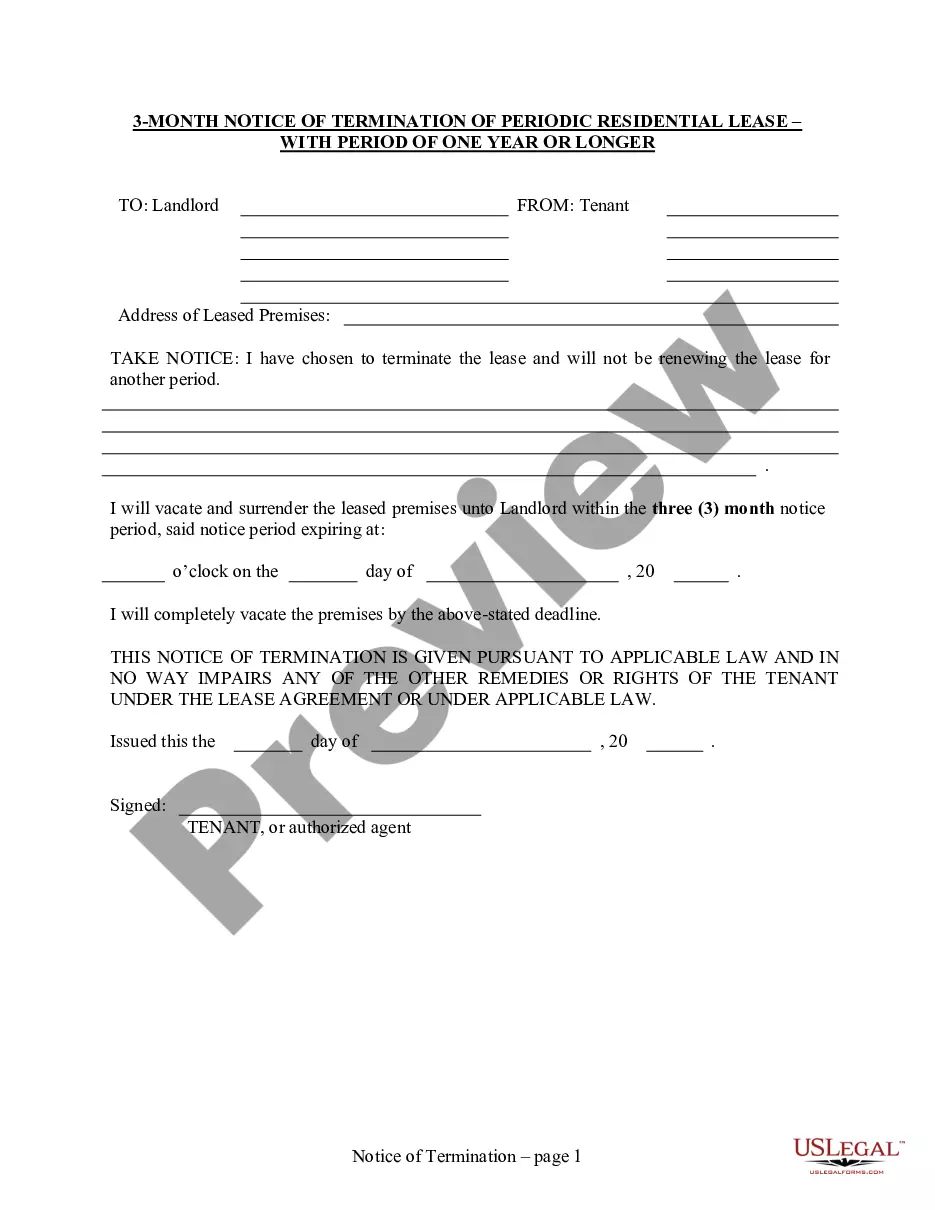

This form is a sample letter in Word format covering the subject matter of the title of the form.

Judgement Lien On My Property In Santa Clara

Description

Form popularity

FAQ

The judgment lien is not going to impact a homesteaded property so the mortgage lender would be able to obtain a first lien on your property. So, as long as you otherwise qualify for a mortgage, the judgment lien should not be a problem.

Most judgments (the court order saying what you're owed) expire in 10 years. This means you can't collect on it after 10 years. To avoid this, you can ask the court to renew it. A renewal lasts 10 years.

Options Invalidate the lien. If the lien is invalid or was obtained in a manner that doesn't follow the procedural requirements under the law, an attorney may be able to strip the lien from the property. Satisfy the debt. This is the simplest way to have the lien cleared. Negotiate a lower payoff. File for bankruptcy.

And a homeowner may find it difficult to sell any property that has a lien against it. Prospective buyers may avoid a property to which someone else has a claim.

A judgment lien in Oregon will remain attached to the debtor's property (even if the property changes hands) for ten years.

Any time you win a lawsuit, you can put a lien on the defendant's real estate by recording an Abstract of Judgment in the Recorder's Office of the county where the real estate is located.

An involuntary lien can occur without your knowledge, depending on the circumstances. A creditor often places a judgment lien after suing you and winning the case.

The answer to your question is generally no. If someone wants to put a lien on the property, they must get the court's approval to do so. For example if it is a contractor, then they must advise the owner of their intent to place a lien on a home.

The easiest way to remove a property lien is to repay the debt that spurred it. If you owe a contractor $1,000 in unpaid labor costs or your property taxes are a few years overdue, settle those balances up and then contact the creditor to have them removed.