Notice For Judgment Debtor In Hillsborough

Description

Form popularity

FAQ

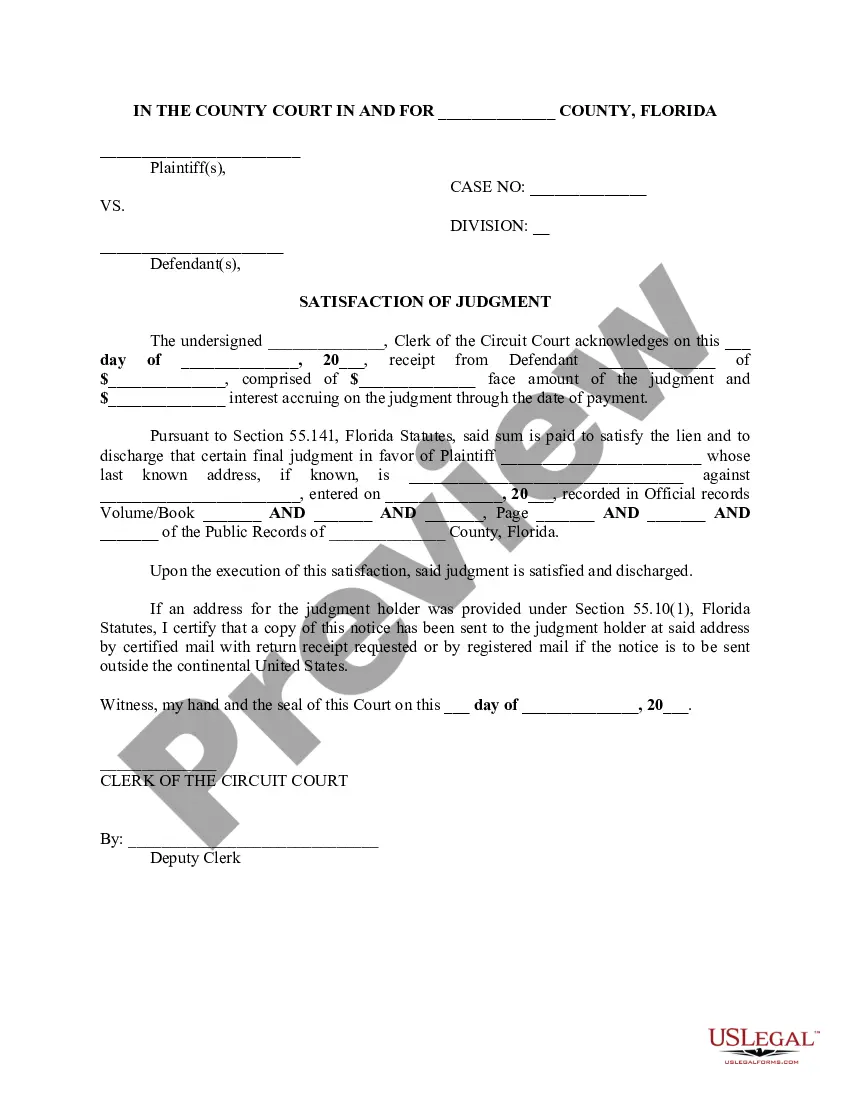

In a debt collection lawsuit, a judgment is a court order that allows the debt collector to use stronger tools, like garnishment, to collect the debt. A judgment is an official result of a lawsuit in court.

The sheriff's department can seize: Personal property: movable things (e.g., cars, horses, boats, furniture, jewelry) owned by the debtor. Real property: land and buildings owned by the debtor.

Most creditors will file the release of judgment within 30-60 after you finish paying them. What if I need the judgment released immediately (“I'm supposed to close next week!”)? You can ask them to give you the release sooner. They might do it; they might not.

Florida Statute of Limitations on a Judgment Lasts 20 Years | Haber law Haber Law.

Presently there is a Florida statute that limits judgment liens to 20 years,3 and there is a Florida statute that limits “actions” on certain judgments to 20 years and other judgments to five years. There is, however, no statute or court rule that places a time limit on the execution of judgments.

The statute of limitations in Florida on debt is five years. This means that once the five-year timeline has expired, creditors can no longer file a lawsuit against the borrower to try and recover the debt. This is only true of debts that include a written agreement, though.

Florida Statute of Limitations on a Judgment Lasts 20 Years. Until recently, there has been some debate on this litigation question caused by the interpretation of some Courts that a Florida judgment is subject to a five year statute of limitations. However, the Florida Supreme Court, in Salinas v.

Your home and Florida's homestead exemption If you own the home you live in, your home is protected from all creditors except those holding a mortgage or lien on your residence. You can exempt or protect your home and up to one-half acre of land from any forced sale if you live in an incorporated area.

You may have received a judgment because the court decided in favor of the debt collector in a trial, or because you did not respond to a lawsuit that was filed against you.