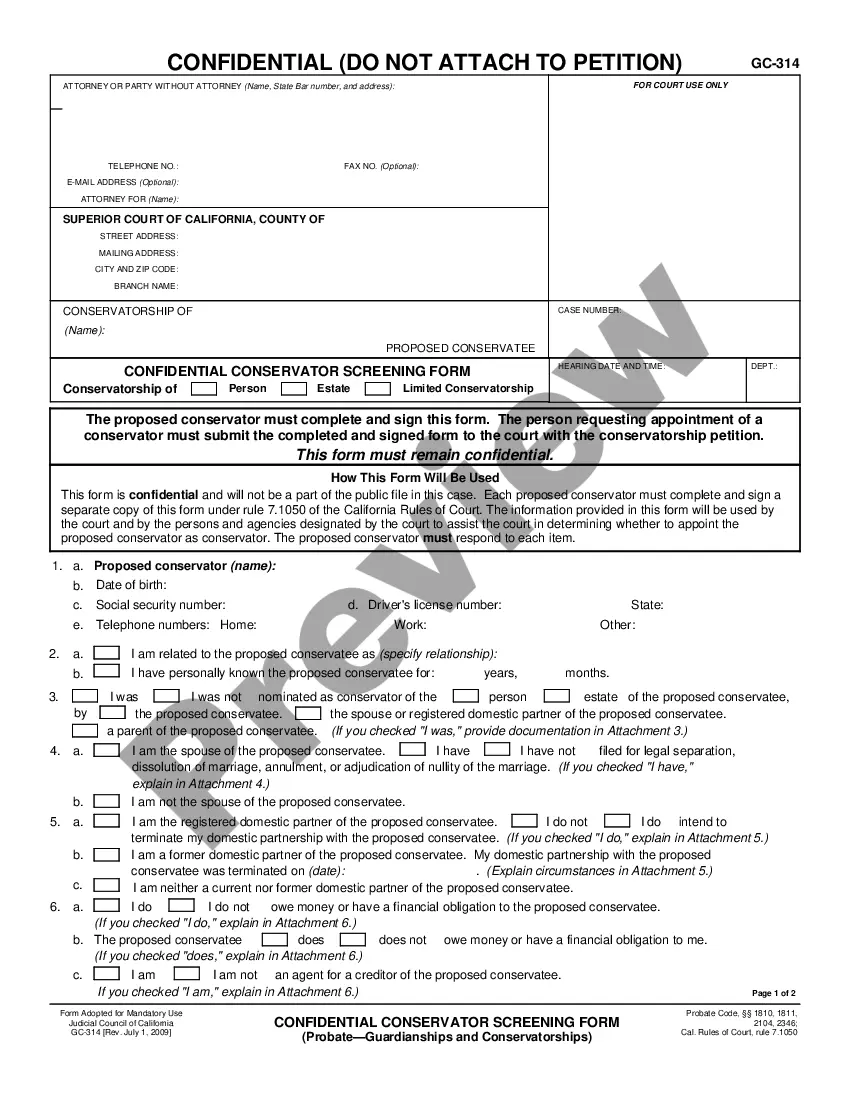

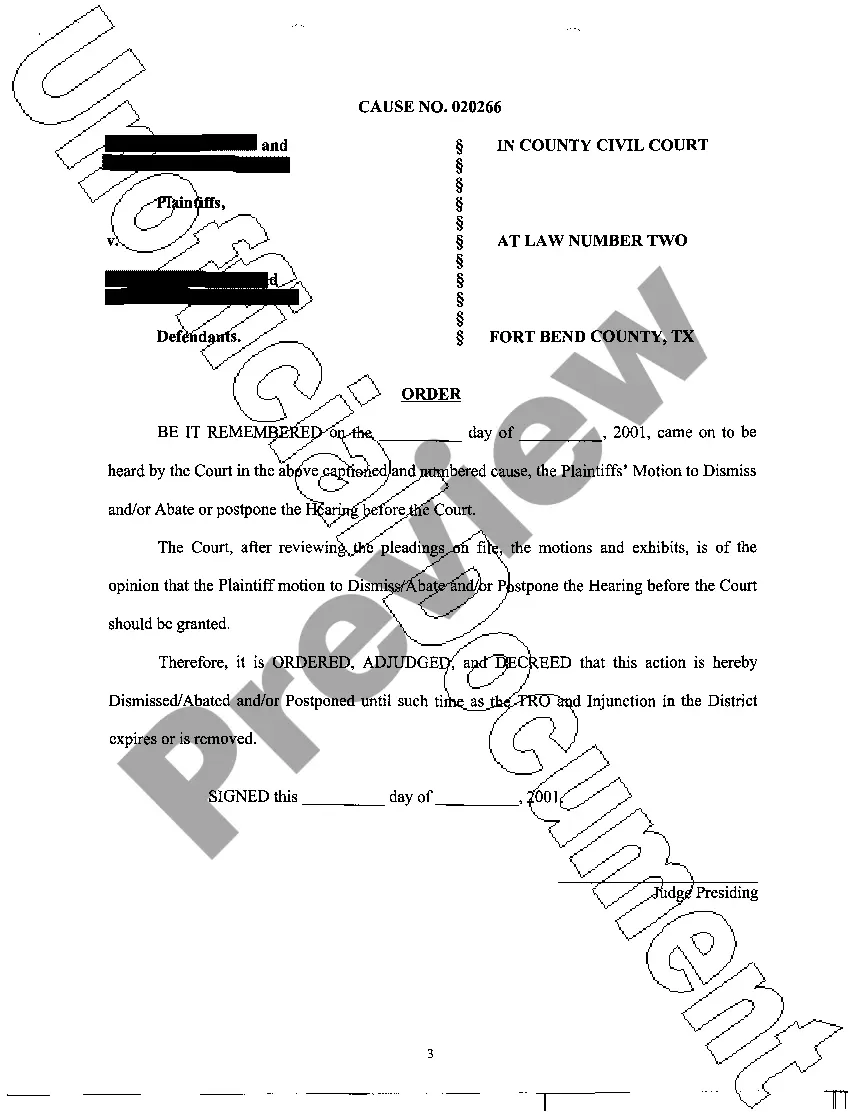

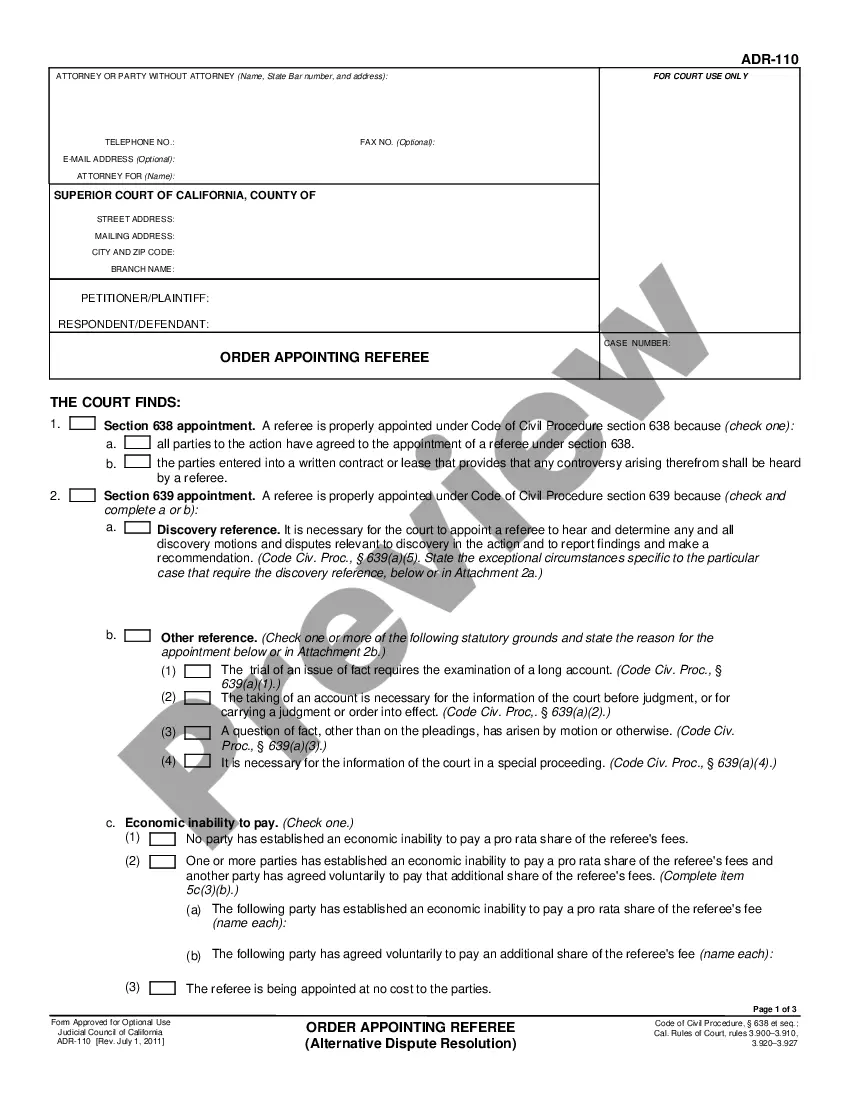

This form is a sample letter in Word format covering the subject matter of the title of the form.

Judgment Lien On Personal Property Without Administration In Franklin

Description

Form popularity

FAQ

Verify the Lien: Ensure the lien is valid and check for any errors that could invalidate it. Satisfy the Judgment: Paying the debt in full is the most straightforward way to remove the lien. Obtain a satisfaction of judgment from the creditor and file it with the court.

And a homeowner may find it difficult to sell any property that has a lien against it. Prospective buyers may avoid a property to which someone else has a claim.

The judgment lien is not going to impact a homesteaded property so the mortgage lender would be able to obtain a first lien on your property. So, as long as you otherwise qualify for a mortgage, the judgment lien should not be a problem.

Property liens can be granted for repossessing property such as a car, boat, or even a house if the owner has defaulted on mortgage payments. Typically, property liens are the final step a creditor will take to collect an unpaid debt.

In Minnesota, an action to enforce a mechanics lien must be initiated within 1 year from the date of the lien claimant's last furnishing of labor or materials to the project. If a claimant records their lien close to Minnesota's 120-day filing deadline, they will have about 8 months to enforce the claim.

Creditors typically acquire property liens through your voluntary consent. On the other hand, creditors get judgment liens after winning a lawsuit against you for a debt you owe.

Banker's Lien It does not apply in the following circumstances. A bank has no claim to the credit balance that is present in a customer's account. In this instance, the banker's right is a right of “set-off.”

What Do You Do When There Is A Judgment Lien On Your Property, But The Judgment Has Expired? Judgments have expiration dates. If they are not timely renewed, they expire. In CA that is 10 years.

Personal Property Execution If a Judgment Creditor knows that the Judgment Debtor owns a car, truck, motorcycle or other personal property of significant value, the Judgment Creditor may file a Property Execution.

In a Nutshell This court order allows them to collect on the debt by seizing your real or personal property (or putting a lien on it), garnishing your wages, or levying your bank account. Personal property includes everything from household goods to vehicles. Real property includes things like your home or land.