Judgment Lien On Personal Property With Mortgage In Tarrant

Description

Form popularity

FAQ

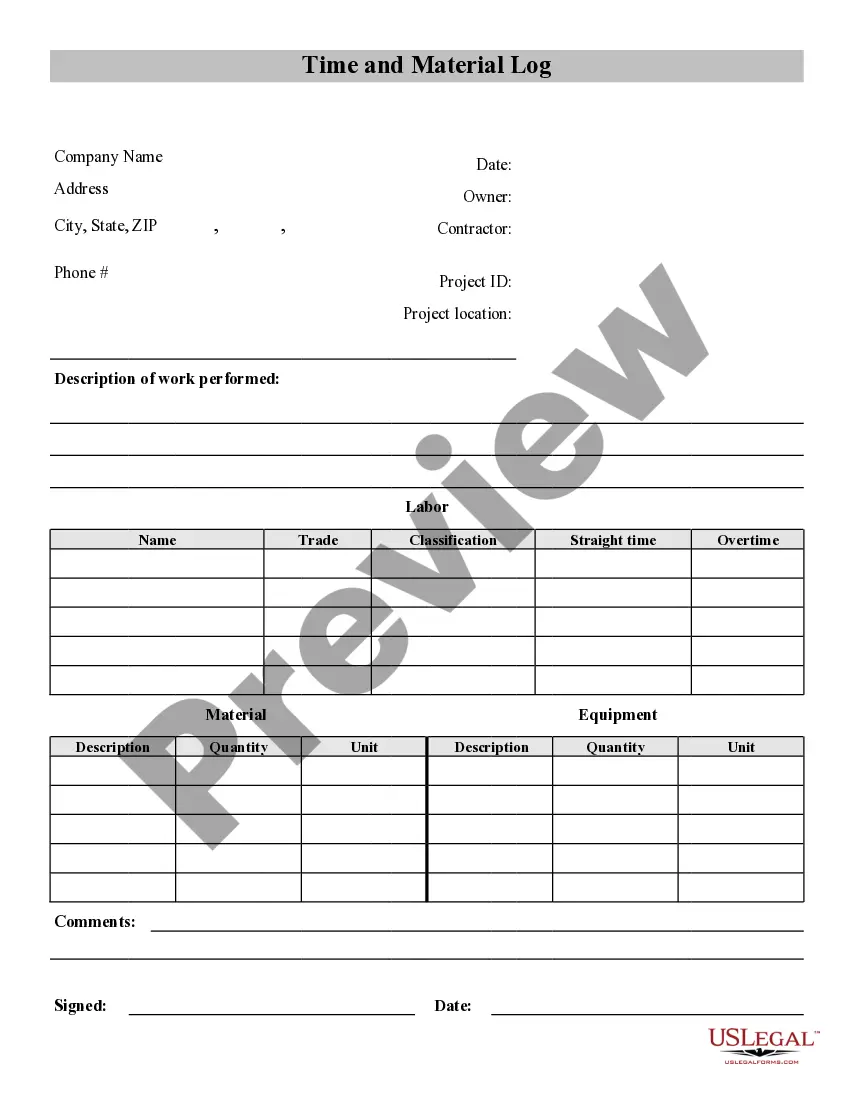

This document is the heart of your lien. It must detail the work done or materials provided. ItMoreThis document is the heart of your lien. It must detail the work done or materials provided. It should also State the outstanding amount remember Precision is your friend here.

A judgment lien is a court ruling that gives a creditor the right to take possession of a debtor's property if the debtor fails to fulfill their contractual obligations.

In Texas, a judgment lien can be attached to real estate only (such as a house or land).

Verify the Lien: Ensure the lien is valid and check for any errors that could invalidate it. Satisfy the Judgment: Paying the debt in full is the most straightforward way to remove the lien. Obtain a satisfaction of judgment from the creditor and file it with the court.

A mortgage is a specific, voluntary lien. It is specific to the piece of property and is voluntary because it was agreed to by the property owner. A judgment lien is an example of a general, involuntary lien. Judgment liens can be applied against any of an individual's assets.

In a Nutshell This court order allows them to collect on the debt by seizing your real or personal property (or putting a lien on it), garnishing your wages, or levying your bank account. Personal property includes everything from household goods to vehicles. Real property includes things like your home or land.

Texas exempts only two types of real property: (1) one or more cemetery plots: and (2) a homestead. Texas Property Code § 41.001(a). Either families or single adults may claim homesteads. The homestead may be either rural or urban.

After a creditor obtains a judgment against a debtor, they may then take action to seize the debtor's assets, including funds in bank accounts, vehicles, or other personal property.

Texas law itself provides a substantial amount of protection for certain assets. In most cases, these include your homestead, a specific amount of personal property, retirement accounts, 529 college savings accounts, life insurance and annuities.

After a creditor obtains a judgment against a debtor, they may then take action to seize the debtor's assets, including funds in bank accounts, vehicles, or other personal property.