Foreign Independent Contractor Agreement For Real Estate In Allegheny

Description

Form popularity

FAQ

What to Include Party Details. The agreement will name the contractor and the client and provide the mailing addresses where invoices and correspondence can be sent. Term. The one-page contract must state the dates the contractual relationship begins and ends. Services. Compensation. Expenses. Signatures.

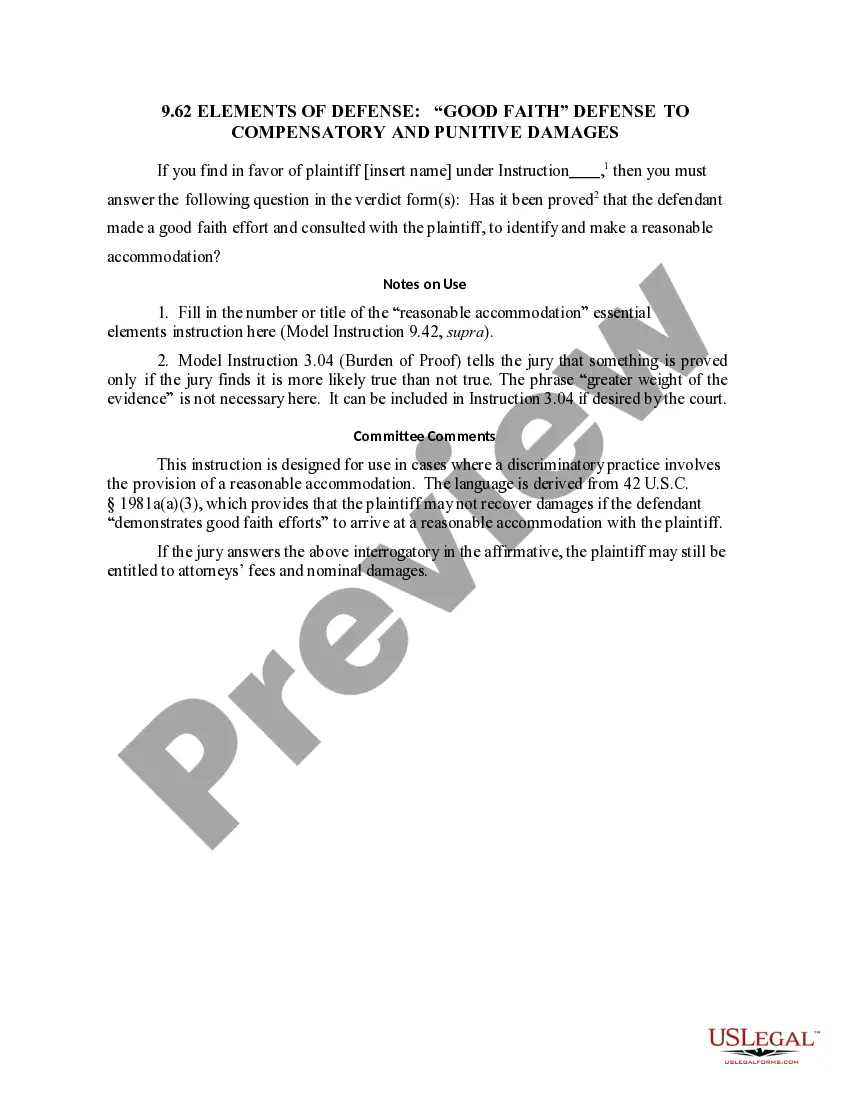

The tax forms for international contractors aren't the same as those self-employed Americans sign. Instead of a W-9, each new foreign contractor should sign and submit Form W-8BEN, which certifies that they don't need to submit forms to the IRS because they aren't a citizen of the United States.

However, the IRS doesn't require a company to withhold taxes or report any income from an international contractor if the contractor is not a U.S. citizen and the services provided are outside the U.S. filing forms 1099 is required if: The contractor is located internationally but is a U.S. citizen.

The W-8BEN and W-8BEN-E forms are essential for foreign independent contractors and businesses. They help verify the contractor's country of tax residence, enabling them to claim deductions or exemptions from US taxes.

