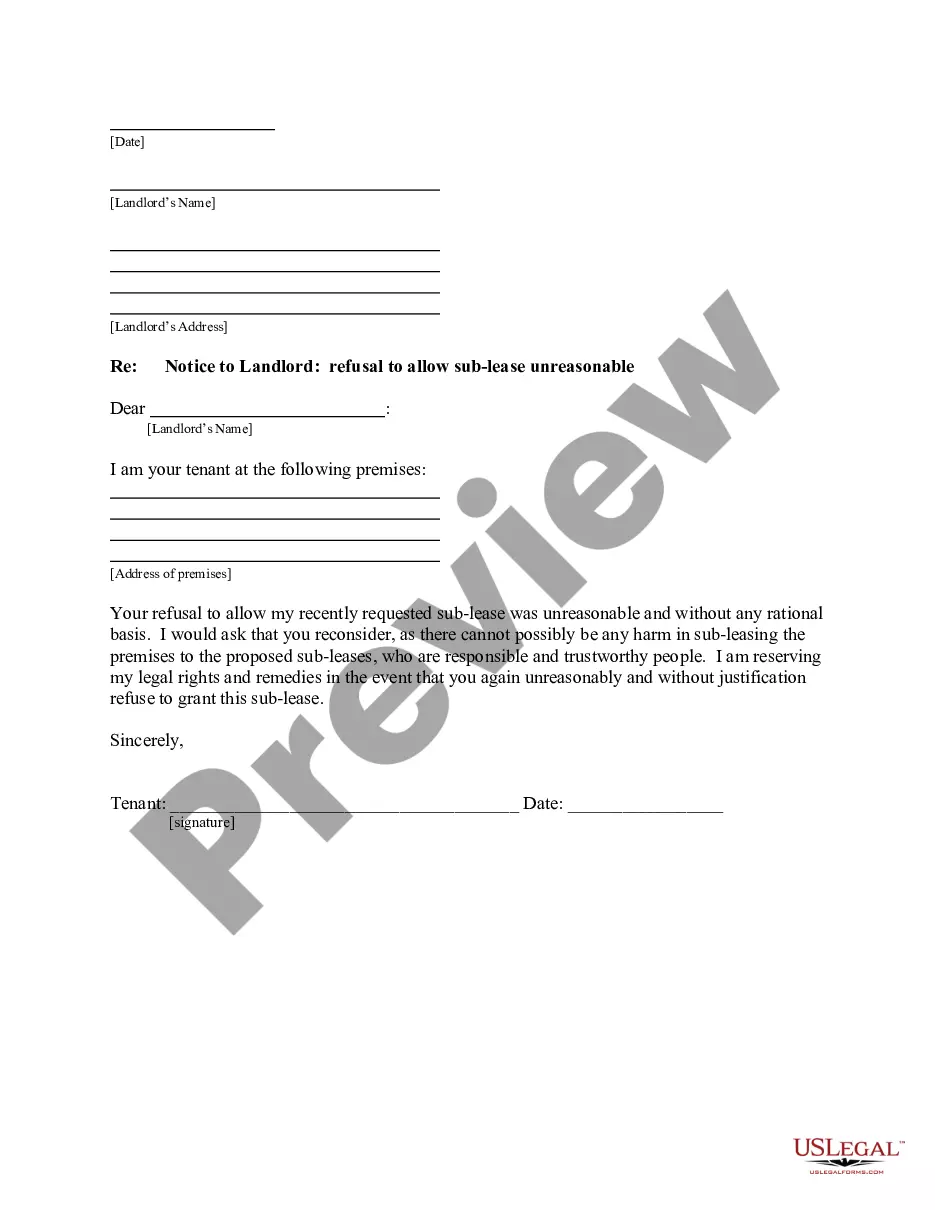

This form is a sample letter in Word format covering the subject matter of the title of the form.

Legal Letter For Collections In Florida

Description

Form popularity

FAQ

In Florida, you have only 20 days to respond by filing an Answer. You can respond with either an Answer document or a Motion; usually, you'll want to respond with an Answer document. If you don't respond within the 20 day period, you will automatically lose your case by default judgment.

Whenever someone tries to collect a debt, ask for all of their company's information, including: The collector's full name. Company name. Company address. Company phone number. Company website address. Company email.

Specifically, the rule states that a debt collector cannot: Make more than seven calls within a seven-day period to a consumer regarding a specific debt. Call a consumer within seven days after having a telephone conversation about that debt.

The 11-word phrase often cited to stop debt collectors is: ``I do not acknowledge this debt and request verification of it.'' This phrase requests that the debt collector provide verification of the debt, which they are legally obligated to do under the Fair Debt Collection Practices Act (FDCPA) in the United States.

These letters often include details like the amount owed, the due date, and any applicable interest or late fees. It's important to note that debt collection letters should adhere to legal regulations and guidelines, such as those outlined by the Fair Debt Collection Practices Act (FDCPA) in the United States.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

Specifically, the rule states that a debt collector cannot: Make more than seven calls within a seven-day period to a consumer regarding a specific debt. Call a consumer within seven days after having a telephone conversation about that debt.

Most states or jurisdictions have statutes of limitations between three and six years for debts, but some may be longer. This may also vary depending, for instance, on the: Type of debt. State where you live.

Specifically, the rule states that a debt collector cannot: Make more than seven calls within a seven-day period to a consumer regarding a specific debt. Call a consumer within seven days after having a telephone conversation about that debt.