Performance Agreement For Personal Assistant In Alameda

Description

Form popularity

FAQ

An independent contractor agreement is a contract that lays out the terms of the independent contractor's work. It covers the contractual obligations, scope, and deadlines of the work to be performed. It affirms that the client and contractor are not in an employer-employee relationship.

What is a 1099 employee? A 1099 employee is a contractor rather than a full-time employee. These employees may also be referred to as freelancers, self-employed workers, or independent contractors. If you are a business that has 1099 employees, determine what type of work this individual will do for your business.

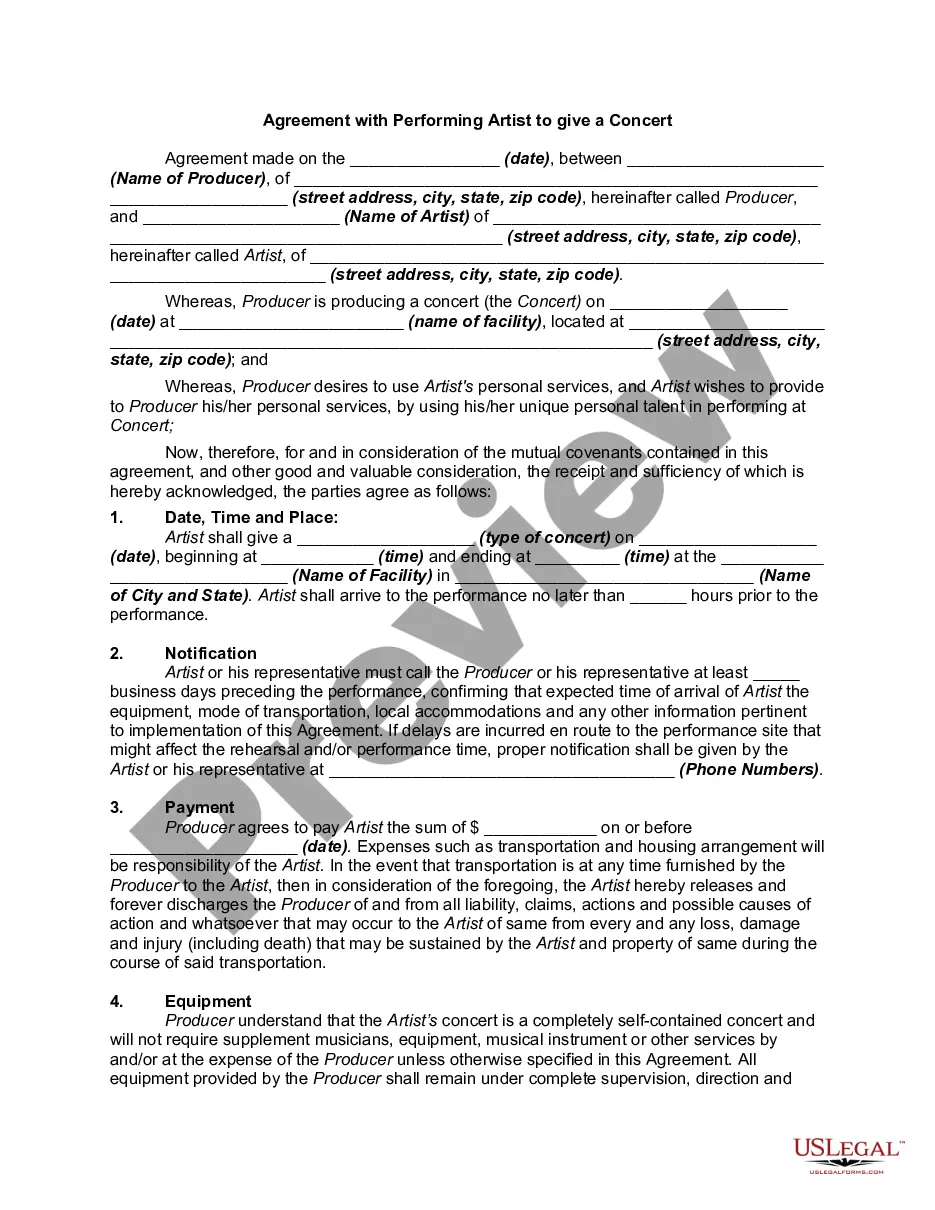

A contractor agreement should describe the scope of work, contract terms, contract duration, and the confidentiality agreement. It should also include a section for the two parties to sign and make the agreement official. If the contract doesn't meet these requirements, it may be inadmissible in a court of law.

Ing to IRS guidelines, it is possible to have a W-2 employee who also performs work as a 1099 independent contractor. For example, it is possible that an individual could work part of the year as an employee and part of the year as an independent contractor due to a layoff or even a resignation.

Here's the proven 9-step process for developing a performance plan: Automate the process. Explain performance reviews. Align goals. Define tactics. Connect employees to the bigger picture. Discuss performance. Create an ongoing communication plan. Set regular performance reviews.

Follow these steps to put an effective performance agreement in place for your staff: Start With Clear Expectations. Build in Milestones. Agree on the Terms. Schedule Accountability Meetings. Establish Outcome Results and Consequences. Sign and Date the Agreement.