Independent Contractor Work Agreement For Employees In Dallas

Description

Form popularity

FAQ

How many hours can a salaried employee work in Texas? A salaried employee in Texas can work up to 40 hours in a standard work week. If a salaried employee's workhours exceed 40, they are eligible for overtime compensation at 1.5 times their regular hourly rate.

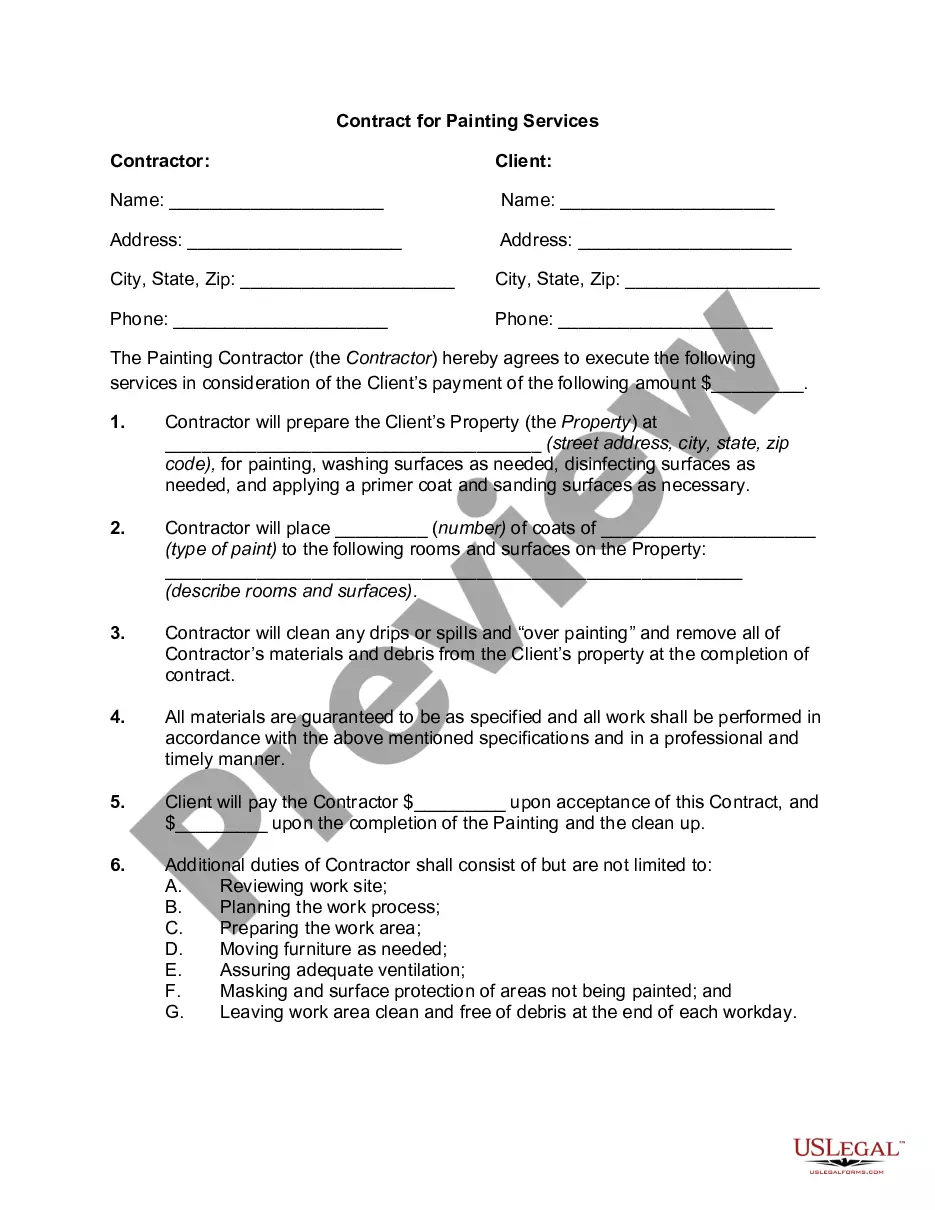

An independent contractor agreement is a contract that lays out the terms of the independent contractor's work. It covers the contractual obligations, scope, and deadlines of the work to be performed. It affirms that the client and contractor are not in an employer-employee relationship.

Right to manage your own business. As a self employed person, you provide your own benefits. Your client has no responsibility for benefits, health insurance, or other things that employees have. Also, you enforce the rights of your business. If someone attempts to abuse your services, you must take action.

If a company wants to change an employee to a contractor, the following process must be followed: Step 1: Determine whether the employee is eligible to be converted to a contractor. Step 2: Negotiate a contract with the employee. Step 3: Terminate the employee's employment. Step 4: Hire the employee as a contractor.

