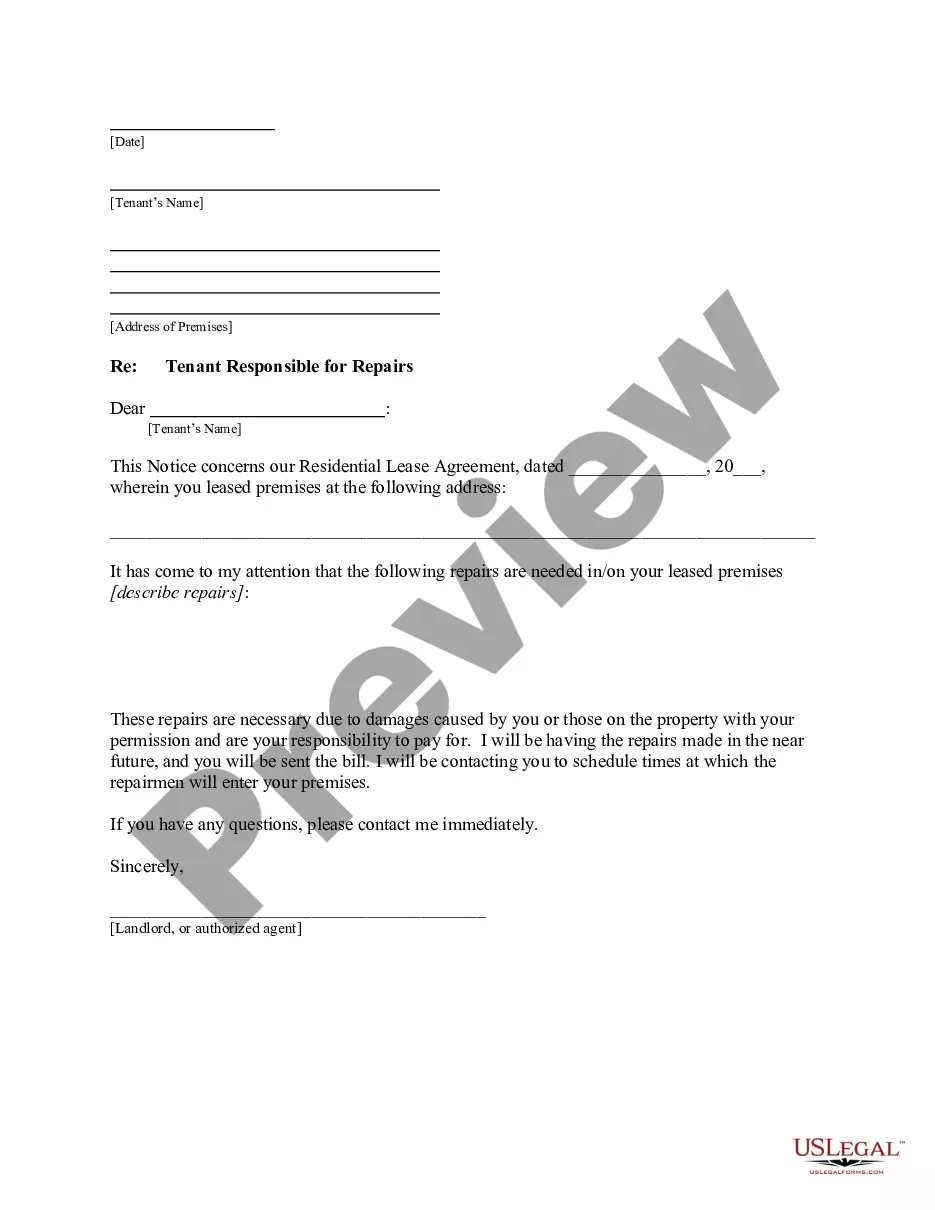

This form is a sample letter in Word format covering the subject matter of the title of the form.

Sample Letter To Collect Judgement For Bir In North Carolina

Description

Form popularity

FAQ

Specifically, the rule states that a debt collector cannot: Make more than seven calls within a seven-day period to a consumer regarding a specific debt. Call a consumer within seven days after having a telephone conversation about that debt.

How to fill out the Sample Judgment Proof Letter for Collection Agency? Enter your address at the top of the letter. Fill in the date of writing the letter. Provide the collection agency's name and address. State your income source ensuring it's protected from garnishment.

Include your full name, company name, and mailing address. Address the letter to your client by their full name. State the problem: Specify and provide proof of the debt in question. Reference the original contract or agreement that states the services the client owes you for.

In fact, it's a bit of a misnomer because the creditor can sue you and get a judgment. But the creditor can't collect on the judgment. So, you can still have a judgment of record against you, but the creditor can't collect on it. However, most creditors won't bother to sue if they know that you're judgment proof.

Dear Creditor: Please provide me with verification of the debt which you state I owe. Please provide me with any records which are in your possession, including, but not limited to, all statements of each account, invoices, and any other documentation which I may have signed.

If you write a letter, instead of using the tear-off form, the debt dispute letter should include your personal identifying information; verification of the amount of debt owed; the name of the creditor for the debt; and a request the debt not be reported to credit reporting agencies until the matter is resolved or ...

``TO WHOM IT MAY CONCERN: This letter serves to inform you that I dispute the validity of this debt. I expect, as a result of my informing you of this dispute, that I will be mailed a copy of verification of this debt. I also request that you provide the name and address of the original creditor.

Removing A Judgment from Your Record There are only three ways in which a judgment can be made to go away: paying the debt, vacating the judgment or discharging the debt through bankruptcy.

The easiest procedure is to file a motion for summary judgment in lieu of complaint. That sets up a summary procedure that is designed to determine whether defendant received proper service of legal papers in the out-of-state case and that granting recognition to the judgment doesn't violate NY public policy.

Some possible options to enforce an out-of-state judgment in California include the following: Levying the debtor's assets and personal belongings. Placing a lien on the debtor's property. Levying the debtor's bank account. Levying the debtor's vehicle. Garnishing the debtor's wages.