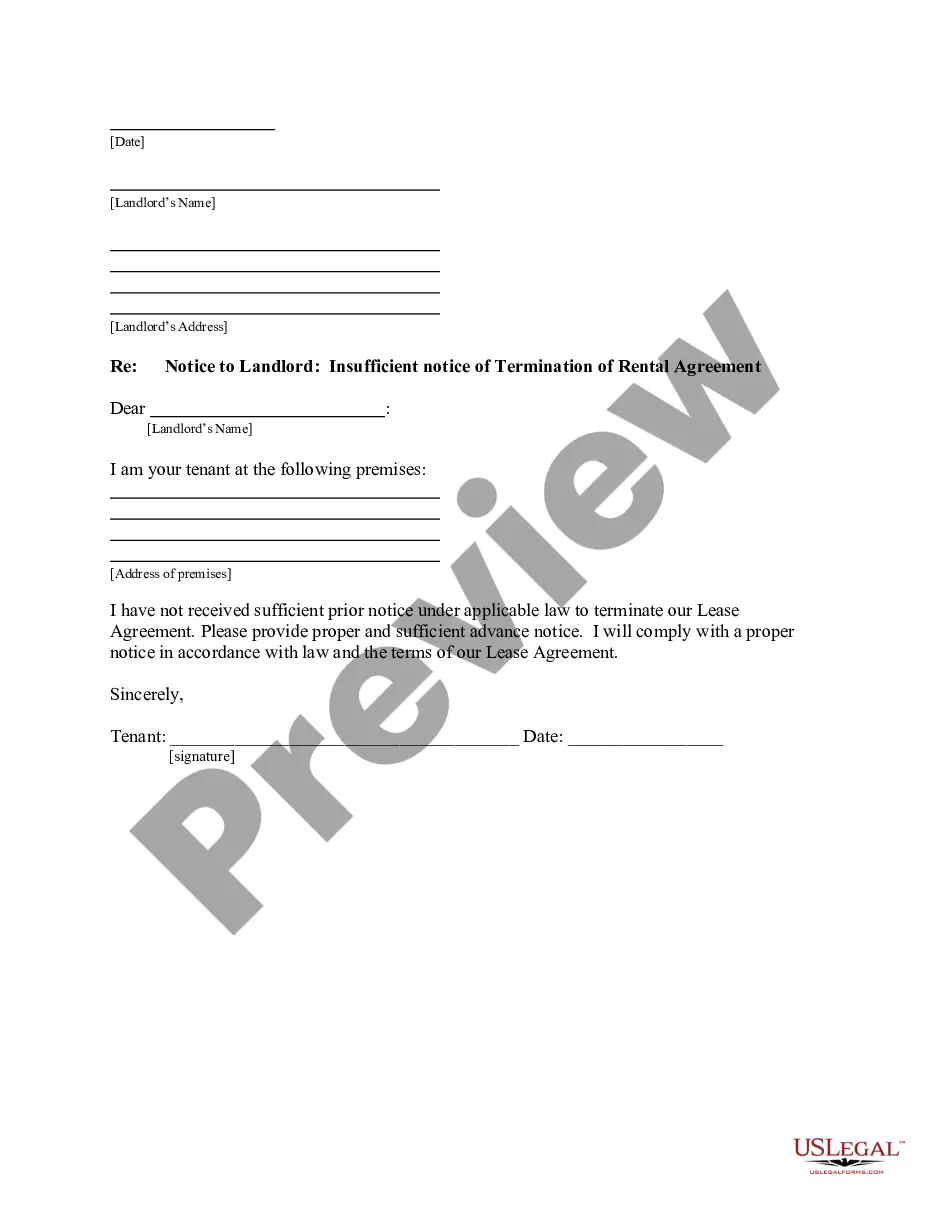

This form is a sample letter in Word format covering the subject matter of the title of the form.

Judgement Lien On Bank Account In Harris

Description

Form popularity

FAQ

A writ of garnishment allows a creditor to seize property from a debtor that is being held by a third party. While some property is exempt from garnishment in Texas, such as wages, other property such as bank accounts and stocks may be subject to garnishment.

You are judgment proof if: You do not own anything of great value aside from exempt property like your homestead, a vehicle, household items and tools of your trade. Your income is from a protected (exempt) source.

With Texas Easy Lien, you can prepare your own construction lien and bond claim documents online. No expensive attorney, finding a notary or waiting. Within minutes, you can do it yourself and save thousands of dollars.

To file a lien claim, you will need: Property owner's name (or company name) and mailing address. Project address and the county where it is located. The amount owed for each month you performed the work that remains unpaid. A brief description of the work you performed.

Requesting a Writ of Execution Another way a creditor may try to collect their judgment is through a writ of execution. A writ of execution allow the debtor's non-exempt property to be seized and sold. The proceeds from the sale go to the debt owed to the creditor.

Generally, to file a judgment lien, an abstract of judgment must be issued by the justice court. Some justice courts have a form available on their website to request an abstract of judgment.

Contact the Harris County clerk's office to get the required form, or check out Texas Easy Lien online options. Once you've collected the information listed above, follow these steps: Fill out the form completely. Attach a copy of your contract, if relevant.