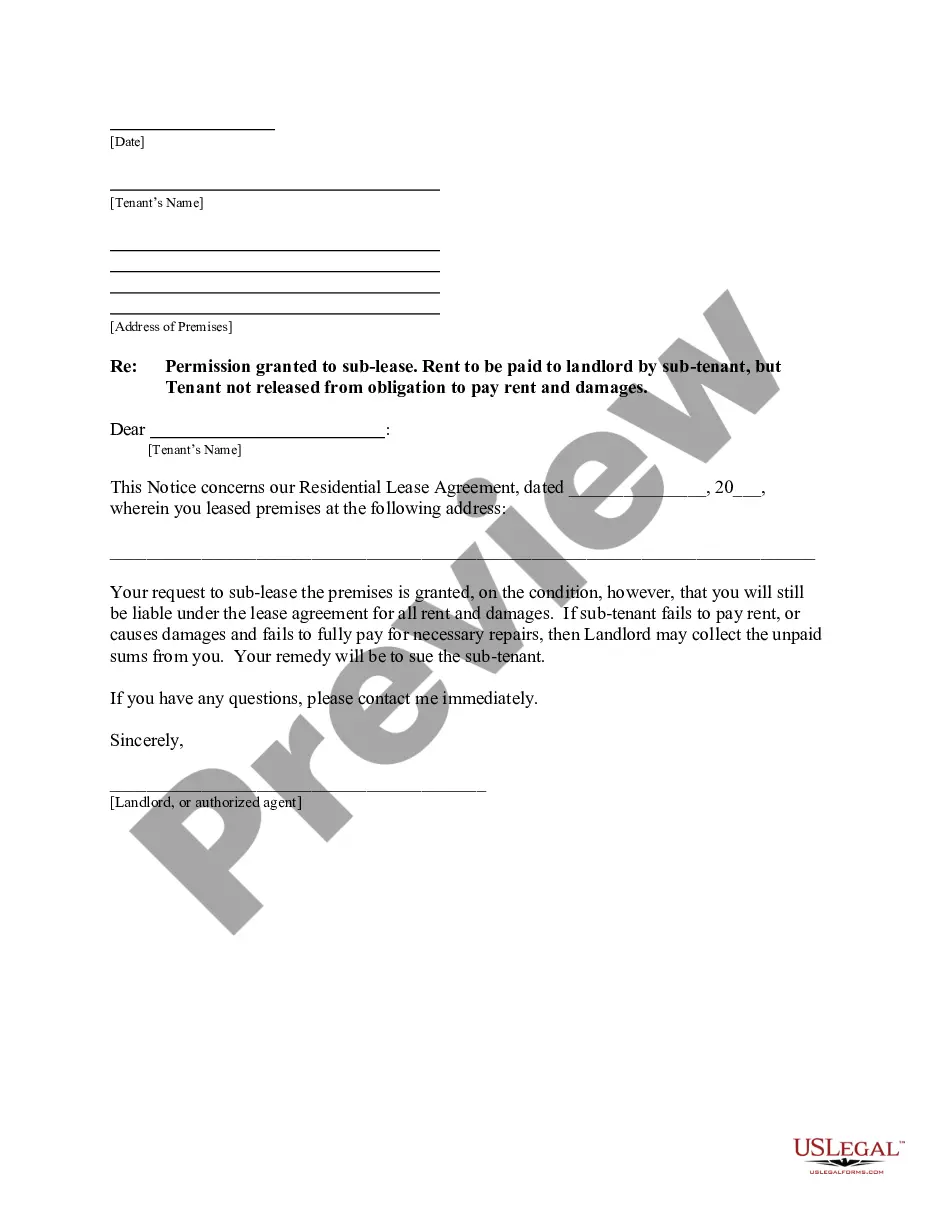

A California Real Estate Independent Contractor Agreement is a legal document that outlines the working relationship between a real estate agent (also known as a sales associate) and a brokerage firm. This agreement clarifies that the agent is an independent contractor, not an employee.

