This form is a sample letter in Word format covering the subject matter of the title of the form.

Letter For Recovery Debt In San Jose

Description

Form popularity

FAQ

The 7-year rule means that each negative remark remains on your report for 7 years (possibly more depending on the remark). However, after that period has ended, a remark will most probably fall off of your report.

Debt collectors may not be able to sue you to collect on old (time-barred) debts, but they may still try to collect on those debts. In California, there is generally a four-year limit for filing a lawsuit to collect a debt based on a written agreement.

Legislation signed into law by California Governor Gavin Newsom on September 24, 2024 will subject commercial debt collectors to new compliance requirements starting in 2025. California Senate Bill 1286 extends the reach of the state's Rosenthal Fair Debt Collection Practices Act (the “Rosenthal Act”), California's ...

Use this 11-word phrase to stop debt collectors: “Please cease and desist all calls and contact with me immediately.” You can use this phrase over the phone, in an email or letter, or both.

Unfortunately, my circumstances are unlikely to improve in the foreseeable future and I have no assets to sell to help clear my debt. I am therefore asking you to consider writing off my debt as I can see no way of ever repaying it. If you are unable to agree to this, please explain your reasons.

Federal law requires collection agencies to provide debt validation notices, so you don't need to request one. In some cases, a collector may provide the validation letter as its initial communication to you. If not, they must provide it within five days of their first communication, either in the mail or via email.

Debt collectors may not be able to sue you to collect on old (time-barred) debts, but they may still try to collect on those debts. In California, there is generally a four-year limit for filing a lawsuit to collect a debt based on a written agreement.

What a Debt Validation Letter Should Include A statement that the notice is coming from a debt collector. Your name and mailing information. The collection agency's name and mailing information. The name of the creditor (or creditors) you owe the debt to. The account number associated with the debt (if any)

How To Fill In A Proof Of Debt Form Box 1 – This is your business name. Box 2 – This is your business address. Box 3 – This is the total amount you are owed. Box 4 – List any supporting documents you have. Box 5 – List any un-capitalised interest on the claim.

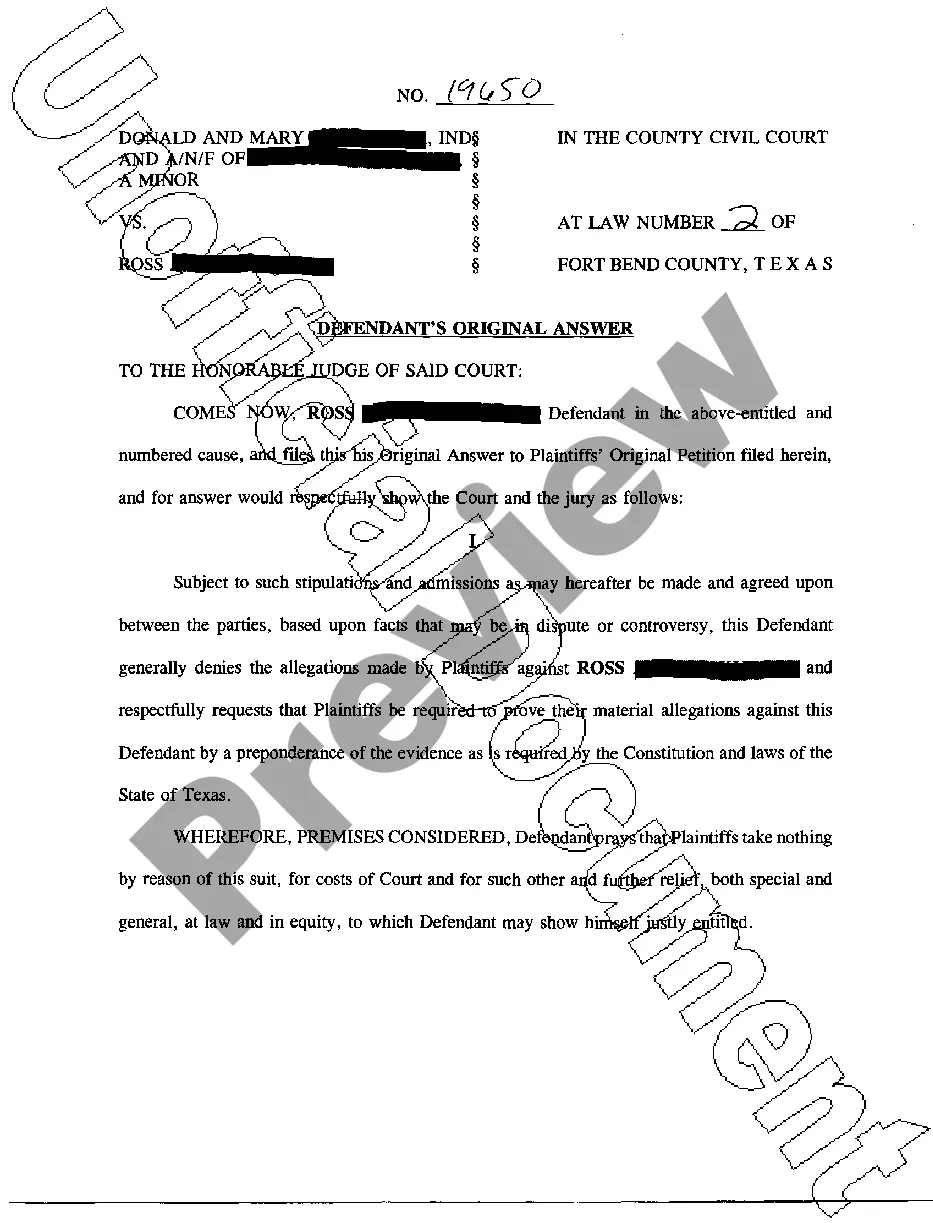

Follow these steps to respond to a debt collection case in California Answer each claim listed in the complaint. Assert your affirmative defenses. File the Answer with the court and serve the plaintiff.