This form is a sample letter in Word format covering the subject matter of the title of the form.

Judgment Against Property For Find In Washington

Description

Form popularity

FAQ

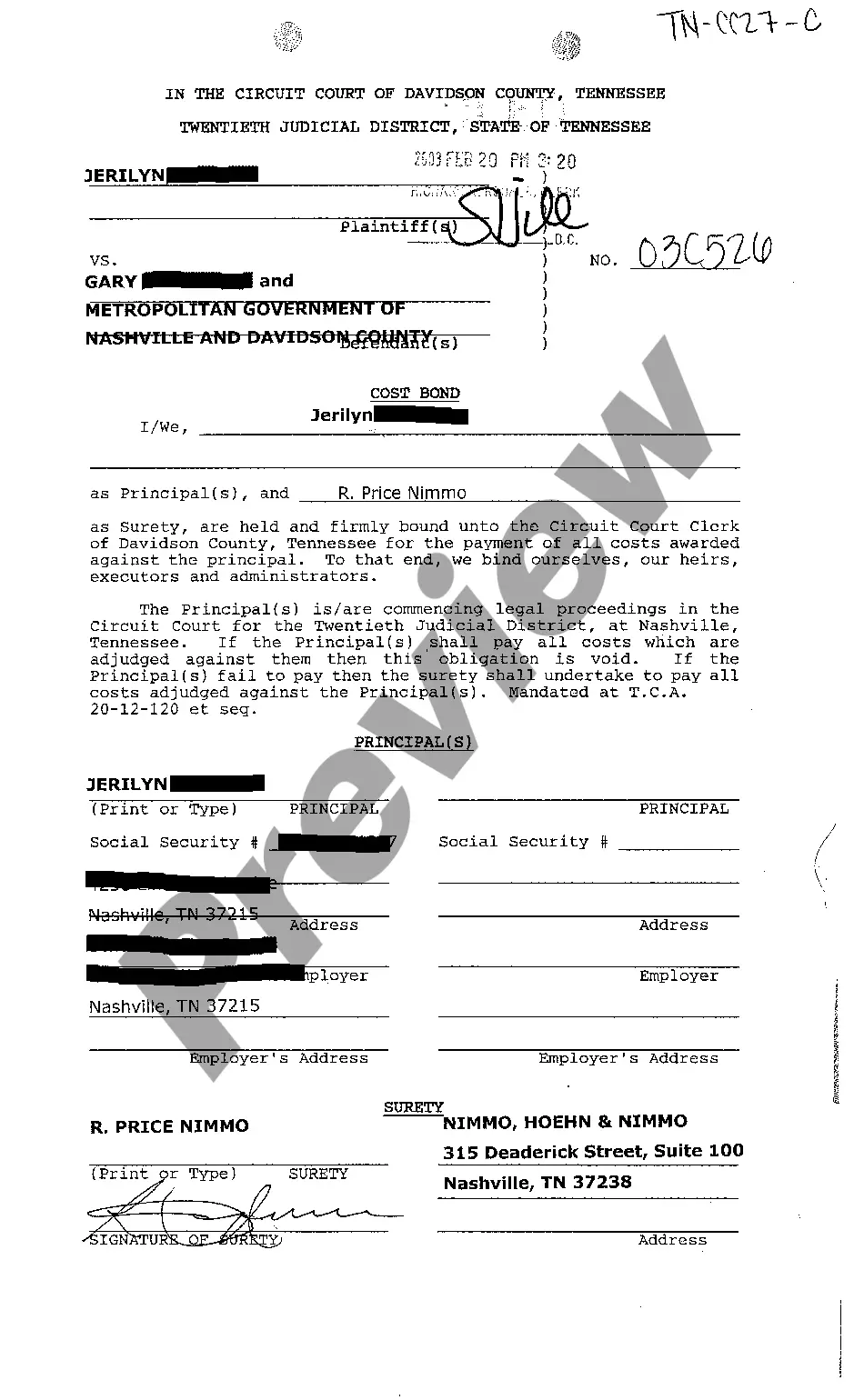

Yes, a lien may be placed on property that is jointly owned. However, the effects of that lien depend on the type of ownership that the property is under. Before discussing the terms of joint ownership, it's important that you understand exactly what liens are and what they may mean for you and your investment.

