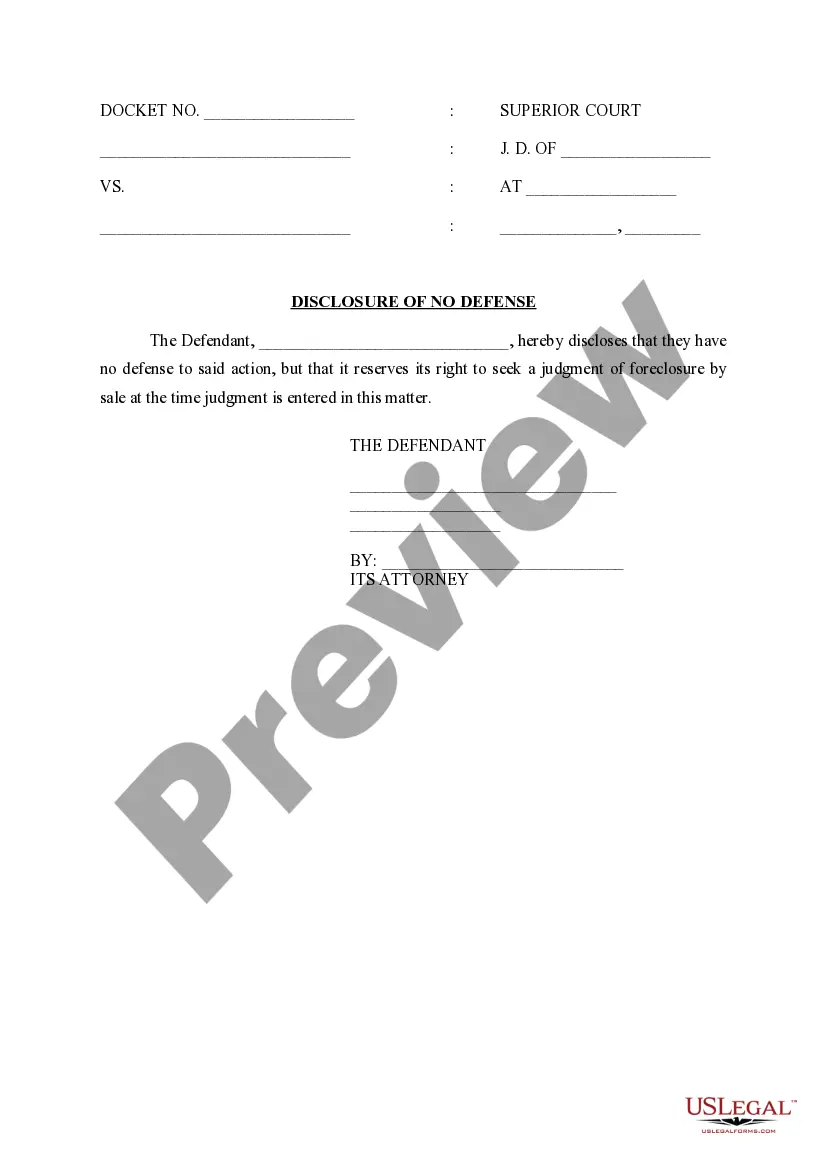

This form is a sample letter in Word format covering the subject matter of the title of the form.

Letters Legal Collections Without Prejudice In Palm Beach

Description

Form popularity

FAQ

File a complaint The DFPI regulates debt collection in the state of California. If a debt collector is contacting you or if a debt collector is lying or threatening you, you can quickly and easily file a complaint on the DFPI File a Complaint Webpage.

Consumer Rights. If a debt collector violates the FDCPA when trying to collect a debt, consumers may sue for damages such as lost wages and medical bills incurred to to the illegal collection practices or attempts. However, if the debt is owed, it is not forgiven just because a collection agency has broken the law.

Sue the Debt Collector in State Court You may bring a lawsuit against the debt collector in state court. In the lawsuit, you must prove that the debt collector violated the FDCPA. If successful, you might be able to collect $1,000 in statutory damages and possibly more if you suffered harm from the violations.

Yes you can sue a company for wrongfully sending you to collections. Wrong is wrong, It doesn't matter who committed the wrong. I suggest you consult an attorney ASAP.

Ignoring or avoiding the debt collector may cause the debt collector to use other methods to try to collect the debt, including a lawsuit against you. If you are unable to come to an agreement with a debt collector, you may want to contact an attorney who can provide you with legal advice about your situation.

If you're in the USA, you can send the debt collector a dispute letter invoking your rights under the Fair Debt Collection Practices Act. (There are many templates online that you can use.) Once they're on notice that they'll have to prove you're the actual debtor, they'll probably move on to easier targets.

Specifically, the rule states that a debt collector cannot: Make more than seven calls within a seven-day period to a consumer regarding a specific debt. Call a consumer within seven days after having a telephone conversation about that debt.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

Specifically, the rule states that a debt collector cannot: Make more than seven calls within a seven-day period to a consumer regarding a specific debt. Call a consumer within seven days after having a telephone conversation about that debt.

The phrase in question is: “Please cease and desist all calls and contact with me, immediately.” These 11 words, when used correctly, can provide significant protection against aggressive debt collection practices.