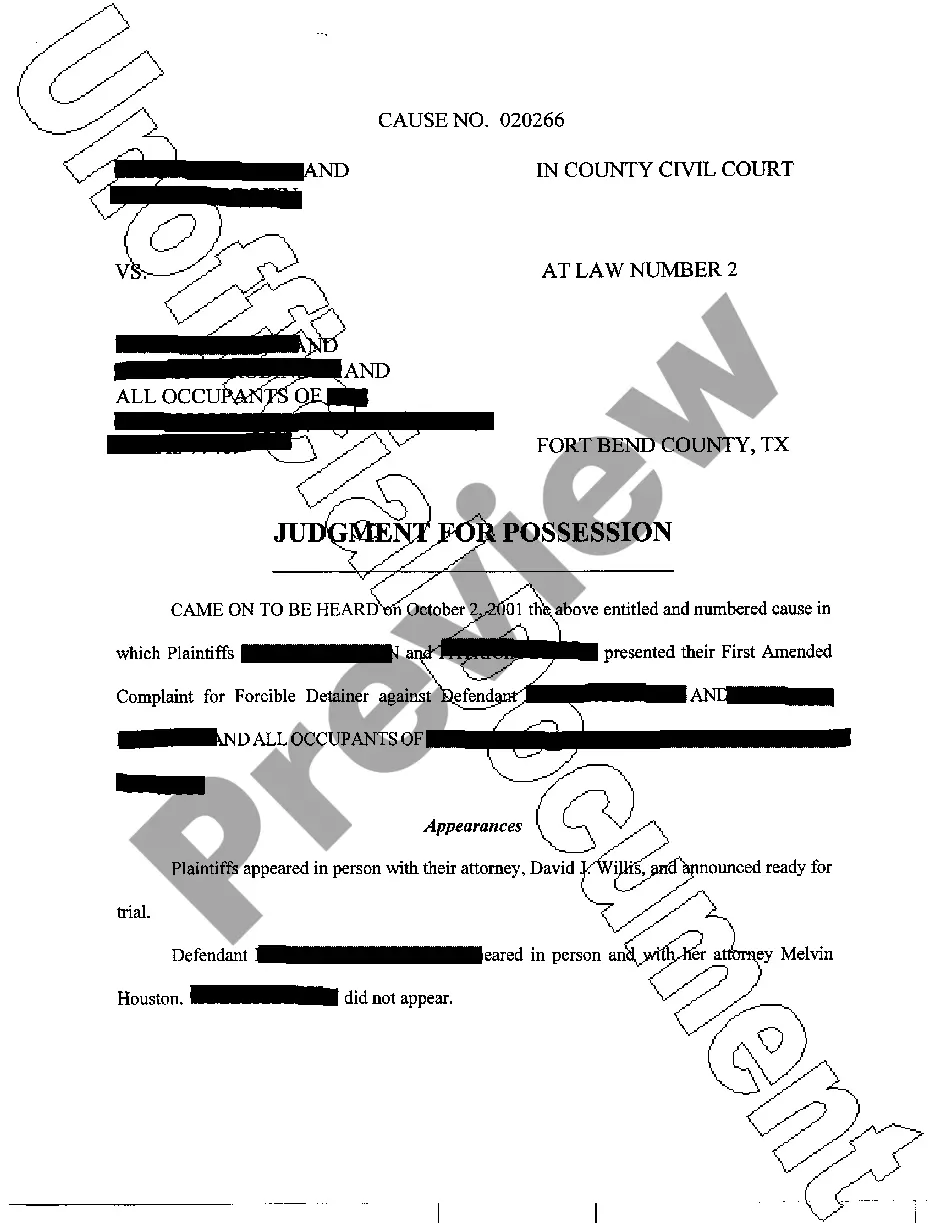

This form is a sample letter in Word format covering the subject matter of the title of the form.

Judgment Lien On Real Property In Washington

Description

Form popularity

FAQ

A lien must be recorded by the county auditor's office where the project itself took place; if the project spanned across county lines, the lien must be filed in all associated county auditors' offices.

The procedure for a lien search usually entails looking through Washington civil court records and public documents kept by county court clerks/recorders, assessors, and other pertinent government entities that maintain property-related records.

Interested parties may contact the county recorder's office where the property is located or where the owner resides to begin a tax lien search in Washington. This may be the most reliable method of obtaining all the information required.

A judgment lien on the debtor's property is created automatically when the property is in the same Washington county where the judgment is entered. But when the debtor's property is in another Washington county, the creditor must file the judgment with the county clerk for that county.

A judgment lien in Washington will remain attached to the debtor's property (even if the property changes hands) for ten years.

Undiscovered liens can result in high fines and even foreclosure on the home you worked so hard to obtain. Creditors should make all possible attempts to notify property owners of liens placed on their property but some liens can still go unnoticed so homeowners must take steps to protect themselves.

The answer to your question is generally no. If someone wants to put a lien on the property, they must get the court's approval to do so. For example if it is a contractor, then they must advise the owner of their intent to place a lien on a home.

In Minnesota, an action to enforce a mechanics lien must be initiated within 1 year from the date of the lien claimant's last furnishing of labor or materials to the project. If a claimant records their lien close to Minnesota's 120-day filing deadline, they will have about 8 months to enforce the claim.

Creditors typically acquire property liens through your voluntary consent. On the other hand, creditors get judgment liens after winning a lawsuit against you for a debt you owe.