Freelance or Contract Work: These roles, often under independent contractor status, generally do not qualify for unemployment benefits unless under special circumstances. Failure to Search for a Job: If you're not actively looking for work, you may be disqualified.

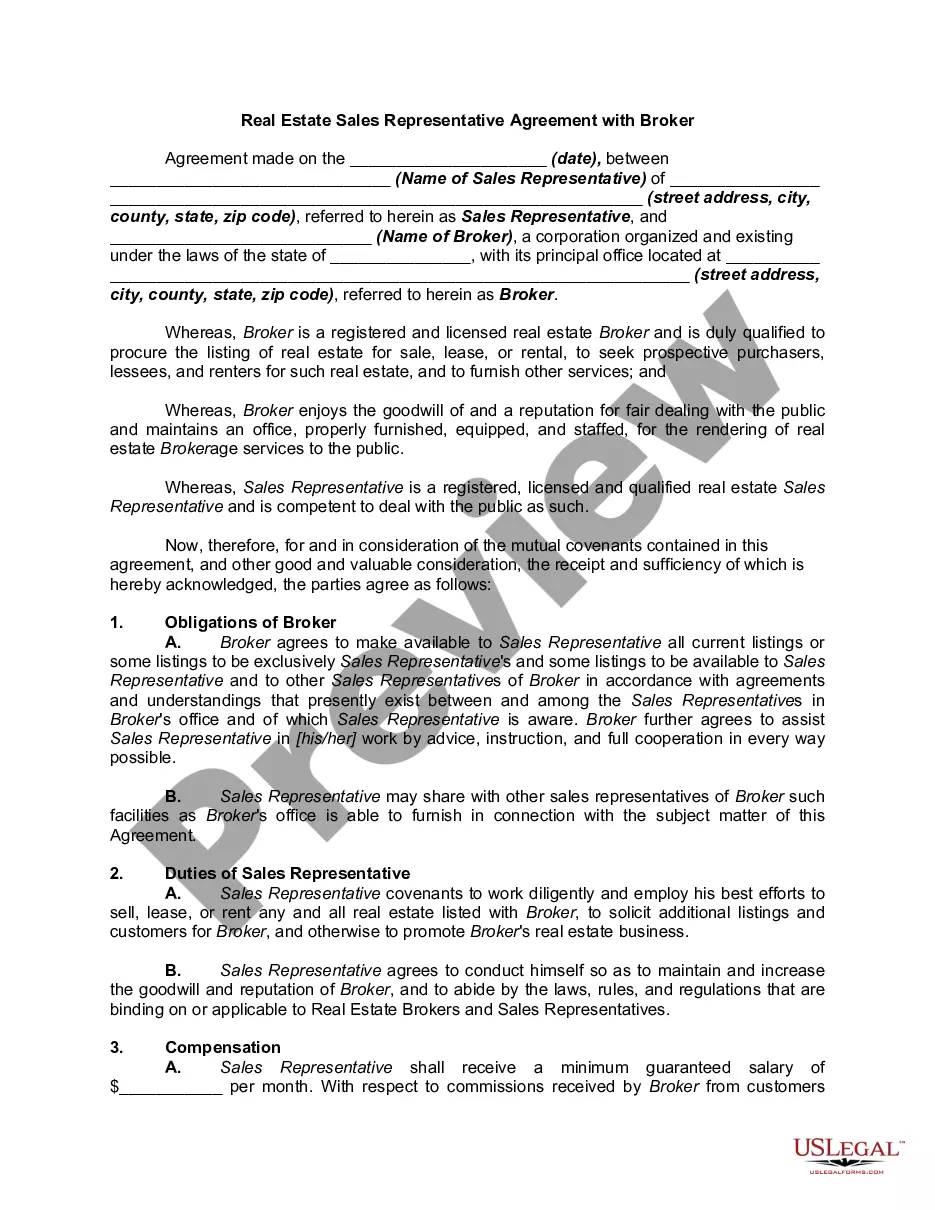

A Texas independent contractor agreement records the arrangement where a contractor provides services in exchange for payment from their client. The contract sets the scope of work, timeline, and compensation the contractor will receive.

Form W-9. The IRS requires contractors to fill out a Form W-9, a request for a Taxpayer Identification Number and Certification, which you should keep on file for at least four years after the hiring. This form is used to request the correct name and Taxpayer Identification Number, or TIN, of the worker or their entity ...

Below are eight important points to consider including in an independent contractor agreement. Define a Scope of Work. Set a Timeline for the Project. Specify Payment Terms. State Desired Results and Agree on Performance Measurement. Detail Insurance Requirements. Include a Statement of Independent Contractor Relationship.

Workers who use their own materials and tools, control meaningful aspects of the working relationship, complete tasks relatively quickly, are highly skilled, and control how they perform their job can usually be classified as independent contractors.