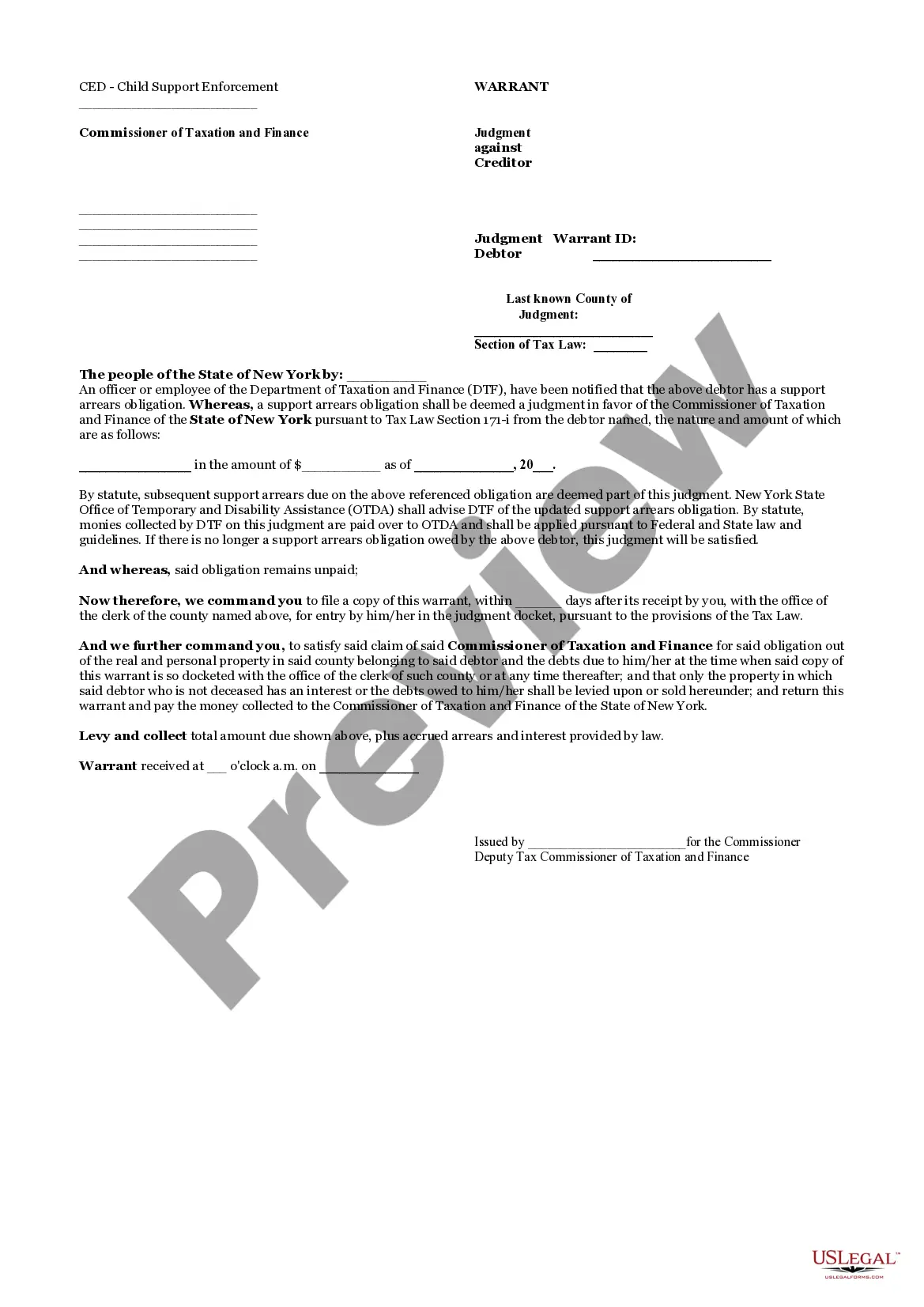

A judgment lien on the debtor's property is created automatically when the property is in the same Washington county where the judgment is entered. But when the debtor's property is in another Washington county, the creditor must file the judgment with the county clerk for that county.

Interested parties may contact the county recorder's office where the property is located or where the owner resides to begin a tax lien search in Washington. This may be the most reliable method of obtaining all the information required.

Washington State's homestead laws exempts a homestead from being taken by the Court or from a forced sale to satisfy a judgment creditor. Unlike many states, however, Washington State's homestead exemption is capped.

Interested parties may contact the county recorder's office where the property is located or where the owner resides to begin a tax lien search in Washington. This may be the most reliable method of obtaining all the information required.

Washington State's homestead laws exempts a homestead from being taken by the Court or from a forced sale to satisfy a judgment creditor. Unlike many states, however, Washington State's homestead exemption is capped.

The abstract of a judgment shall contain (1) the name of the party, or parties, in whose favor the judgment was rendered; (2) the name of the party, or parties, against whom the judgment was rendered; (3) the date of the rendition of the judgment; (4) the amount for which the judgment was rendered, and in the following ...