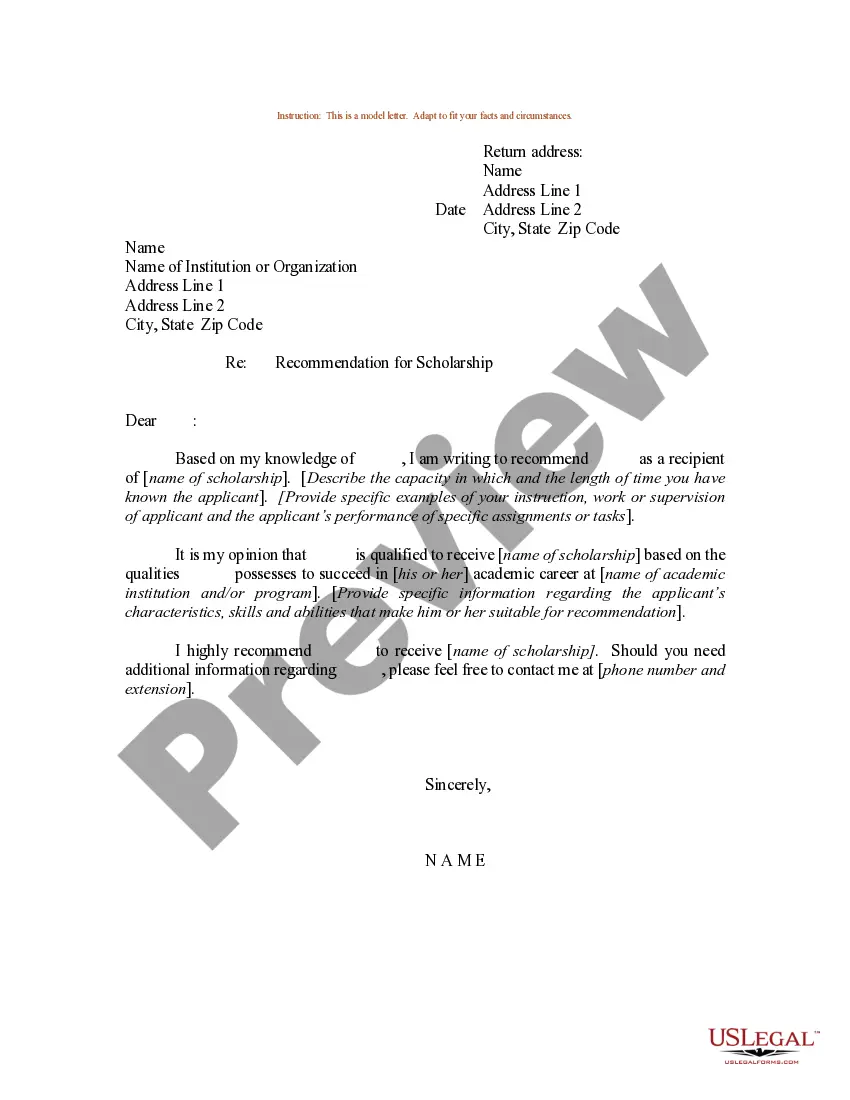

This form is a sample letter in Word format covering the subject matter of the title of the form.

Judgment Against Property Foreclosure In Montgomery

Description

Form popularity

FAQ

In Maryland, the borrower has until the court ratifies the foreclosure sale to redeem the home. Ratification typically takes place 30 to 45 days after the sale, though this varies from county to county.

– Notice of Default (NOD) –the first step in the foreclosure process is the recordation of the notice of default. After the NOD, the Trustee must wait three calendar months before giving a Notice of Trustee Sale on the property.

Borrowers are entitled to loss mitigation evaluations under the new rules, even if they applied for and were rejected for loss mitigation before the new rules took effect, provided they file their complete applications more than 37 days before a scheduled foreclosure sale.

Approximately half of the states in the United States, including Virginia and Maryland, are “deed of trust states,” which means they typically allow foreclosure by non-judicial sale. The District of Columbia is also a deed of trust jurisdiction.

While most states have either mortgages or deeds of trust, there are a few states that allow you to choose which is better for you. These states include Alabama, Arizona, Arkansas, Illinois, Kentucky, Maryland, Michigan, and Montana.

Most foreclosures in Maryland are what's called “nonjudicial” or “quasi-judicial.” With a nonjudicial foreclosure, the lender must complete specific out-of-court steps detailed in state law before selling the property. In most states, a court is not involved in a nonjudicial foreclosure whatsoever.

In other words, a judgment on the pleadings is a judgment on the facts as pleaded, while a summary judgment is a judgment on the facts as summarily proved by affidavits, depositions, or admissions.

The summary judgment hearing means the foreclosure lawsuit is resolved fast, because the summary judgment ends the dispute in a “summary” fashion and the bank gets a judgment to use in foreclosure proceedings on the home.

Usually when foreclosing on a property the bank presents the owed amount including interest charges penalties and fees. The judge award that amount or another calculation he feels necessary. This is called the final judgement amount.