Independent Contractor Agreement Template With Benefits In Hillsborough

Description

Form popularity

FAQ

Organizations aren't required to provide benefits to self-employed workers like contractors. However, you can do so in some cases as long as you follow regulations and applicable state laws.

Entities provide a Form 1099-Misc to independent contractors and Form W-2 to employees. See this article on worker classification for more information. However, there may be instances where a worker may be serving as an independent contractor and an employee for the same entity.

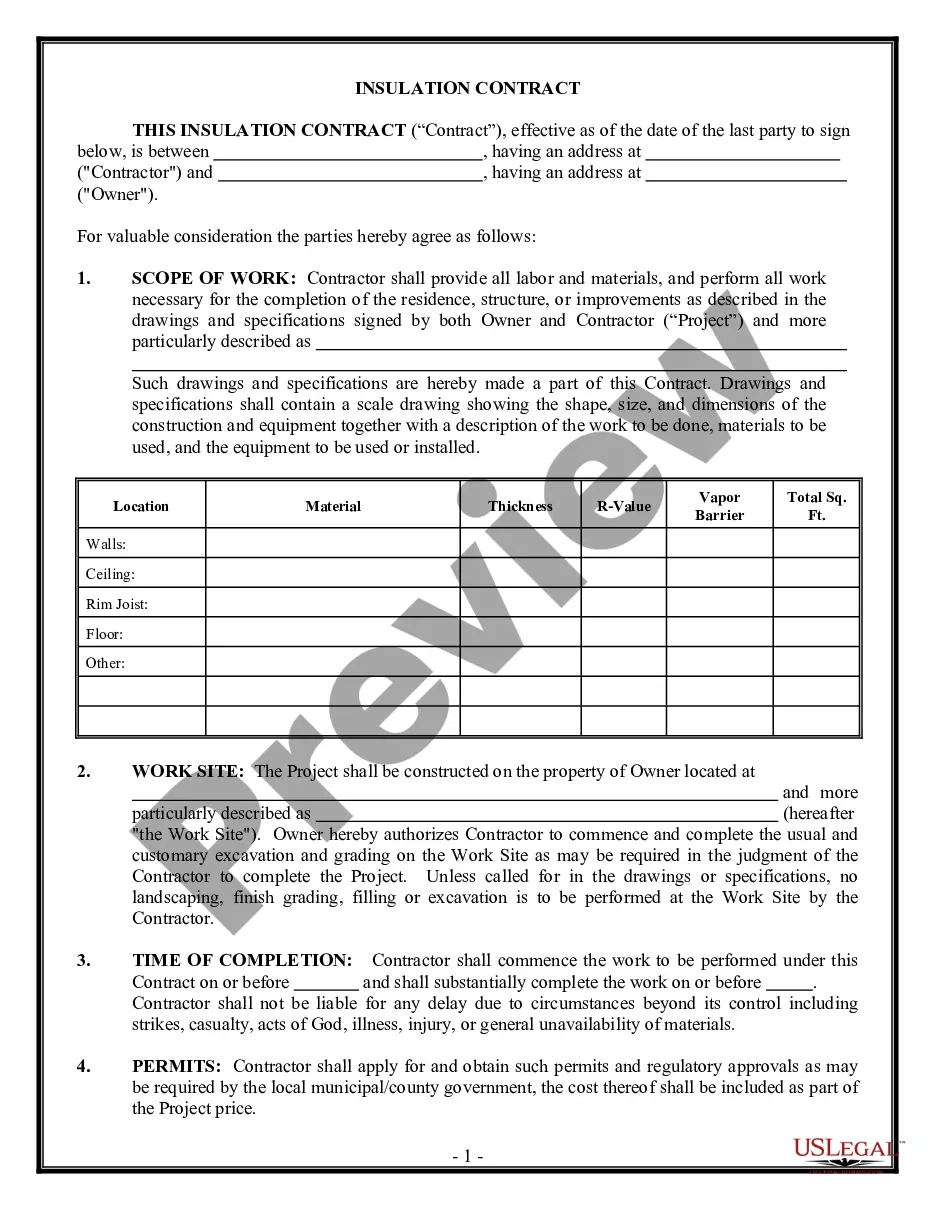

What to Include Party Details. The agreement will name the contractor and the client and provide the mailing addresses where invoices and correspondence can be sent. Term. The one-page contract must state the dates the contractual relationship begins and ends. Services. Compensation. Expenses. Signatures.

Form 1099-NEC and independent contractors | Internal Revenue Service.

Answer: Independent contractors generally report their income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship). Also file Schedule SE (Form 1040), Self-Employment Tax if your net earnings from self-employment are $400 or more.

Simple Contract Example The names and addresses of all the parties involved. A brief description and mission statement of each party. A statement that summarizes the contracted party's role. A description of the business relationship between the parties. A description of what each party promises to provide.

What to Include Party Details. The agreement will name the contractor and the client and provide the mailing addresses where invoices and correspondence can be sent. Term. The one-page contract must state the dates the contractual relationship begins and ends. Services. Compensation. Expenses. Signatures.

Creating a Self-Contract Stick to just one goal. Write down the steps you need to take to achieve the goal. Set a deadline for the contract to one day, or a week at most. Keep it short and focused, but formal. Focus on the upsides of the contract. Change the contract if you feel that you've accomplished it already.

Unlike employees receiving insurance and benefit options from their employer, independent contractors must seek these out on their own. The Health Insurance Marketplace is the most accessible place to find coverage with options based on estimated yearly earnings.

The law may state that these types of contracts need to be in writing, but it doesn't usually say anything about them having to be typed. This means that a handwritten contract is a valid contract in the eyes of the law, although you should always seek legal advice and check your state's laws.