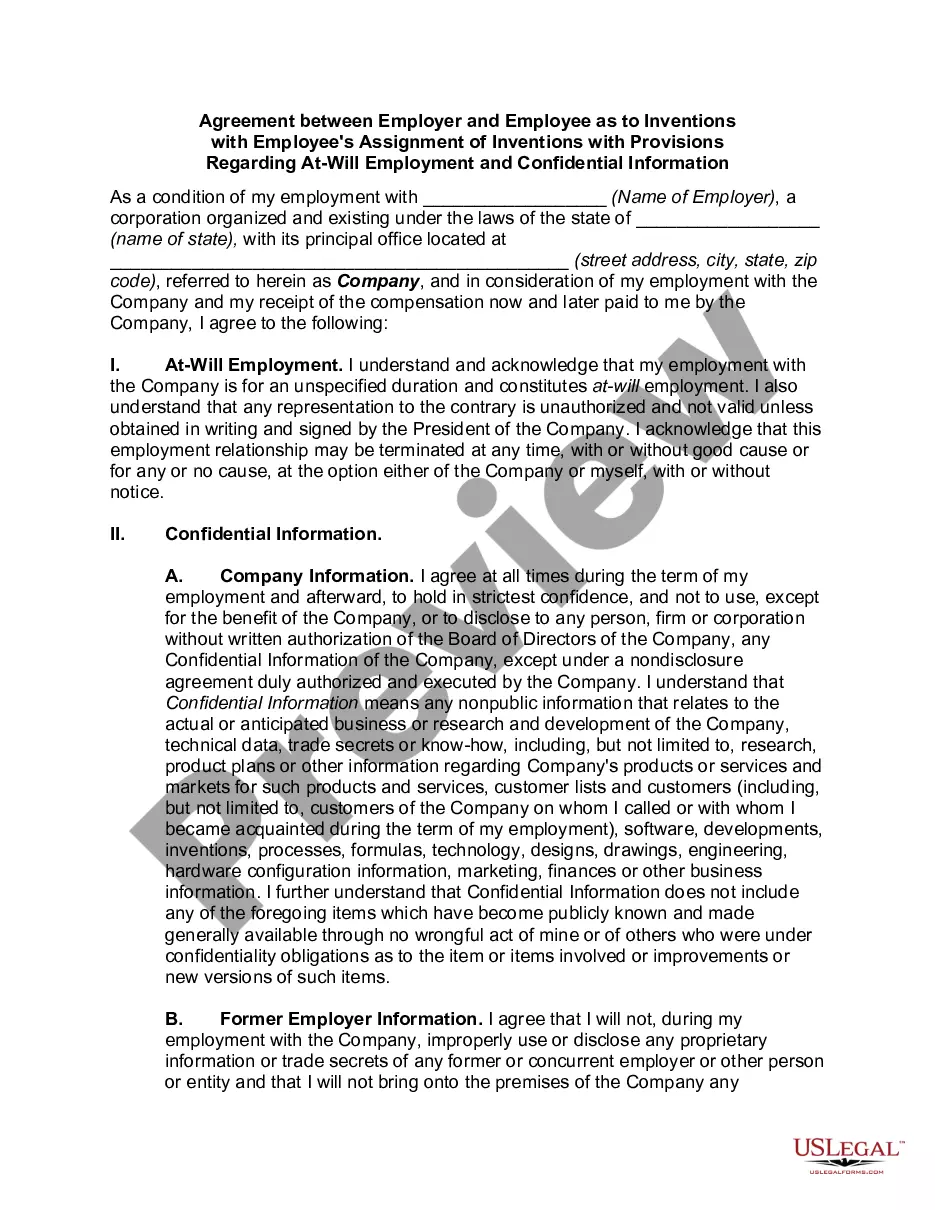

There are typically three parties involved in an independent contractor agreement: the contractor themselves, the person paying for the services, and the relevant tax authority. Unlike employees, independent contractors are responsible for paying their own income taxes.

Nature of Relationship: Contractor relationships are project-specific and time-limited, whereas vendor relationships tend to be ongoing, providing a consistent supply of goods or services. Independence vs. Partnership: Contractors operate independently, managing their own resources and working towards project goals.

You need an independent contractor agreement when you want to hire a contractor to perform work for your business. Many important services can be obtained by hiring a contractor instead of an employee. Some of these services include: App development.

An independent contractor agreement is a contract that lays out the terms of the independent contractor's work. It covers the contractual obligations, scope, and deadlines of the work to be performed. It affirms that the client and contractor are not in an employer-employee relationship.

A California Real Estate Independent Contractor Agreement is a legal document that outlines the working relationship between a real estate agent (also known as a sales associate) and a brokerage firm. This agreement clarifies that the agent is an independent contractor, not an employee.